As a researcher who has been following the crypto market for over a decade now, I must say that the recent surge in Bitcoin‘s price and interest is nothing short of remarkable. The confirmation of President-elect Donald Trump’s plans for a Bitcoin reserve sent ripples throughout the market, and it’s fascinating to witness such a shift in perception from skepticism to acceptance.

On Monday, Bitcoin attained a record peak following a surge in institutional interest towards the digital currency, triggered by President-elect Donald Trump’s confirmation of his intentions to establish a Bitcoin reserve.

At exactly 12:40 AM UTC, Bitcoin (BTC) hit a record high of $106,488.25 after a continuous climb that lasted for 25 minutes. This surge came shortly after former U.S. President Donald Trump announced plans to establish a strategic U.S. Bitcoin reserve at the New York Stock Exchange on Dec. 12. Trump’s statement aimed to maintain America’s edge against international competitors has stirred investor enthusiasm, fueling market growth. Addressing CNBC, Trump expressed his ambition: “We aim to achieve great things with cryptocurrency… we want to stay ahead.“.

The push towards Bitcoin has been noticeably strengthened by Senator Cynthia Lummis’ BITCOIN Act, which intends to acquire 1 million Bitcoins for the U.S. over the next five years as a strategy to tackle the massive $35 trillion national debt. This trend is growing in popularity worldwide, with Russia considering establishing a Bitcoin strategic reserve following President Vladimir Putin’s statement that Bitcoin cannot be prohibited.

Beyond that proposal, I myself, as a researcher, have contemplated the idea put forth by Anton Tkachev, a former Russian Finance Minister, regarding the establishment of a strategic Bitcoin reserve. This strategy is seen as a potential solution to mitigate the impact of international sanctions imposed on our country.

MicroStrategy, a significant Bitcoin investor, recently purchased 21,550 more Bitcoins for approximately $2.1 billion. This brings their total Bitcoin holdings up to 423,650 BTC. Furthermore, this company is now included on the Nasdaq 100 index and will be accessible to the public starting December 23.

Michael Saylor calls on the US Government to sell all of its gold and buy #Bitcoin.

— Watcher.Guru (@WatcherGuru) December 15, 2024

The intense desire among investors to not miss out on potential opportunities has peaked, particularly following the significant accumulation of over $50 billion in U.S. Spot Bitcoin Exchange-Traded Funds (ETFs) within a year.

Bitcoin hashrate hits record highs

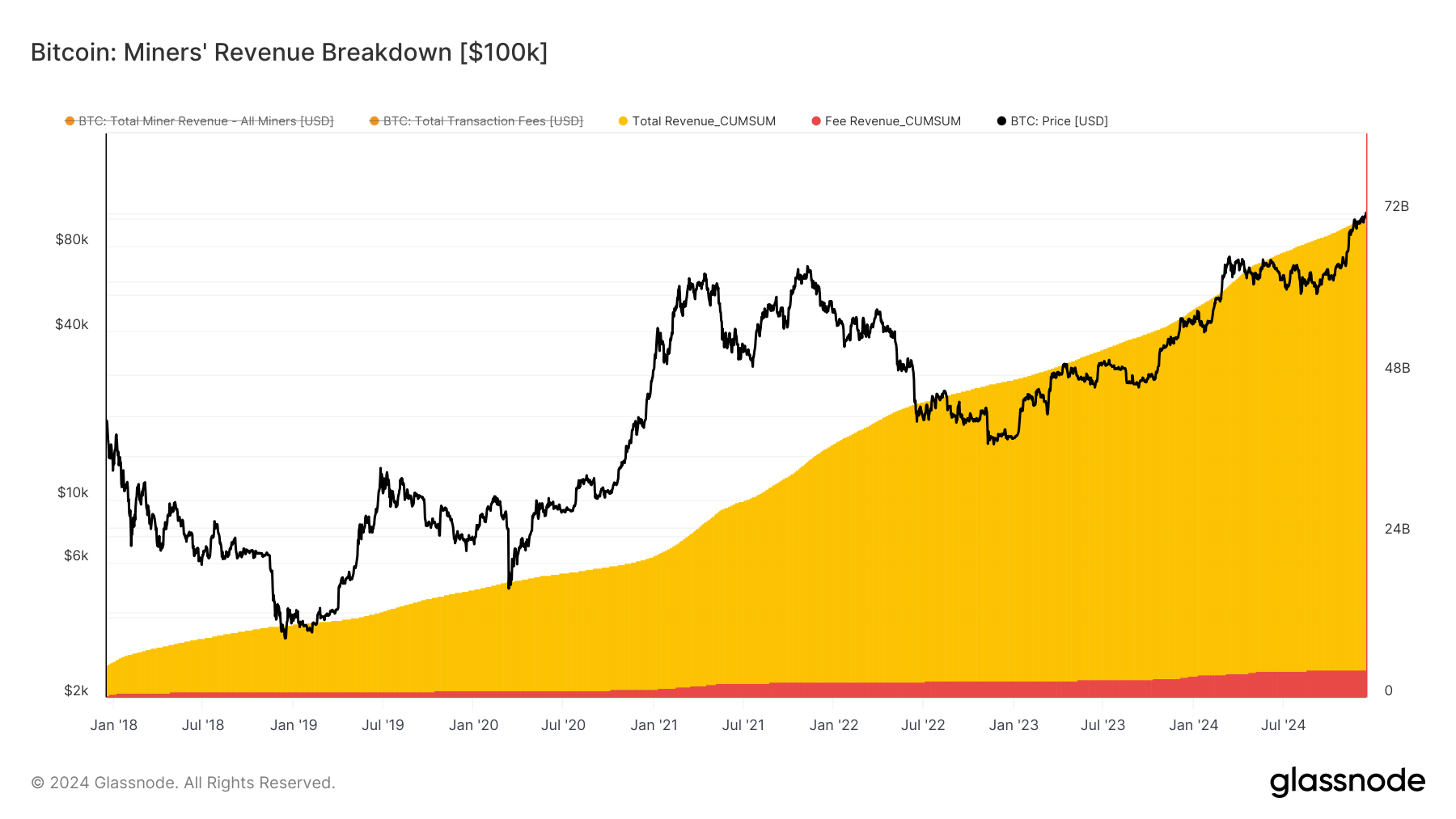

The Bitcoin mining network’s hashrate has reached unprecedented heights, as shown by data from Glassnode, surging from 128 quadrillion hashes per second (EH/s) to over 804 EH/s. Remarkably, nearly 37% of the total computational work done in 2024 was performed during this period. The robust network security and economic rewards have motivated miners to collectively earn approximately $71.49 billion since the network’s inception.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-16 09:30