As a seasoned crypto investor with several years of experience in the market, I’ve seen my fair share of market fluctuations and mining difficulty changes. The recent drop in Bitcoin mining difficulty to its lowest level since December 2022 is an interesting development, but it doesn’t necessarily fill me with optimism.

Bitcoin mining difficulty has dropped to its lowest level since December 2022.

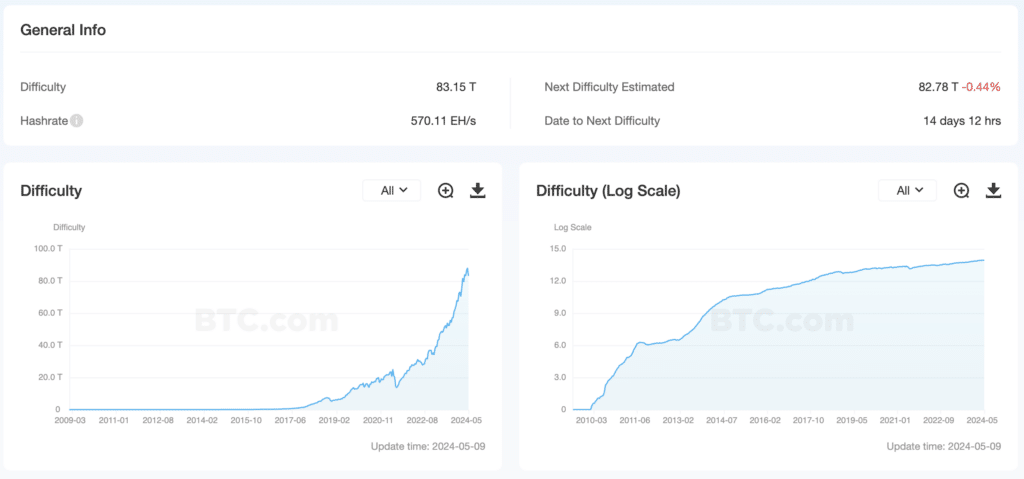

Based on BTC.com’s data, the Bitcoin (BTC) mining difficulty decreased by approximately 5.63% on May 9, reaching a level of 83.15 T. This value last occurred during the 2022 bear market due to a string of bankruptcies, including Terra and FTX’s collapse.

As a researcher studying Bitcoin mining trends, I’ve observed a noteworthy change in the average hashrate over the past two weeks. Specifically, it dropped from 630 EH/s to 595 EH/s. This decrease could be indicative of miners shutting down their equipment due to unprofitability following the latest Bitcoin halving event.

The indicator’s next change will occur on May 23. The predicted value is a drawdown of 0.19%.

On April 20th, the block reward for mining Bitcoins was reduced from 6.25 to 3.125. Following this change, known as a “halving,” the mining difficulty surged due to elevated transaction fees on the Bitcoin network. However, miners’ earnings remained largely unaffected by the halved reward.

In early May, the earnings of Bitcoin miners reached levels last seen in October 2023, according to Blockchain.com data. Specifically, their daily revenue dipped to approximately $26.38 million on May 3.

Ki Young Ju, the founder and CEO of analytical firm CryptoQuant, didn’t detect any indications of miner surrender. He calculated that the remunerative price level for Bitcoin following its halving of the block reward should be approximately $80,000.

Bitcoin miners have experienced a significant decrease in earnings, bringing revenues back to early 2023 levels following the halving. At present, miners face two possible scenarios: 1) giving up and selling their equipment (capitulation), or 2) remaining patient and holding out for an increase in Bitcoin’s price. No clear signs of capitulation have emerged as of yet.

— Ki Young Ju (@ki_young_ju) April 30, 2024

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-09 17:31