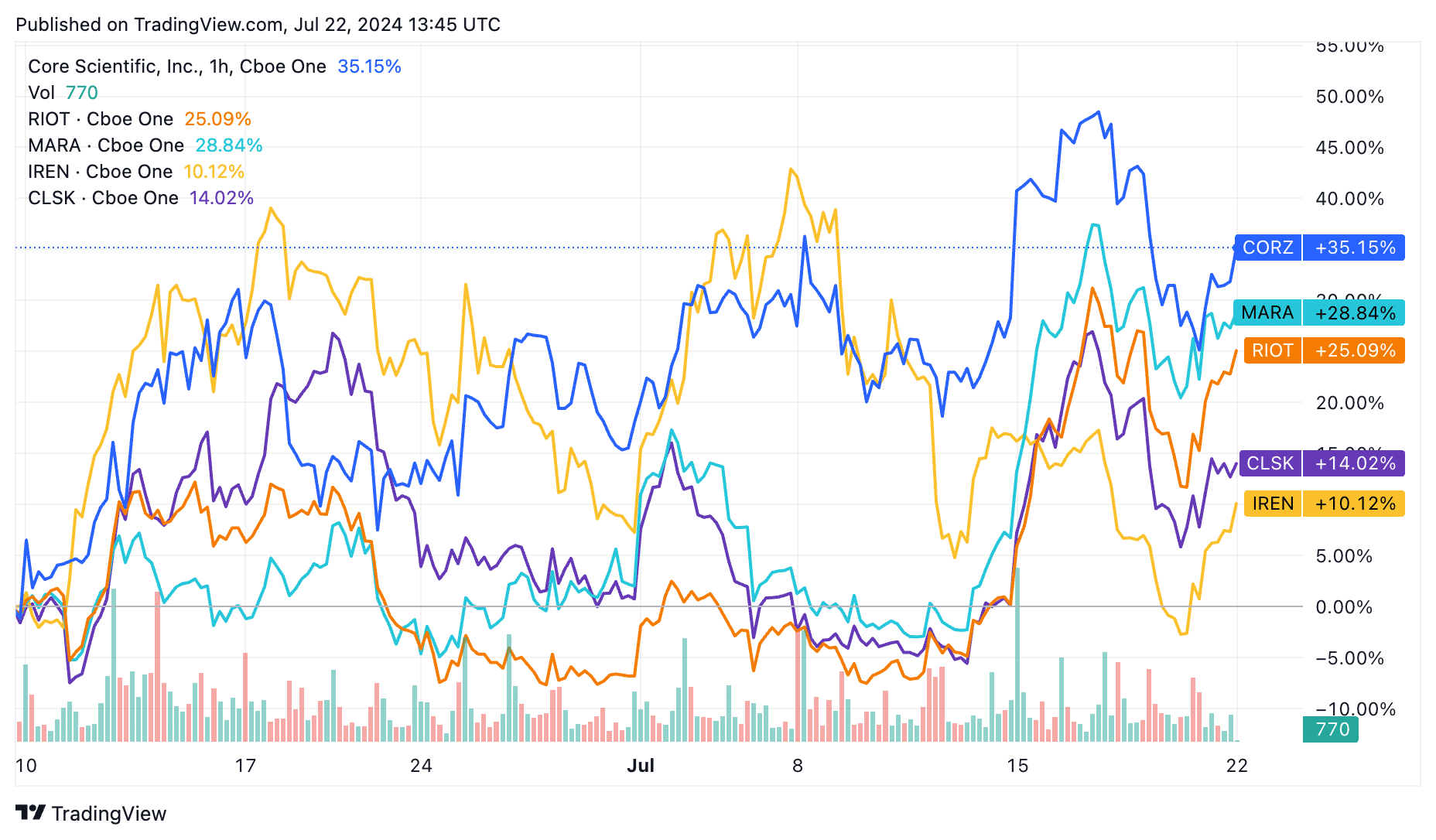

As a seasoned financial analyst with over a decade of experience in the crypto market, I have witnessed numerous price fluctuations and trends in Bitcoin and its associated stocks. The recent recovery of Bitcoin mining stocks, as reflected by companies such as Core Scientific (CORZ), Riot Platforms (RIOT), Marathon Digital (MARA), Iris Energy (IREN), Cipher Mining (CIFR), and CleanSpark (CLSK), is a trend that I find particularly interesting.

Bitcoin mining stocks continued their recovery as Bitcoin continued rising during the weekend.

Bitcoin mining stocks are rising

Bitcoins have surged past the 26% mark since hitting their lowest this month, fueled by investor optimism that the cryptocurrency will eventually reach $70,000.

As a researcher studying the stock market trends, I observed that Core Scientific’s (CORZ) stock price increased by 2.3% on Monday. Furthermore, Riot Platforms (RIOT), Marathon Digital (MARA), Iris Energy (IREN), Cipher Mining (CIFR), and CleanSpark (CLSK) experienced significant gains, with each company’s stock rising over 2%.

Companies have gained traction among investors, who are hopeful that Bitcoin will bounce back strongly in 2023. According to Polymarket, approximately two-thirds of their users anticipate Bitcoin reaching a new height of $70,000 this month – a significant leap from its current price of around $67,000.

It’s plausible that the recent market surge can be attributed to optimistic poll results suggesting a victory for Donald Trump over Kamala Harris in the upcoming election.

It’s expected that the price of Bitcoin may increase prior to the Bitcoin conference in Nashville, at which Donald Trump is scheduled to speak. Additionally, attendees can purchase tickets for Trump’s campaign fundraiser, priced steeply at over $800,000 each.

Bitcoin mining companies experience increased success when Bitcoins price is on the rise due to heightened revenue and profit generation. This trend is crucial as numerous miners saw a decrease in their coin production following the halving event in April.

Industry consolidation is becoming apparent as evidenced by recent corporate developments. Earlier in the year, Riot Platforms put forth an offer for Bitfarms, while Core Scientific declined a takeover attempt from CoreWeave. More recently, Cipher Mining has reportedly been mulling over a potential sale following receipt of acquisition bids.

Bitcoin mining businesses may receive takeover proposals from companies aiming to expand their AI capabilities by acquiring these mining operations.

Bitcoin technicals are sending mixed signals

Despite this, Bitcoin-related businesses continue to encounter technical risks as cryptic price indicators convey conflicting messages. In his note published over the weekend, experienced prop trader Peter Brandt expressed doubt about the bullish significance of the current chart pattern. Instead, he posits that Bitcoin’s trend is bearish.

In my efforts to maintain transparency towards Edwards, Magee, and Schabacker during the process of pattern identification, I want to make it clear that the present Bitcoin congestion should not be perceived as a flag due to its prolonged duration. Instead, it manifests itself more as a downward channel on the price chart. ($BTC)— Peter Brandt (@PeterLBrandt) July 20, 2024

Bitcoin appears to be shaping up as a falling broadening wedge on the charts, which is typically seen as a bullish indicator. Additionally, Bitcoin has entered the third stage of the “three-doves” pattern, suggesting further price increases.

Bitcoin has continued to stay above its 200-day moving average, indicating further potential growth. As Michael Novogratz stated in June, a confirmation of more Bitcoin price increases would occur if it surpassed its year-to-date high of $73,400.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-07-22 17:40