As a seasoned crypto investor with over a decade of experience navigating the digital currency market, I have witnessed its transformation from a niche concept to a mainstream asset class. The latest rally, pushing Bitcoin (BTC) towards $100K, is an exciting development that underscores the power and resilience of retail investors.

As a researcher, I am observing that currently, the value of Bitcoin stands at approximately $99,340.23, edging closer to the significant milestone of $100,000. It appears that retail investors are continuing to exert their influence over the market dynamics.

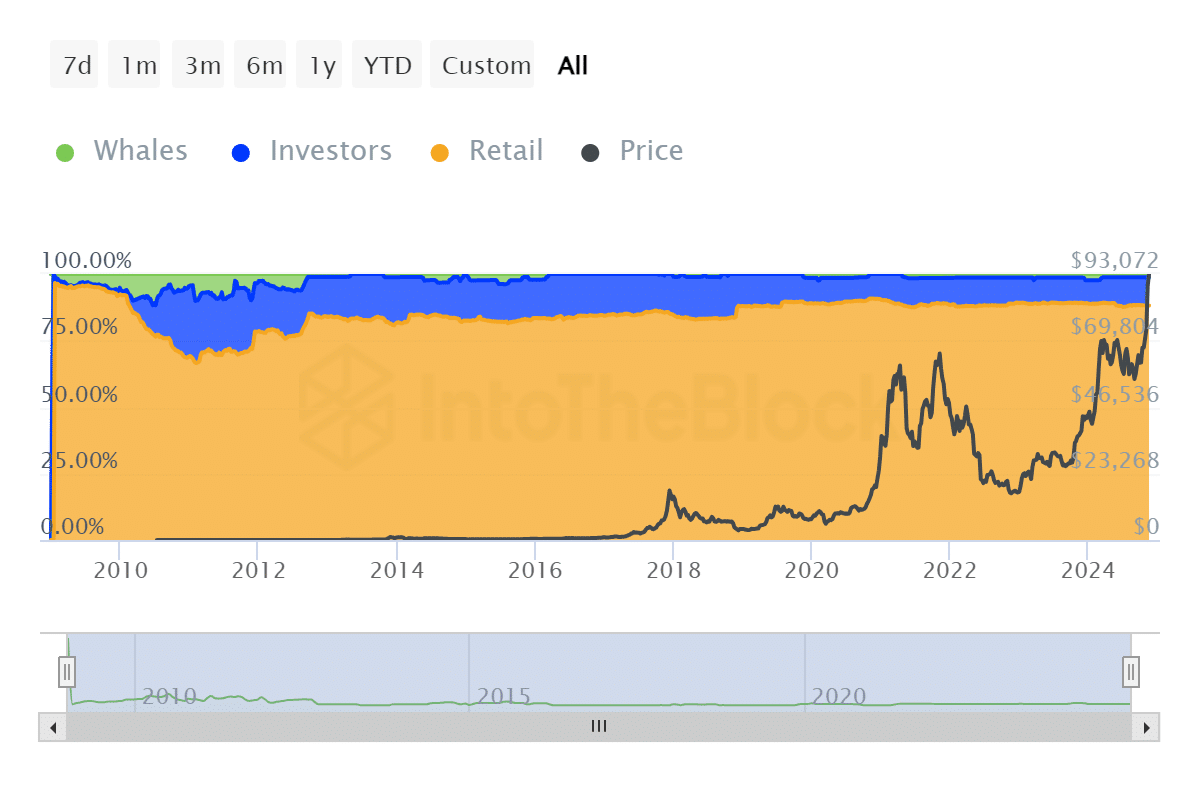

It’s particularly noteworthy that this Bitcoin rally is largely driven by retail investors, who control an impressive 88.07% of all circulating Bitcoins as reported by The Block. This contradicts the notion that institutional investors are surpassing retail investors in terms of BTC ownership. Instead, it seems that retail investors continue to hold a significant stake in Bitcoin, demonstrating their firm grip on the market. Compared to the minor shares held by whales (1.26%) and institutional investors (10.68%), this grassroots control is quite substantial.

In a significant development, BlackRock’s Bitcoin ETF options made their debut with a whopping $1.9 billion worth of trades on its first day. This is notable because it indicates increasing institutional interest in Bitcoin. It also makes investing in Bitcoin more accessible for regular investors. However, Jeff Park, Head of Alpha Strategies at Bitwise Invest, notes that there is still some distance to cover before we fully grasp the potential impact this ETF could have on shaping access to Bitcoin.

As anticipated, the market displayed a “volatility pattern” known as a “smile,” which was firmly in place by 9:45 AM and persisted for the remainder of the day. Remarkably, this smile expanded further during the day, culminating in higher ‘wings’ at the end of the trading session.

— Jeff Park (@dgt10011) November 20, 2024

Bitcoin Breakdown:

The distribution of Bitcoin ownership generally aligns with the market’s overall pattern of asset circulation. Notably, companies like Coinbase possess considerable amounts of Bitcoin, totaling over 2.25 million units. Despite this substantial holding, most of these Bitcoins are stored for their clients. The wallet associated with Satoshi Nakamoto, who played a crucial role in initiating the Genesis block, holds approximately 96,8452 BTC and remains unchanged.

Approximately 5.2% of all Bitcoin (around 1.09 million) is held in funds and ETFs, whereas governments like the United States and China together possess roughly 2.5%.

As an analyst, I’ve observed that while Bitcoin (BTC) has experienced significant price increases, the market remains unpredictable and prone to extreme fluctuations. For example, on November 21st, the price of BTC plummeted to $95,756.24, with a trading volume of approximately $98.40 billion. This volatility underscores the significant impact that retail investors can have during price rallies, as institutional investors increasingly participate in the market.

Opponents suggest that Bitcoin is growing increasingly centralized, yet the evidence does not support this notion. Institutions find financial tools like ETFs enticing, and these products also make Bitcoin more accessible to individual investors. Bitcoin still adheres to Satoshi Nakamoto’s concept of a distributed and inclusive financial model. As Bitcoin approaches the $100,000 mark, it is clear that ownership remains crucial in the ongoing dialogue about its value.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2024-11-22 11:02