As an experienced financial analyst, I believe this latest move by Riot Platforms to acquire a 12% stake in Bitfarms is a calculated response to the shorting pressure from Kerrisdale Capital and a demonstration of its belief in Bitfarms’ potential. Despite the operational concerns raised by Kerrisdale, Riot seems confident that it can bring about positive change through the appointment of new directors to the Bitfarms board.

A Colorado-based cryptocurrency mining company, Riot Platforms, has purchased a 12% share in its competitor, Bitfarms, in defiance of short selling attempts instigated by Kerrisdale Capital.

Riot Platforms, a Bitcoin mining firm, announced on June 5th through a press release that they had obtained ownership of roughly 12% of Bitfarms’ common shares. They purchased a total of 1,460,278 shares at a price of $2.45 per share, amounting to an investment of approximately $3.5 million.

After completing the takeover, Riot announced its intention to convene a gathering of Bitfarms’ shareholders for a particular purpose. During this assembly, Riot intends to propose “several highly capable and unbiased individuals” as new members for the Bitfarms board. This move is being made in response to “grave concerns over the board’s history of questionable corporate governance.”

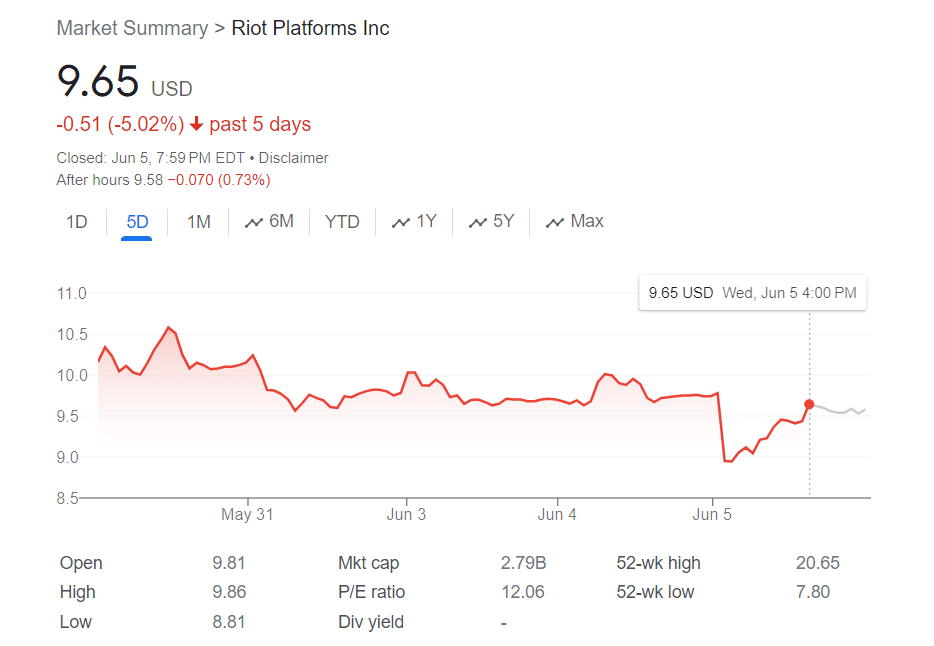

Amidst growing short selling from Kerrisdale Capital, who revealed a short position in Riot and raised concerns over equipment sourced from China and operational issues, leading to a 9% dip in Riot’s stock price to $8.84, the company responded by purchasing more shares in Bitfarms. This announcement caused Riot’s share price to recover, reaching $9.65 according to Google Finance data.

In late May, I learned that Riot had proposed a $950 million takeover of Bitfarms. According to Riot, the founders of Bitfarms weren’t serving the interests of all shareholders. However, my findings indicate that Riot’s initial, private proposal in late April was dismissed by the Bitfarms board without providing meaningful dialogue or consideration.

As a crypto investor, I’d interpret Bitfarms’ statement as follows: When Riot extended an offer for our company, Bitfarms felt that it didn’t accurately reflect our potential for growth. We requested typical confidentiality and non-solicitation protections during negotiations, but Riot failed to acknowledge these requests.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-06-06 10:18