As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends. Based on my analysis, Bitcoin’s historical trend suggests a bearish September, but there are factors that could potentially flip this narrative.

Following Bitcoin‘s down month of August, experts at QCP Capital anticipate a potentially bearish trend continuing into September for cryptocurrencies. However, if the Federal Reserve shifts its stance (pivot), this could potentially bring some respite.

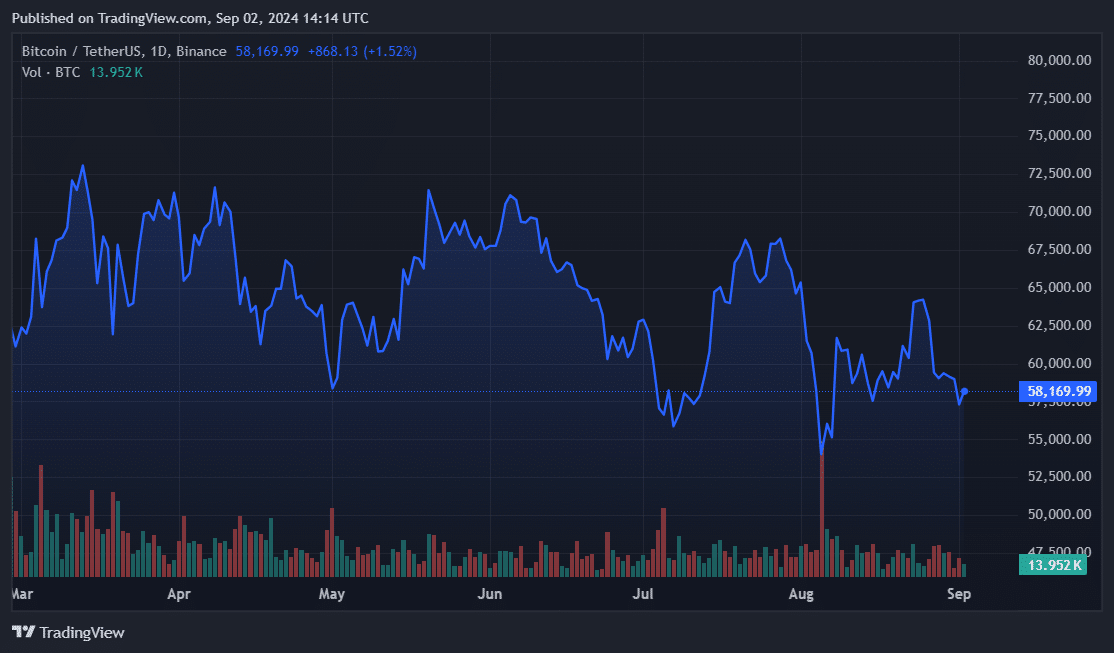

Based on the analysis by the digital asset trading desk, it appears that Bitcoin’s (BTC) previous pattern could recur. There’s a possibility that Bitcoin might experience a drop of approximately 5% in the current month due to the decline in August.

In six out of the past seven Septembers, Bitcoin has seen declines, with an average loss of around 4.5%. Yet, according to QCP Capital, these drops might actually help propel Bitcoin towards an uptrend.

The company anticipates Bitcoin’s value to regain strength approximately at $54,000 – a point it previously bounced from before soaring to $70,000 in July. Currently, Bitcoin is being traded at roughly $58,000 and has increased by almost 2% due to a minor upward trend in the market.

Experts: Fed rate cuts could negate historical Bitcoin trend

In simpler terms, although Bitcoin (BTC) usually sees a downtrend during this month, a potential shift in monetary policy by the U.S. Federal Reserve could trigger an upward surge, as suggested by Philipp Zentner, CEO of Li.Fi, via email to crypto.news on September 2.

In his speech at Jackson Hole last month, Federal Reserve Chair Jerome Powell indicated that an adjustment in interest rates was due. Many investors predict that reductions of around 0.25% to 0.50% could occur as soon as September this year.

Zentner highlighted three positive signs for Bitcoin (BTC): a growing influence of BTC over other cryptocurrencies, decreasing amounts of crypto held on exchanges, and increased availability of mined BTC in the open market. These trends suggest a bullish outlook for Bitcoin.

As a crypto analyst, I’ve observed a surge in Bitcoin’s (BTC) dominance, reaching approximately 58%. This shift reflects investor confidence in BTC relative to other cryptocurrencies, particularly Ethereum (ETH), which have shown comparative underperformance compared to Bitcoin.

Over the past month, data from CoinGlass indicates that vast amounts of Bitcoin have been withdrawn from platforms such as Binance and Coinbase. Moreover, in June, the balance of Bitcoin and Ethereum on exchanges dropped to a level not seen in four years. This downward trend could potentially reflect a positive investor outlook towards these cryptocurrencies. However, it’s important to note that overall sentiment remains somewhat divided, as people anticipate upcoming interest rate reductions.

From my perspective as an analyst, it appears that the market is gearing up for a potentially robust uptrend. This surge seems to be fueled by several key elements: the robustness of Bitcoin’s underlying fundamentals, the healthy capitalization of the stablecoin sector, and the expectation of a more accommodating monetary policy landscape. The convergence of these factors suggests that we may be entering a bullish phase for Bitcoin and the wider market as we progress deeper into the year.

Philipp Zentner, Li.Fi CEO

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Brent Oil Forecast

- Roblox: Project Egoist codes (June 2025)

- EUR CNY PREDICTION

2024-09-02 17:26