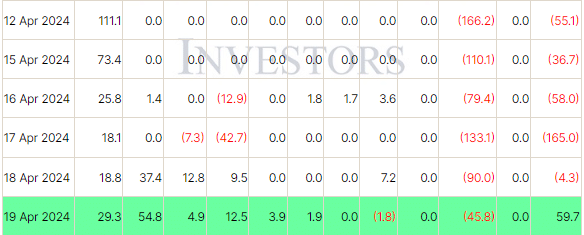

Amidst growing excitement about a potential increase in Bitcoin‘s value following the halving event, investments in Bitcoin ETFs in the US saw a turnaround on April 19th, bringing an end to five consecutive days of outflows with inflows totaling $59.7 million. This surge was primarily driven by FBTC, which recorded $54.8 million in new investments, according to Farside Investors’ recent report.

A notable shift in investment flow emerges, marking a contrast to past outflows, particularly from Grayscale Bitcoin Trust ETF (GBTC), fueled by SEC approvals for spot Bitcoin ETFs. Investers have poured money into alternatives like Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), Invesco Galaxy Bitcoin ETF (BTCO), and Franklin Bitcoin ETF (EZBC).

On April 20, the Bitcoin network experienced a surge in fees as the transaction costs for confirming block 840,000 – the fourth-ever halving event – amounted to 37.7 BTC or approximately $2.4 million.

In the past, between 2016 and 2020, Bitcoin’s value jumped significantly after its halving event. Its price rose from $8,500 to approximately $65,000 within a four-year span. This notable increase suggests a positive outlook among investors following the halving, as they have shown increased faith in Bitcoin’s potential for further growth by investing in ETFs (Exchange-Traded Funds).

After the Bitcoin halving, investors have been pouring more money into Bitcoin ETFs, indicating a positive attitude towards Bitcoin’s future value increase. This shows that investors believe in Bitcoin’s capacity to grow.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-20 10:28