Crypto markets experienced significant volatility just prior to Bitcoin‘s halving event, causing the asset to fluctuate between $61,000 and $64,000.

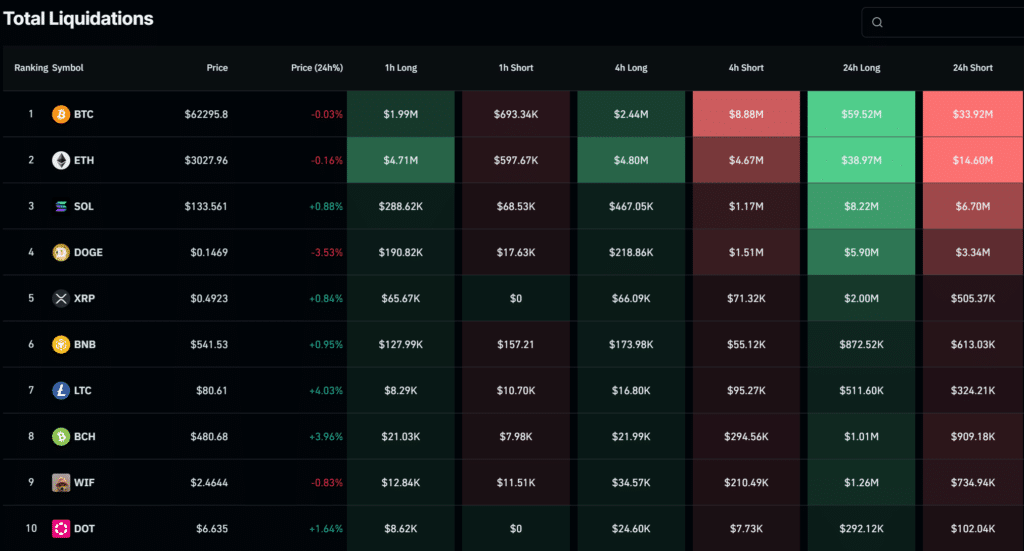

Based on CoinGlass’s report, the market instability caused numerous Bitcoin (BTC) liquidations and affected various digital assets. The longest BTC positions were significantly impacted on April 18 when the token dipped below $62,000.

In the past day, traders holding long positions on Bitcoin, expecting its price to rise, faced over $57 million in losses as their bets were liquidated across various trading platforms. Conversely, short positions, taken by investors anticipating a price drop, suffered losses of approximately $36 million.

At the current moment on crypto exchange OKX, Data is identified as having the largest liquidation order worth $5.3 million in BTC/USDT pair trades, affecting over 74,571 accounts and resulting in their positions being terminated.

The second largest cryptocurrency, Ethereum (ETH), had over $53 million in liquidations for both long and short traders, which was more than Bitcoin (BTC). In comparison, Solana (SOL), a major altcoin, had significantly less with approximately $14 million, while Dogecoin (DOGE), an established meme token, had around $9 million.

Bitcoin pre-halving swings

After reaching a new record high for Bitcoin in the previous month, causing a surge in the entire crypto market close to its 2021 peak, the price fluctuations and corrections appear to have led to a cooling off period in the market.

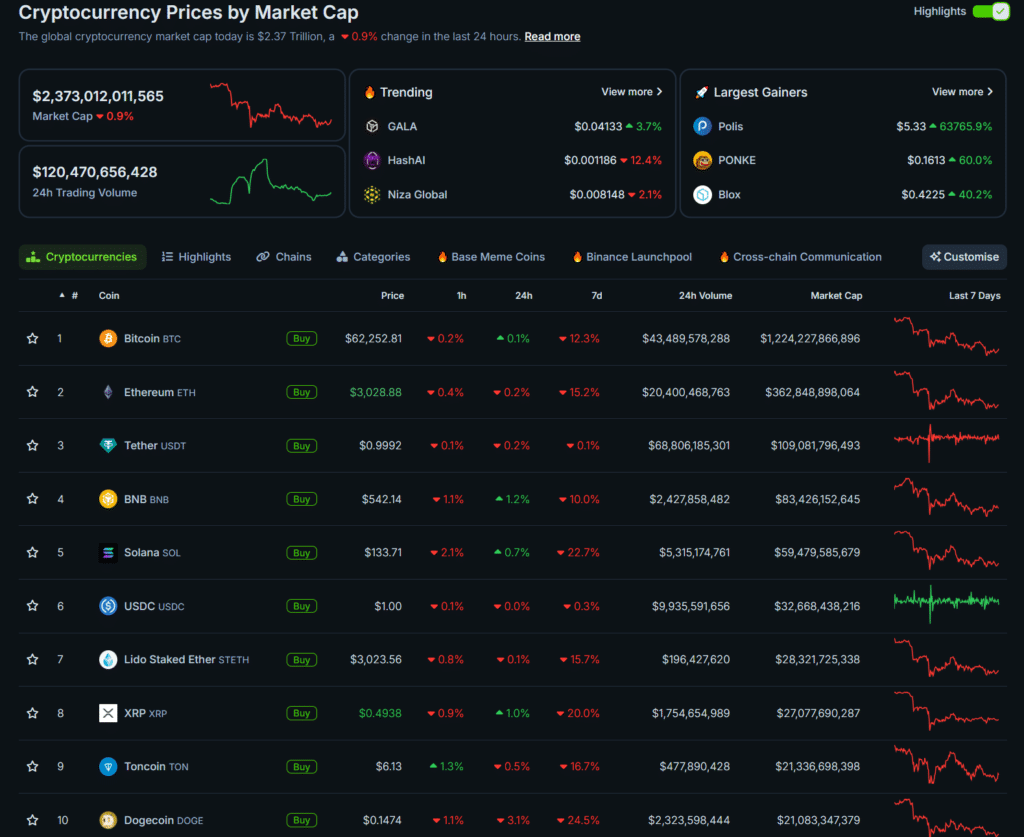

At present, the overall crypto market is experiencing little change, declining by 0.9% to reach a market value of approximately $2.3 trillion according to CoinGecko. Previously, during the bull run, this sector exceeded $3 trillion. It almost reached that mark again after Bitcoin saw significant growth earlier in the year.

The decrease in volatility prior to Bitcoin’s halving is not an unprecedented occurrence in the crypto market. Historically, markets have seen price drops of up to 50% before Bitcoin undergoes its code change. As suggested by its name, this event reduces the block reward by half, which could significantly affect mining companies’ income.

To prepare for the upcoming halving event, miners are said to have activated additional mining equipment in advance. This step aimed to maximize their earnings from the blockchain and build up funds to help cover future expenses.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-18 18:14