As a seasoned cryptocurrency enthusiast who has witnessed Bitcoin’s rollercoaster ride for over a decade now, I find these predictions both intriguing and somewhat daunting. While I certainly hope to see Bitcoin reach new heights in the coming years, I can’t help but remember the times when even $10,000 was considered an impossible dream.

As Bitcoin surpasses $66K, is this the beginning of a prolonged bull market or simply a fleeting price increase?

Table of Contents

Bitcoin is back in action

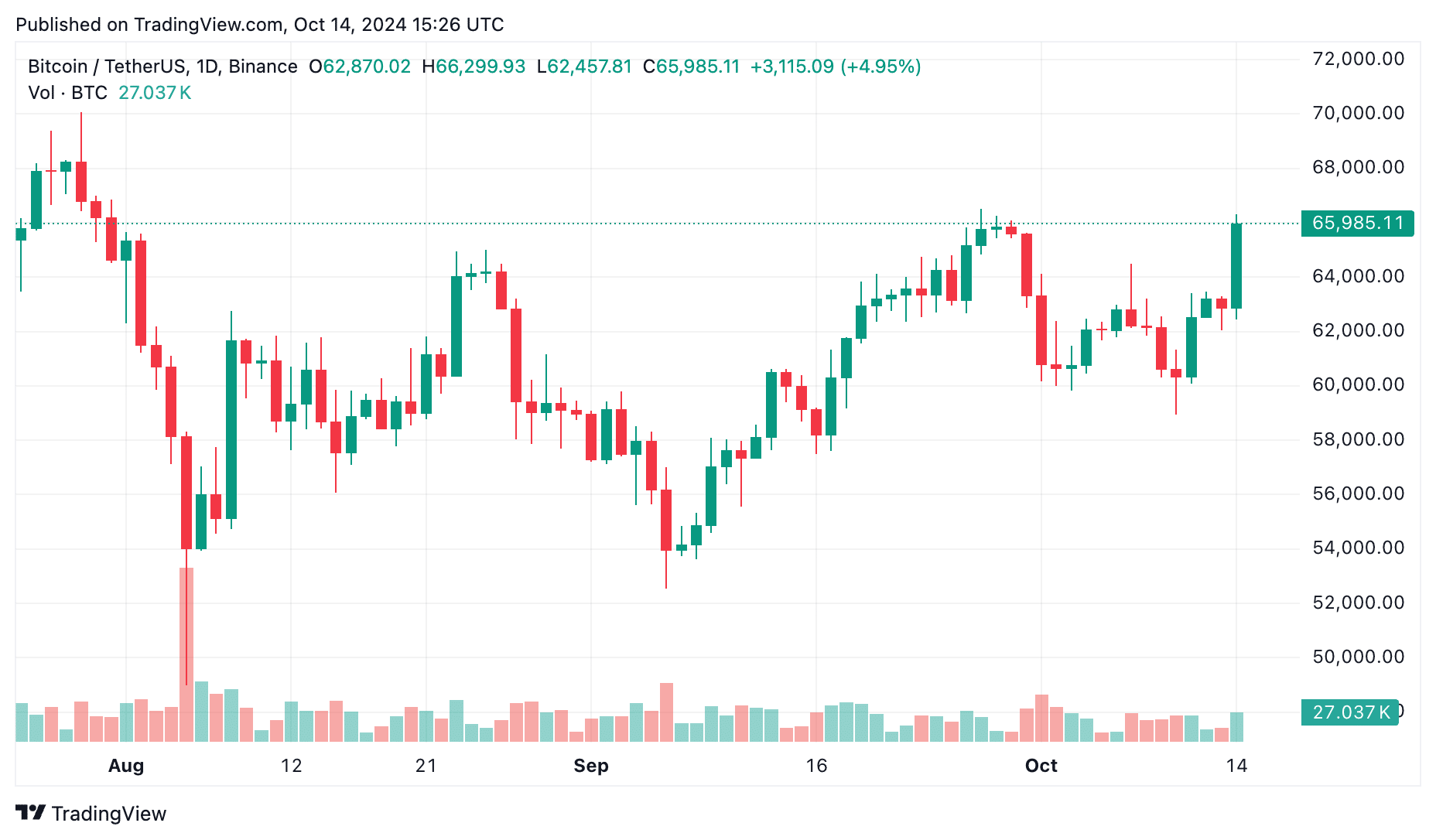

Bitcoin (BTC) has once again taken center stage, surpassing the $64,000 barrier as the overall cryptocurrency sector indicates signs of revival. As of October 14, Bitcoin is being traded around $66,000 levels, representing a substantial 5.5% increase over the past day.

This spike comes after several turbulent weeks in the cryptocurrency market, primarily due to international economic worries and escalating geopolitical conflicts, notably in the Middle East.

The surge of energy we’re seeing is largely due to the world’s financial markets adjusting to China’s recent economic news. As they work on resuscitating their economy, their latest policy announcement regarding economic stimulus has sparked curiosity about whether it will be sufficient.

Financial experts argue that China’s attempts to combat deflation aren’t proving effective, leading the spotlight to shift towards Bitcoin. As reported by Bloomberg, certain investors are choosing to leave Chinese equities in favor of cryptocurrency, leveraging Bitcoin’s ongoing surge.

According to Caroline Mauron, one of the co-founders of Orbit Markets, the shift of capital from Bitcoin into Chinese stocks had been restricting cryptocurrencies. However, as this movement slows down, it seems that Bitcoin is experiencing positive effects as a result.

As a crypto investor, I’m feeling a sense of relief following the recent decision made by the bankrupt Mt. Gox exchange to postpone their creditor repayment deadline for another year. With an outstanding debt of approximately $2.7 billion in Bitcoin, this extension has eased some market uncertainties about a potential massive sell-off.

October, often referred to as “Uptober” by the crypto community, is historically Bitcoin’s most profitable month. On average, it has yielded more than a 21% increase since its creation, although there have been some downturns in 2014 and 2018.

Now that we’ve reached this point, let’s delve further into what lies ahead for Bitcoin (BTC). We’ll explore potential future developments in the cryptocurrency market and examine various Bitcoin price forecasts to understand their implications for the near future.

Factors fueling the market momentum

Bitcoin has been gaining steam lately, driven by several key factors.

A strong indicator of progress is the increase in investments into Bitcoin exchange-traded funds (ETFs) on the spot market. Following a short spell of withdrawals, these Bitcoin ETFs experienced a significant turnaround on October 11, recording their largest influx in two weeks, exceeding $253 million.

It seems like the intense demand to sell Bitcoin may be decreasing, as investors appear to be growing more confident again. Increased ETF inflows usually signal institutional investment, implying potential positive developments for Bitcoin in the future.

It’s worth noting that the ongoing U.S. presidential election could be contributing to Bitcoin’s surge. Recent shifts in prediction markets suggest a preference for Republican candidate Donald Trump who is perceived as being more favorable towards cryptocurrencies, compared to Democratic Vice President Kamala Harris.

By October 14th, Trump’s chances of winning, according to Polymarket, are approximately 54%, while Harris’s have decreased to 45%. This is Harris’s lowest point since she started her campaign, suggesting a possible Trump victory. Such an outcome could be advantageous for the crypto industry, as it may lead to more policies supportive of cryptocurrencies.

Currently, MicroStrategy (MSTR), a major supporter of Bitcoin, consistently surpasses market standards. Ever since it embraced its Bitcoin-focused approach in August 2020, MicroStrategy’s shares have skyrocketed by an impressive 1,620%, outperforming not only Bitcoin but also the leading tech titans known as the “Magnificent 7” and the S&P 500.

The only thing better than #Bitcoin is more Bitcoin.

— Michael Saylor⚡️ (@saylor) October 12, 2024

In simpler terms, the Executive Chairman, Michael Saylor, continues to express a positive outlook. He recently stated on Twitter that nothing is superior to Bitcoin compared to having even more Bitcoin.

On the other hand, Bitcoin mining’s performance has been a bit of a roller coaster recently. Although Bitcoin prices have increased by 5% this month, the computing power of the network (hashrate) has gone up by 11%. This slight increase in hashrate might affect miners’ profits.

According to analysts at Jefferies, the income from mining a single exahash of minerals declined by about 2.6% in September. If prices don’t increase significantly, October might prove to be even tougher for miners.

The push behind Bitcoin’s growth continues with the latest actions taken by the Federal Reserve. On September 18th, the Fed reduced its interest rate by 0.5%, causing the short-term benchmark rate to range between 4.75% and 5.00%.

In simpler terms, there’s a high probability, approximately 86%, that the market will see a reduction of 0.25% (or 25 basis points) in interest rates during both November and December. This typically favors investments considered riskier, such as Bitcoin, because lower borrowing costs make higher-yielding options more attractive to investors.

What to expect next?

By examining a mix of broad market trends and cryptocurrency-related statistics, several important predictions about the market’s possible trajectory are becoming clearer. Here are some crucial findings worth considering.

Whale accumulation and minimal resistance

Based on data from IntoTheBlock’s “In/Out of the Money Around Price,” Bitcoin encounters relatively little resistance when its value falls within the range of approximately $55,000 to $64,000.

Based on data from @intotheblock, the price of Bitcoin appears to encounter minimal significant resistance as far as trading volume is concerned. Notably, large investors (whales) have been accumulating more Bitcoins in the range below $60K. At present, approximately 4.3 million Bitcoins are considered profitable, or “In the Money”, within the price range of $55K and above.

— Slim Daddy◻️𓃵 ₿ (@felixreads) October 14, 2024

Approximately 4.3 million Bitcoin transactions have surpassed their purchase price, implying that numerous owners currently find themselves with a profit. This situation underscores the significance of this particular price range.

One significant insight from this data is that substantial Bitcoin owners, comparable to whales, have consistently been expanding their investments beneath the price point of $60,000.

According to the analysis of Slim Daddy, who keeps an eye on the crypto market, there’s been a noticeable rise in the stockpiling of Bitcoin by large-scale investors, specifically in the price range below $60K. This trend indicates that these major players think Bitcoin is currently underpriced and could soon experience a surge.

Historically, an increase in whale activity (large-scale Bitcoin investors) has tended to predict bullish market rallies. This is because their significant buying power exerts upward pressure on the price of Bitcoin. From a technical perspective, this makes a strong argument for a breakout, especially since Bitcoin remains above $62,000.

Key resistance at $64,000

According to crypto analyst Michaël van de Poppe, Bitcoin’s recent attempt at $62,000 could signal an upcoming larger price surge. He anticipates that a significant accumulation phase is taking place now, and a retest of $64,000 might trigger the substantial breakout the market has been waiting for.

It seems like we might experience a brief period of stability in Bitcoin, but we’ve already reached the $62,000 mark. A push towards $64,000 could potentially trigger the significant breakout that we anticipate. The momentum leading up to this point is immense.

— Michaël van de Poppe (@CryptoMichNL) October 13, 2024

The significance of the $64,000 point can’t be overlooked, as it serves both psychological and technical purposes. Psychologically, it acts as a significant spot for numerous traders to establish stop-loss orders or cash in on profits. Technically, this region is considered a resistance zone where intense selling activity might arise.

Should Bitcoin convincingly surpass $64,000, it might set off a prolonged surge aimed at revisiting its past peak highs. Conversely, if Bitcoin doesn’t manage to exceed this mark, there could be a dip in its price.

If the concentration of whales (large investors) remains around $60,000, it could provide a degree of support. However, if this level fails to hold, we might observe a brief period of stabilization or even a minor drop, up to $64,000.

Bitcoin price predictions: 2024 and beyond

As Bitcoin experiences a resurgence, many are pondering: Where might Bitcoin head next?

Analysts and market gurus have put forth numerous projections, each stemming from distinct statistical frameworks. In this article, we’ll delve into the views on Bitcoin’s future, starting with 2024.

Bitcoin price prediction for 2024

According to Coincodex, one of the less modest estimates, Bitcoin could potentially reach an unprecedented peak of around $89,885 by November 2024. This projection represents a significant increase of approximately 38% from its current value and exceeds its previous high of $73,750 achieved in March 2024.

DigitalCoinPrice presents another forecast, suggesting a wider price range for Bitcoin. They estimate that the price may fluctuate between approximately $59,195 and $144,380. On average, they predict an average Bitcoin value of around $137,331 in 2024.

Bitcoin price prediction for 2025

As a crypto investor, I’m excitedly looking forward to the potential price movements of Bitcoin in 2025. Based on Coincodex’s predictions, we could see trades ranging from around $65,494 to $102,794. However, DigitalCoinPrice presents a more optimistic scenario, forecasting a range of $141,620 to $169,264. Either way, it’s an encouraging outlook for Bitcoin investors like myself!

A prominent figure in cryptocurrency forecasts that Bitcoin might reach $105,000 by 2025 using Fibonacci circle analysis, implying there may be room for further growth if market conditions are favorable, potentially indicating even more substantial increases.

In simpler terms, the projected price of Bitcoin could reach $105,000 (rocket emoji indicates potential significant increase). This estimate is relatively conservative for this market cycle, derived from Fibonacci circle analysis. However, on a personal note, I suspect it might even surpass that figure slightly.

— Titan of Crypto (@Washigorira) October 12, 2024

Bitcoin price prediction for 2030

2030 Bitcoin price forecasts are growing more intense. According to Coincodex, Bitcoin could range from $118,333 to $305,028 by then. DigitalCoinPrice, however, anticipates a significantly higher value, projecting Bitcoin to approach nearly $493,000 – a substantial surge from its current value.

As a researcher exploring the future of digital currencies, I can’t help but be intrigued by the possibility that Bitcoin could solidify its standing as a widely-accepted financial asset among institutions. If this trend continues, it wouldn’t be surprising to see it reaching significant valuations by 2030. However, it’s crucial to remember that such predictions are based on current trends and should be met with a healthy dose of caution.

The road ahead

Keeping in mind that these Bitcoin prediction scenarios present an enticing vision for the future, be cautious when interpreting them. The unpredictable nature of Bitcoin means significant fluctuations in prices, both upwards and downwards, are always a possibility. Factors such as market sentiment, global financial circumstances, and unexpected occurrences can swiftly alter these predictions.

For investors, staying informed and keeping a long-term perspective is key. Always consider your risk tolerance and the broader market before making investment decisions. Never invest more than you can afford to lose.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-10-14 18:37