As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely followed the intricacies of Bitcoin (BTC) and its associated industries for years. The recent surge in BTC price and mining stocks, following the failed assassination attempt on Republican presidential candidate Donald Trump, is an interesting development that warrants closer examination.

Based on their analysis, H.C. Wainwright’s experts suggest that the bullish sentiment towards cryptocurrencies could indicate growing optimism regarding the chances of Republican presidential candidate Donald Trump in the upcoming election.

Trump’s self-assurance stems from his well-known advocacy for cryptocurrencies, most notably his backing of Bitcoin (BTC) mining operations within the United States.

After a failed assassination attempt against Trump during a campaign rally in Butler, Pennsylvania, on July 13, Bitcoin (BTC) and related mining stocks experienced significant gains. The cryptocurrency’s price soared by nearly 9%, peaking around $63,790 on Monday. Mining stocks, meanwhile, saw an approximately 10% increase during the same trading session.

“According to many, the unfortunate incident significantly increased Trump’s chances of winning the November election. Given Trump’s reputation as a pro-crypto candidate, who has openly endorsed Bitcoin mining in the United States, financial markets reacted positively following the failed attempt.”

Selling pressure

The price surge for Bitcoin occurred concurrently with the conclusion of selling actions from the German government, who had disposed of their last 50,000 BTC seized during the Movie2k case. This large volume was withdrawn from the market, reducing the downward pressure on Bitcoin prices. Notably, U.S. Bitcoin ETFs experienced significant inflows last week, totaling over $1 billion and purchasing approximately 18,000 BTC.

Additionaly, the intense selling activity on the blockchain was partly caused by the initiation of long-anticipated Mt. Gox reimbursements. Launched in 2010, Mt. Gox once held the title of the world’s biggest Bitcoin exchange. However, it encountered a major hurdle in 2014 when it suspended trading, declared bankruptcy, and revealed the loss of around 850,000 BTC due to thefts. Lately, the transfer of 47,228 BTC from a wallet linked to Mt. Gox has stirred up market responses. Moreover, the selling pressure from miners persists as they adjust to the recent halving which decreased mining rewards by half.

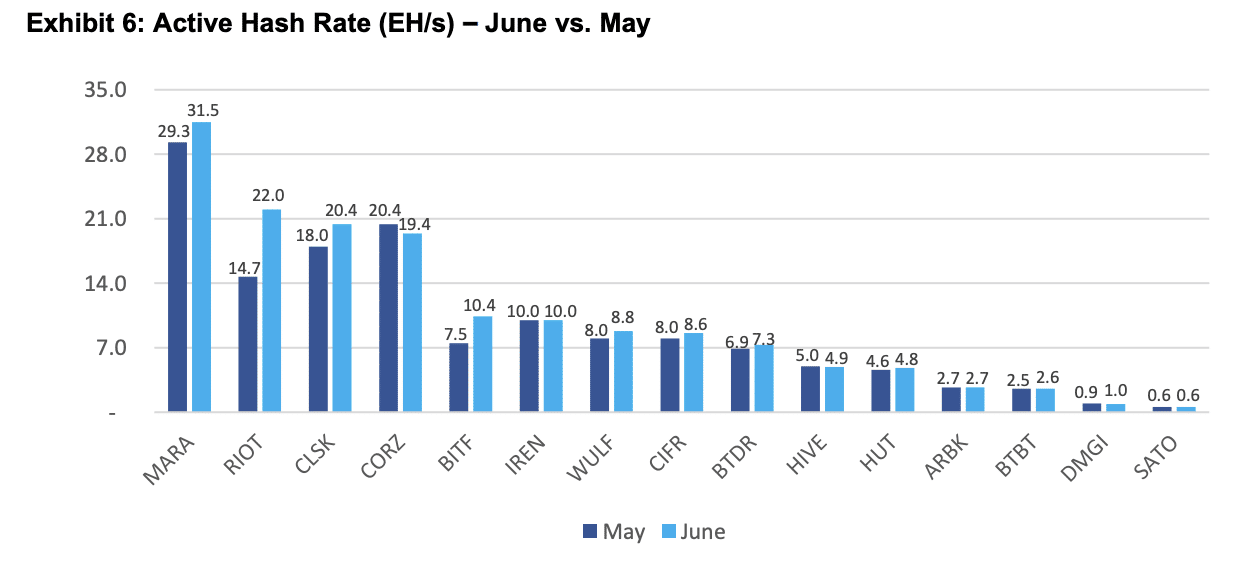

Increased hash rate

Last week, from July 4 to July 10, Bitcoin surged 8.7% to reach $61,015. This growth was more significant than the advancements seen in wider equity markets. Meanwhile, the mining network’s hash rate experienced a 2.7% boost, amounting to 598 exahashes per second (EH/s). The network difficulty, however, stayed constant at 79.5 terhashpersecond (TH/s) after undergoing a 5% adjustment on July 4.

As a cryptocurrency analyst, I’ve observed an intriguing development in the Bitcoin market. With prices on the rise, transaction fees have dropped somewhat. However, this decrease in fees was more than offset by the positive impact on hash rates. Specifically, the higher BTC prices led to a 5.2% increase in hash prices, pushing them back up to $0.049 per TH/day. This marks the first time we’ve seen hash prices surpass the $0.05/TH/day threshold in over three weeks.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-16 22:36