As a seasoned investor with decades of experience under my belt, I’ve seen my fair share of market upheavals – some expected, others completely unexpected, the so-called black swans. These events can be devastating, but they also offer valuable lessons and opportunities if we know how to navigate them.

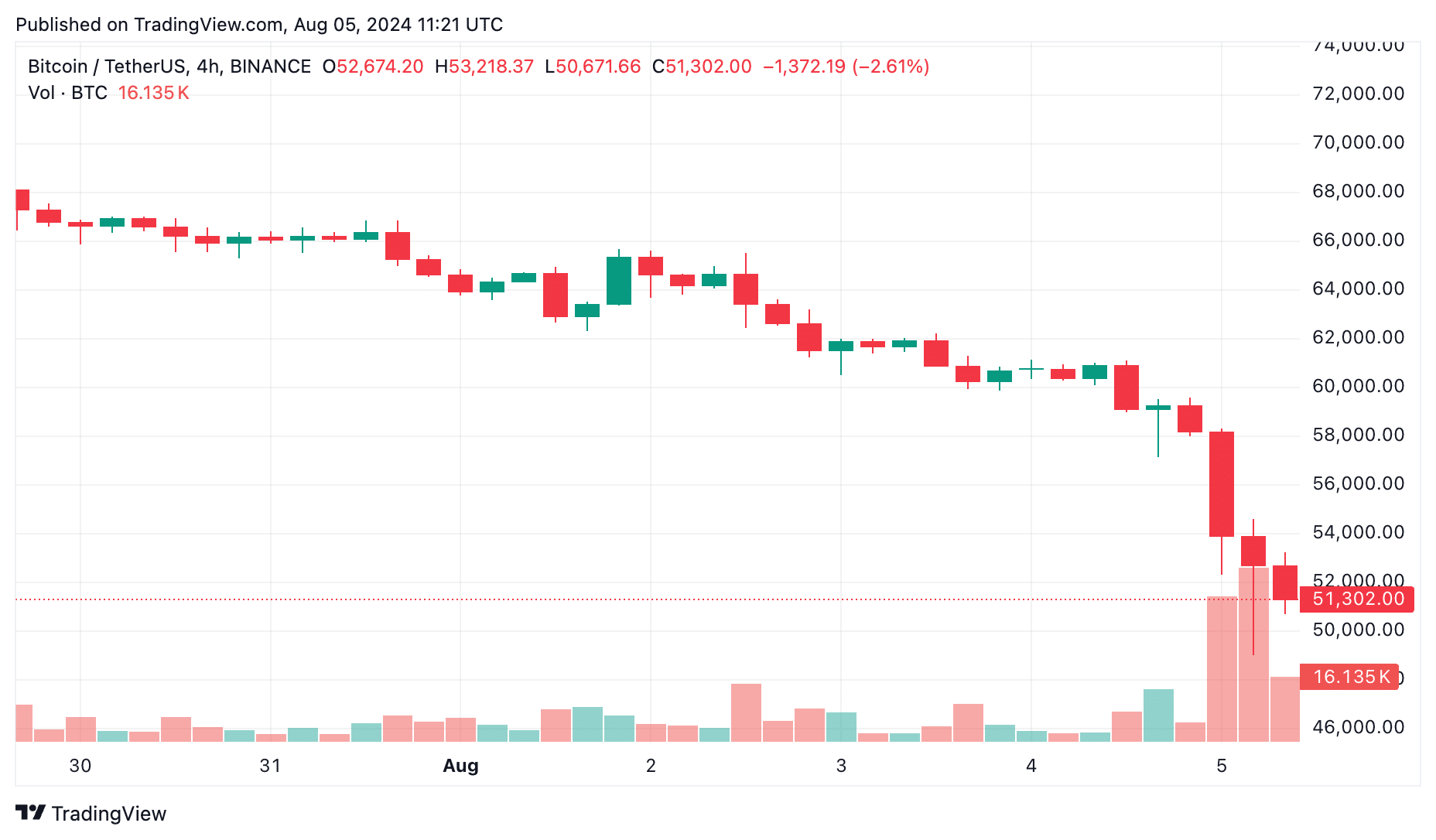

On Black Monday, the crypto market took a significant hit as well, with Bitcoin reaching a multi-month low, mirroring the decline in traditional stock markets.

Table of Contents

Between August 4th and 5th, there was a substantial drop in the cryptocurrency market. Bitcoin (BTC) dipped below $50,000, while Ethereum (ETH) dropped to approximately $2,200. Consequently, other major digital assets within the top 10 by market capitalization also plummeted.

A large decrease in value led to numerous sell-offs in futures agreements, totaling over $1 billion within a single day. Notably, most of these positions were long ones.

Why is crypto crashing right now?

The fall of the cryptocurrency sector can be attributed to multiple reasons. Interestingly, these digital currencies exhibit a strong link with traditional stock markets that have been experiencing a decline since the previous week. Furthermore, the fluctuations in the crypto market are not only affected by economic factors but also geopolitical tensions, particularly those arising in the Middle East.

More recent unexpected shifts in the Bank of Japan’s monetary policy, combined with the U.S. Federal Reserve’s reluctance to reduce interest rates, are contributing to an increase in economic unpredictability.

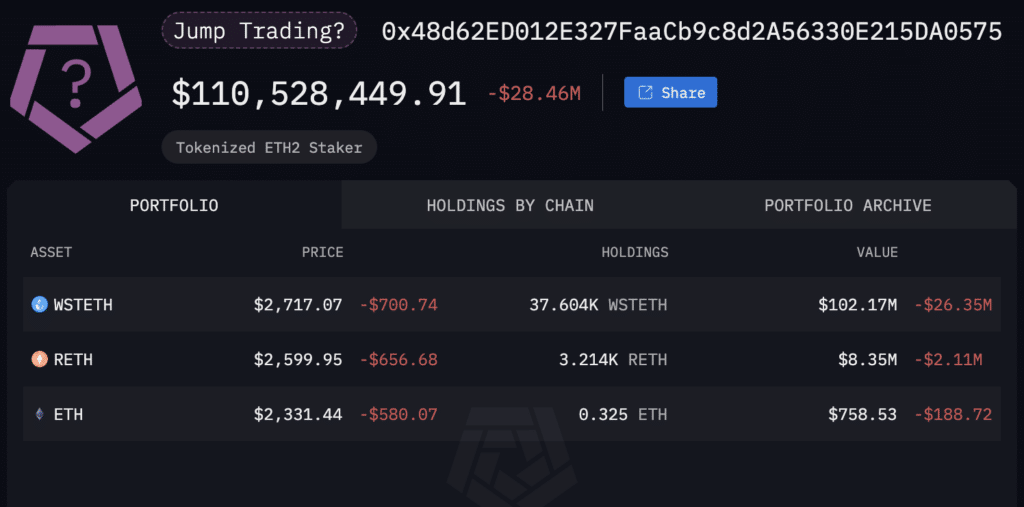

Apart from their discussions, there’s speculation about a major market participant potentially flooding the market with assets, a situation referred to as a dump. Cryptocurrency analysts are suggesting that Jump Crypto, a significant market player, may have liquidated its holdings. Previously, Jump Crypto had released 120,000 wETH from Lido and sold a large portion of it, which is believed to have contributed to the downfall of Ethereum.

According to Spot On Chain experts, over a period of 11 days, more than 100,000 Ether have been transferred from wallets believed to be linked with Jump Trading, to centralized exchange platforms. This transfer started on July 25, which was just two days after the U.S. debut of the Ethereum Exchange-Traded Fund (ETF).

On August 4th, an additional 17,576 Ether valued at approximately $46.78 million was taken out from the Jump Trading account. This brings the total value of assets moved to exchanges up to more than 104,000 Ether. As per data from the Arkham Intelligence platform, the company still holds over $109.4 million in rETH, wstETH, and regular Ethereum.

Furthermore, the drop in the cryptocurrency market is being exacerbated by Mt. Gox’s settlement payments to creditors, turbulent Exchange Traded Fund (ETF) developments, and shifting political landscapes within the U.S. elections.

What experts say

According to economist Peter Schiff, who serves as the president of Euro Pacific Capital, he is optimistic that the upward trend will continue when trading begins on the U.S. stock market.

He observed that gold dropped by 45% from its peak in November 2021. Currently, it’s trading above $50,000, yet it would be prudent to wait until the stock market reopens.

#Bitcoin has dropped below $50,000, marking a decrease of approximately 22% since the closing bell on Friday in the U.S. stock market. This decline amounts to a 45% reduction when compared to its Nov. 2021 peak in terms of gold value over nearly three years. Currently, it has rebounded above $50,000 again, but be prepared for further potential selling pressure once the stock market opens and ETF holders can finally unload their positions.

— Peter Schiff (@PeterSchiff) August 5, 2024

According to cryptocurrency expert DeFi Mochi, the steep drop in ETH‘s value can be attributed primarily to large-scale selling by institutional investors like Paradigm and Grayscale, which significantly impacted the market and led to its decline.

Has a black swan come to the crypto market?

In both traditional financial markets and cryptocurrency, the concept known as the “Black Swan” phenomenon is relevant. Let’s delve into its workings in these domains.

Nassim Nicholas Taleb, both an economist and a renowned author of the popular book “The Black Swan,” devised a concept. This concept pertains to occurrences that are difficult to foresee yet carry great impact, often overlooked or disregarded despite their prominent effects.

Taleb points out that for centuries, it was thought that all swans were white, with the sighting of a black swan being considered an impossibility. Yet, this notion was challenged dramatically when European explorers discovered black swans swimming in Australian lakes, leaving them astounded.

In his published work, Taleb refers to World War I, the emergence of the Internet, and the 2008 Global Financial Crisis as unforeseen, extraordinary events – or, in his terms, “black swans.”

What is it that these unforeseen incidents share in common? A black swan incident can only take place if three key features are present.

Initially, I found myself investigating an occurrence that was far from desirable – an event akin to a ‘black swan’. These occurrences are inherently rare and statistically improbable. In fact, they seem almost nonexistent, given the myriad of instances where similar conditions did not lead to such events.

Furthermore, a Black Swan incident brings about massive consequences: When a Black Swan incident arises, it markedly alters its surroundings. Typically, this alteration is severe and often results in negative outcomes, although it may occasionally be beneficial.

Although black swan events might seem unpredictable at first, upon reflection, it’s often possible to understand why they happened, as even seemingly implausible events can sometimes be foreseen in retrospect.

Significant black swans of the crypto market

FTX

Among the significant unexpected events in 2022 was the downfall of FTX. This digital currency trading platform encountered legal troubles, internal turmoil, and an investigation by the Securities and Exchange Commission (SEC). As a result, the market plummeted due to the panic among users who were trying to withdraw their funds from the platform. Unfortunately, numerous FTX users were unable to recover all of their money before the exchange shut down.

Terra Crash

As an analyst, I’ve noticed that the relationships between certain cryptocurrencies can make them vulnerable to simultaneous crashes due to unforeseen events. For instance, in May 2022, one user holding a significant amount of UST (now referred to as USTC) decided to liquidate all his coins. This mass sell-off triggered the collapse of UST’s capital, causing a wave of users to move their funds into stablecoins.

Coronavirus Pandemic

In March 2020, one of the first unexpected catastrophic events impacting cryptocurrencies emerged – the coronavirus pandemic, causing disruption across all financial markets, including crypto. Analyst Willy Woo had pointed out in March 2020 that there were unusual occurrences in the market, evident through investor behavior. Simultaneously, he hinted at the possibility of this industry encountering a black swan event.

As someone who has been closely monitoring the cryptocurrency market for several years now, I have noticed that the current chart of “investor activity” is intriguing. In the long term, it appears to be solid and promising, which is a good sign based on my past experiences. However, the short-term trend is quite unusual. Typically, the oscillations are smooth and predictable, but lately, it seems as though something has disrupted this pattern – perhaps the ongoing COVID-19 pandemic? It’s hard to say for certain, but whatever the cause, it’s causing a fizzing effect that I haven’t seen before.

— Willy Woo (@woonomic) March 10, 2020

The very next day following the WHO’s declaration of a pandemic, the value of Bitcoin plummeted nearly 50%. Shortly after, other cryptocurrencies experienced similar declines, leading to an overall drop in market capitalization by approximately 40% within a single day. This sudden crash left many investors facing financial disaster.

Is it possible to predict a black swan event and be prepared for it?

The sudden drop in the value of cryptocurrencies, including Bitcoin reaching levels not seen for several months, suggests that the crypto sector may have been underprepared for recent events. Yet, a “black swan” event implies extended losses in the crypto market, so it’s too early to predict its occurrence at this time.

Keep in mind that unforeseen incidents known as “black swan events” are common in the cryptocurrency market. These events can cause significant damage, yet they might also present chances. Preparation is crucial – always have a plan ready to execute should such an event happen.

Key point to bear in mind about black swans: They’re inherently unforeseeable events. One can never pinpoint exactly when or where they’ll happen, nor predict the specific outcomes accurately. Nevertheless, investors can enhance their readiness and even leverage these occurrences by staying informed about them and grasping their underlying dynamics.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-05 17:55