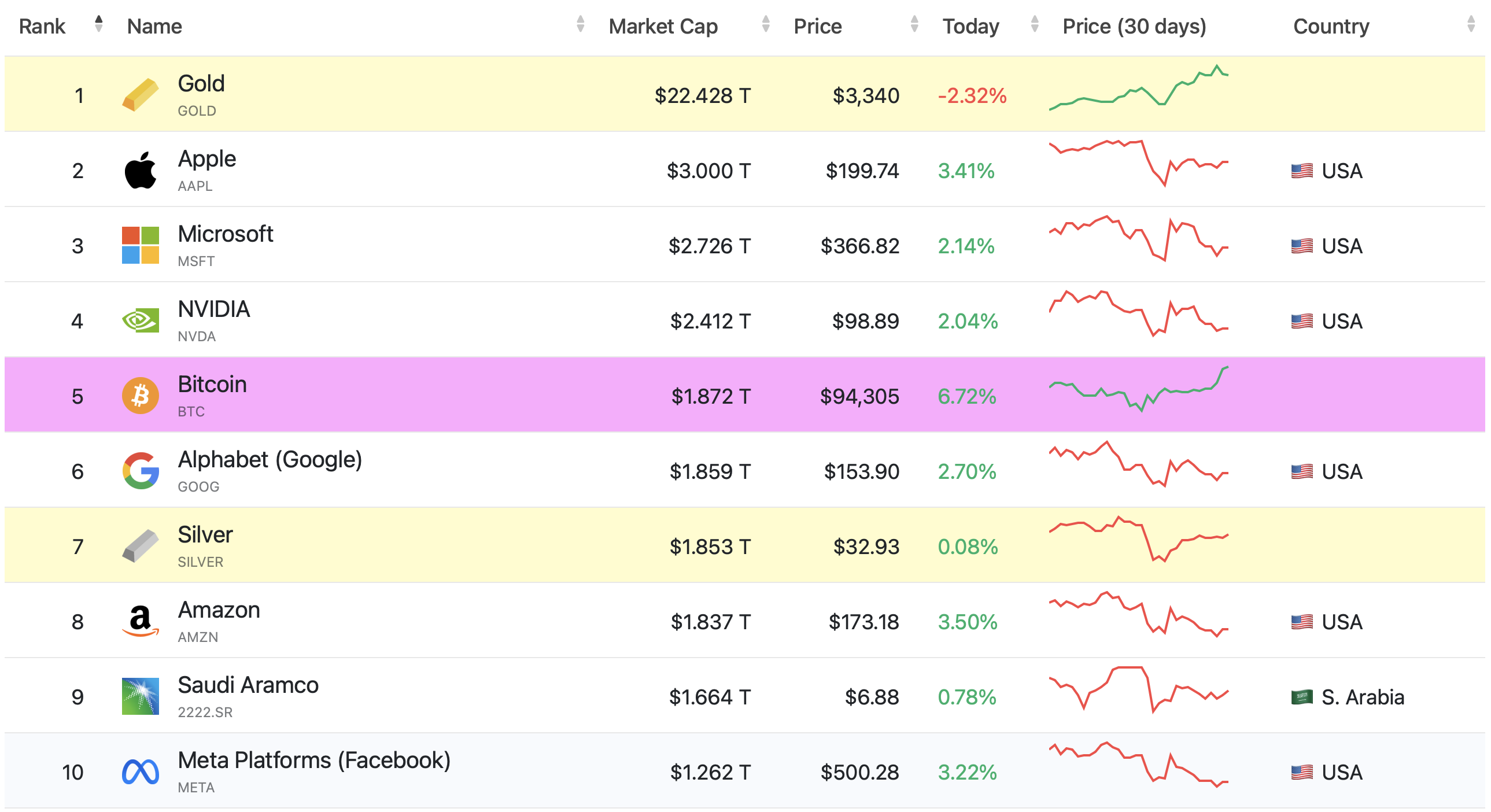

In a rather spectacular turn of events, Bitcoin has now decided to join the ranks of the financial elite, boasting a market cap of $1.87 trillion. Yes, you read that right – trillion. A modest leap from its humble beginnings, where it was just a whisper in the wind among Wall Street’s finest. 📈

In case you were wondering, Bitcoin’s price recently had an eye-watering surge, hitting a lofty $94,000. That’s a charming 6.7% increase in a mere 24 hours. Nothing like a little volatile excitement to spice up your day, eh? This comes as part of a broader crypto market recovery – a trend that has seen Bitcoin and its digital comrades clambering upward like eager interns hoping for a corner office. 🤑

A Historic Ranking

Now, Bitcoin finds itself positioned just behind the likes of NVIDIA ($2.41 trillion), Microsoft ($2.73 trillion), Apple ($3.00 trillion), and, of course, Gold – still holding onto its crown with a market cap of $22.43 trillion. Not bad for a digital asset that was once considered something of a whimsical tech experiment. The cryptocurrency is now poised to give traditional assets a run for their money, literally. Should we start sending thank-you cards to Satoshi? 🤔

What’s Driving Bitcoin’s Growth?

So, what’s fueling this meteoric rise? Well, the usual suspects: institutional adoption, growing public awareness, and an economy that has been handing out inflation like free candy. As more investors seek refuge from the often treacherous waters of fiat currency and traditional assets, Bitcoin has positioned itself as the ‘safe haven’ du jour. But with the added bonus of decentralization and the ever-tempting promise of high returns – who could resist? 🍾

And let’s not forget the regulatory landscape. It’s becoming slightly more hospitable toward cryptocurrency, as nations begin to craft clearer rules and frameworks. Naturally, this has boosted investor confidence, allowing Bitcoin to step forward as a legitimate, if slightly unpredictable, alternative asset. But really, who doesn’t love a bit of financial rebellion every now and then? 😏

The Future Outlook

Despite all the excitement, Bitcoin’s future remains a curious case. Sure, its surge has been impressive, but the volatility factor looms like a cloud of uncertainty. The crypto world still feels like a high-stakes poker game, and no one’s quite sure who’s bluffing. Yet, with Bitcoin now firmly planted in the top 5 largest assets globally, its role in the future of finance seems unavoidable. Many experts are now suggesting that this is merely the beginning of Bitcoin’s glorious conquest of the global markets. 🏆

As the digital age continues its relentless march forward, Bitcoin’s rise challenges the very notion of what constitutes a “safe haven” in investment circles. Could it one day surpass even bigger assets? Perhaps. But then again, who can predict the next great financial revolution – especially one that’s as unpredictable as Bitcoin itself? Time will, as always, reveal all. ⏳

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-04-23 13:01