As an experienced analyst, I believe that the recent bearish momentum in Bitcoin (BTC) is a result of various factors including increased selling pressure and profit-taking from previous gains. The significant surge in exchange inflows and outflows, as indicated by Santiment data, suggests that investors are either entering or exiting the market in large quantities. This could be due to a variety of reasons such as tax-related selling, profit-taking, or simply taking advantage of lower prices to accumulate more BTC.

Bitcoin‘s price has taken a turn for the worse following a three-day period of stability, causing it to dip below the $66,000 threshold.

In simple terms, the price of Bitcoin has decreased by 0.9% over the last 24 hours and currently stands at $65,600. The market value of this cryptocurrency fell below $1.3 trillion for the second occasion this month. Despite the dip in price, the daily trading volume of Bitcoin saw a significant surge, amounting to $36.3 billion – an increase of 125%.

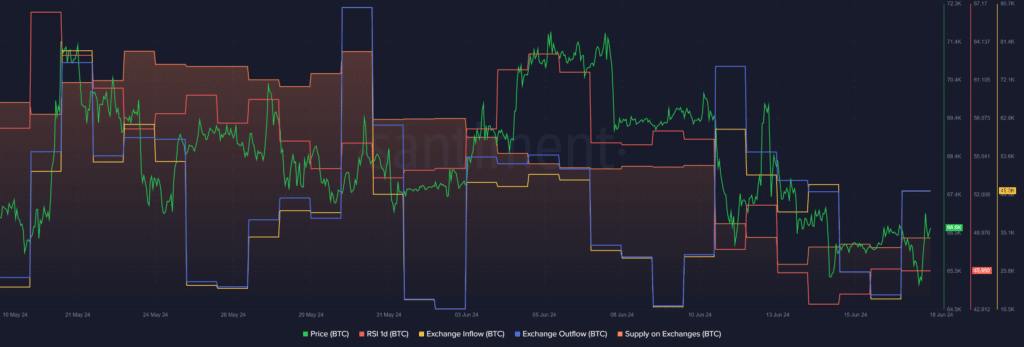

Based on Santiment’s recent data, I’ve noticed a significant increase in Bitcoin (BTC) inflows into exchanges. In just one day, there was a jump from 19,172 BTC to 45,356 BTC – a striking rise of 137%. This could potentially indicate increased selling pressure or a heightened interest in trading, which might impact the market dynamics for BTC.

According to market intelligence data, there’s been a substantial rise in Bitcoin being moved off exchanges. Specifically, as reported by Santiment, there was an impressive 119% increase within the last 24 hours – a jump from 19,871 BTC to 43,493 BTC.

As a cryptocurrency market analyst, I’ve observed an increase in the Bitcoin supply held on exchanges from 937,240 BTC to 939,230 BTC within the past day. This signifies a net inflow of approximately 1,863 BTC into exchanges during this period. This exchange influx occurs amidst the broader cryptocurrency market experiencing bearish trends.

Additionally, the total value of all cryptocurrencies dropped by 2.6% over the last 24 hours and now stands at approximately $2.485 trillion, based on information from CoinGecko. According to their data, a full 96% of the top 300 digital currencies, including meme coins, are presently trading in the red.

Based on Santiment’s analysis, Bitcoin’s relative strength index (RSI) stands at 46 as of now. This reading suggests that Bitcoin is slightly undervalued according to the RSI indicator.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-18 09:46