As a seasoned analyst with over two decades of market experience under my belt, I’ve seen bull runs and bear markets come and go, and Bitcoin is no exception. The recent downturn in Bitcoin’s price is a familiar sight to me, but it doesn’t make it any less frustrating for those who are new to the game.

Over the last few days, I’ve noticed a consistent decrease in the value of Bitcoin, which could be attributed to the wider cryptocurrency market undergoing a corrective phase.

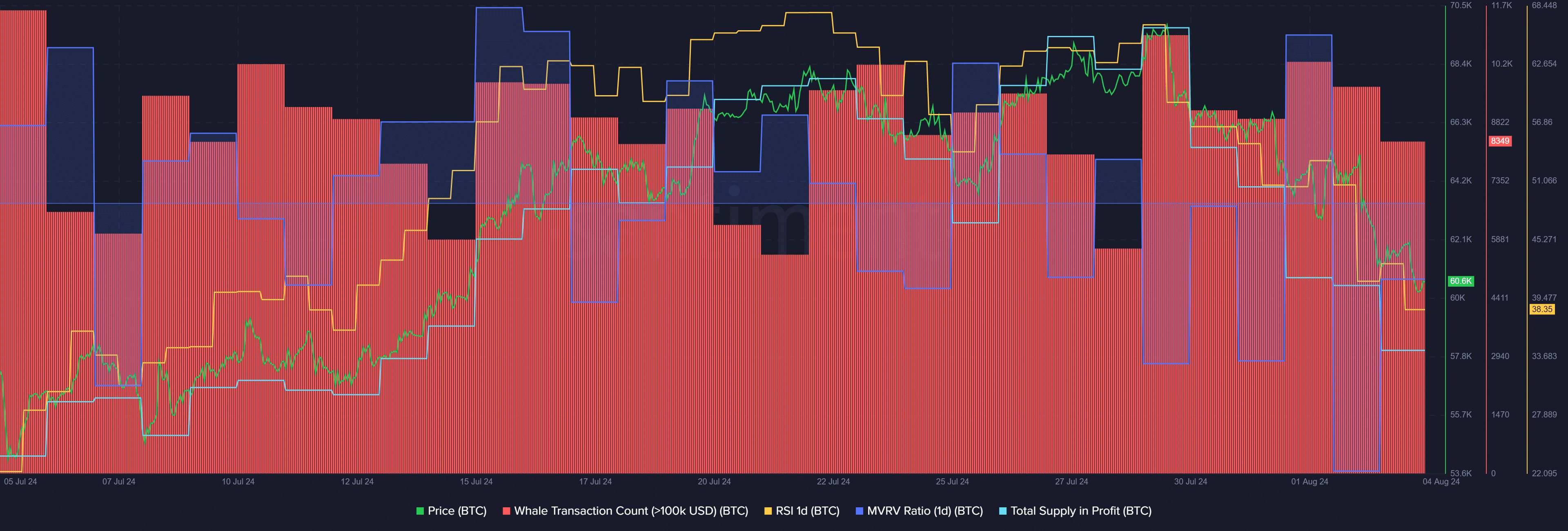

As a crypto investor, I’ve seen Bitcoin (BTC) reach an impressive local peak of nearly $70,000 just last week on July 29. However, since then, it seems our flagship cryptocurrency has taken a dip and dipped below the $60,000 mark earlier today.

In the last 24 hours, Bitcoin has experienced a decrease of approximately 1.55% and is currently valued at around $60,532.45. At this moment, its market capitalization stands at an impressive $1.19 trillion. Notably, the daily trading volume for Bitcoin dropped by a substantial 36%, currently estimated at about $27.4 billion.

Based on data from Santiment, the Relative Strength Index (RSI) of Bitcoin decreased from 66 on July 29 to 38 as of the current report. This suggests that Bitcoin is currently oversold at its current price level and may be primed for a possible price increase.

According to data from our market research tool, the Bitcoin MVRM (Market Value to Realized Value) ratio stands at -0.94%. This suggests that short-term investors are experiencing losses right now.

historically, when the MVRV ratio for Bitcoin (BTC) dipped just slightly below zero, it has tended to experience small recoveries in its price.

Based on Santiment’s findings, the amount of Bitcoin held at a profit decreased from approximately 18.96 million units on July 29 to about 16.19 million coins at this moment. It’s important to note that there are presently 19.73 million Bitcoins in circulation.

Since the beginning of this month, there’s been a decrease in significant Bitcoin transactions made by “whales” (large-scale investors). As per Santiment’s data, the number of whale transactions worth at least $100,000 has dropped from 10,353 on August 1 to only 8,349 unique transactions within the last 24 hours.

A decrease in significant Bitcoin transactions (whale activity) and transaction volume might signal reduced price fluctuations, potentially leading to an upward trend, given the low Relative Strength Index (RSI) and Market Value to Realized Value (MVRV) ratio levels.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-04 16:00