The stock prices of Bitcoin mining businesses are dropping significantly as they prepare for the upcoming halving event.

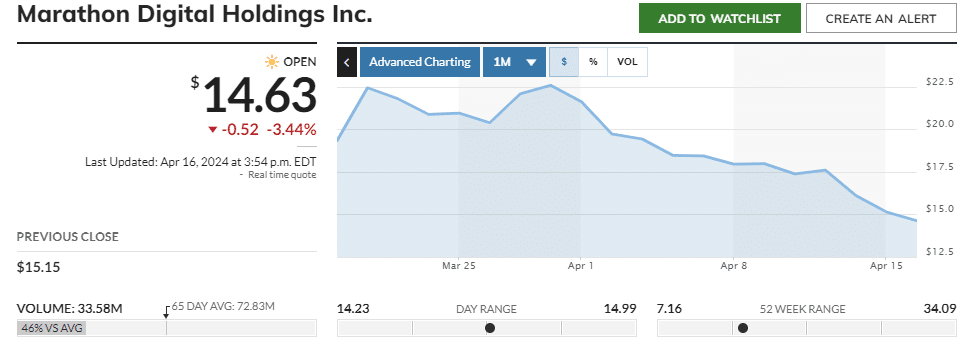

Marathon Digital Holdings, the biggest publicly traded Bitcoin mining company, along with Riot Platforms and CleanSpark, have experienced three straight days of share price drops. Marathon Digital Holdings suffered a significant loss of approximately 25% over the past month. Riot Platforms endured nearly a 30% decrease in stock value. Furthermore, the Bitcoin Miners exchange-traded fund managed by Valkyrie has witnessed a decline of around 28% this month.

With cryptocurrency mining stocks seeing an uptick in short selling and heightened geopolitical tension between Iran and Israel, the value of stocks, including those in the market, is dropping as investors opt for safer investments.

In spite of the obstacles, the CEOs of these mining businesses remain hopeful, as reported by Bloomberg. Mining companies’ cost savings, state-of-the-art mining tech, and growing cryptocurrency market demand could help offset the projected $10 billion yearly revenue decrease resulting from the forthcoming Bitcoin halving.

Additionally, companies are optimistic that the rise in demand caused by new Bitcoin spot ETFs will be enough to boost Bitcoin’s price and counteract any negative impacts from the update. These ETFs, launched by traditional asset management firms in January, have already drawn in a significant total net inflow of $12.4 billion.

The approval of Bitcoin ETFs in Hong Kong has brought substantial excitement among crypto industry leaders. As expressed to crypto.news, Sumit Gupta, the co-founder of CoinDCX – a prominent exchange in India – voiced his optimism with the first significant ETF approval occurring in Asia.

“Historically, institutions have played a significant role in drawing more attention and momentum to different types of assets. This trend is now emerging in Asia for the first time, making it feel more relatable and emphasizing its global impact. The crypto industry is slowly moving towards wider acceptance, with indications of steady growth and eventual mainstream recognition.”

– Sumit Gupta, co-founder of CoinDCX

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-16 23:46