As an experienced financial analyst, I’ve closely monitored Bitcoin’s price movements and market trends for several years. The recent surge above $65,000 is an exciting development that reflects growing investor confidence in this digital asset.

Bitcoin’s price has surpassed $65,000 after the cryptocurrency dropped below $57,000 last week.

At present, Bitcoin (BTC) hit a peak price of $65,500, but based on information from CoinMarketCap, its price had dipped back down to $63,500 by the time of reporting.

The coin’s significance in the cryptocurrency market was restored as Bitcoin’s price surged, accounting for approximately 54.8% of the entire crypto market capitalization.

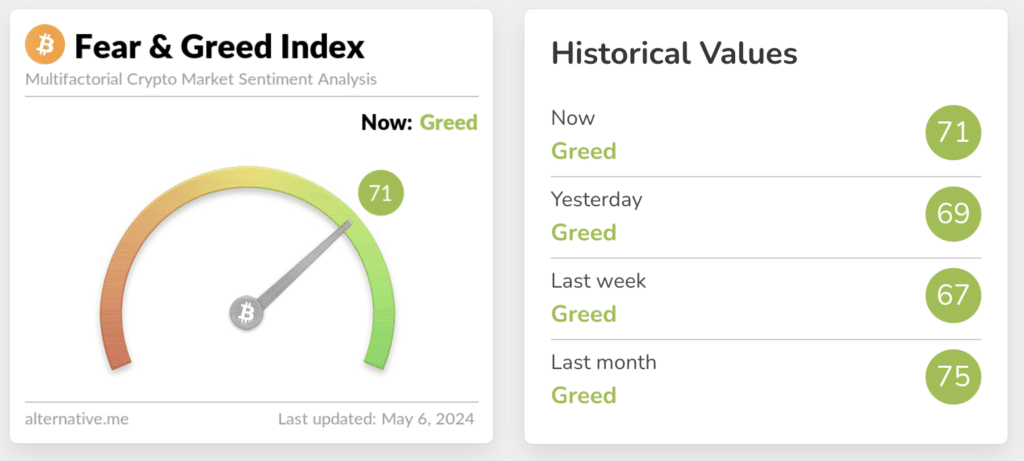

In addition, the Fear and Greed Index has risen two basis points over the past 24 hours.

As a researcher studying the intersection of financial markets and economic data, I’ve noticed an intriguing connection between the recent U.S. labor market report and Bitcoin’s price movement. Specifically, the publication of the May jobs report led to a significant surge in Bitcoin’s value, pushing it above $60,000 on that day. This price increase can be attributed to the report’s implications for Federal Reserve monetary policy. Prior to the release of the jobs report, it was widely anticipated that the Fed would make a key rate cut in November. However, the stronger-than-expected labor market data shifted these expectations, leading investors to believe that the Fed might act more aggressively and cut rates earlier, in September. This shift in monetary policy expectations contributed to the buying frenzy in Bitcoin, driving up its price.

Over the past month, investors have progressively pulled out approximately $1.2 billion from Bitcoin spot exchange-traded funds (ETFs). This trend came to a halt on May 3, as there was an inflow of $378 million into these ETFs on that day.

Since January of this year, total inflows into BTC ETFs have exceeded $11.5 billion.

As a crypto investor, I’m always keeping an eye on new developments that could impact the market. And I was excited to learn that on April 30, spot Exchange-Traded Funds (ETFs) for Bitcoin and Ethereum became available in Hong Kong. While these ETFs don’t yet match the trading volume of their American counterparts, seeing them emerge in the Asian market is a promising sign. It’s another step towards wider acceptance of cryptocurrencies in this region, which could lead to increased demand and potential growth opportunities for investors like myself.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-06 17:12