As a long-term crypto investor with several years of experience under my belt, I find the current state of Bitcoin’s on-chain activity both intriguing and slightly concerning. The recent decline in transaction volumes, daily active addresses, and whale transactions suggests that traders are exhibiting fear and indecision in the market.

The number of transactions on the Bitcoin network is nearing record lows, as traders have noticeably reduced their activities in the past two months following Bitcoin’s achievement of a new peak price.

As an analyst studying the trends in the Bitcoin network, I’ve noticed some intriguing insights from data analytics firm Santiment. The data reveals that on-chain activity has been decelerating over the past few months. This subtle shift in network usage offers a nuanced perspective on Bitcoin’s current condition.

In a May 11 announcement regarding X, Santiment noted that the Bitcoin network’s on-chain activity is currently at its lowest point since 2019. This finding arises from a clear decrease in several key metrics, such as transaction volume, daily active addresses, and whale transactions.

The level of on-chain activity for Bitcoin is nearing record lows, with traders significantly reducing transactions in the past two months following its all-time high. This doesn’t automatically mean further price drops for Bitcoin, but instead reflects growing uncertainty and hesitation among investors.

— Santiment (@santimentfeed) May 11, 2024

Based on data from Santiment, Bitcoin’s transaction volumes on the blockchain are approaching their ten-year low, and the number of daily active addresses is currently at its minimum since early 2019.

As a researcher examining transaction data from a prominent analytics firm, I’ve noticed an intriguing trend. The frequency of whale-sized transactions, defined as those exceeding $100,000, has significantly decreased. This trend recalls the subdued activity levels observed back in December 2018.

Analysts at Santiment propose that a decrease in Bitcoin’s on-chain activity might not automatically indicate approaching price declines, based on their observations in the past few weeks.

I would explain it this way: The cause of the market’s downturn is believed to be rooted in traders’ collective anxiety and hesitance, which is closely connected to the intricacies of on-chain behavior and investor sentiment.

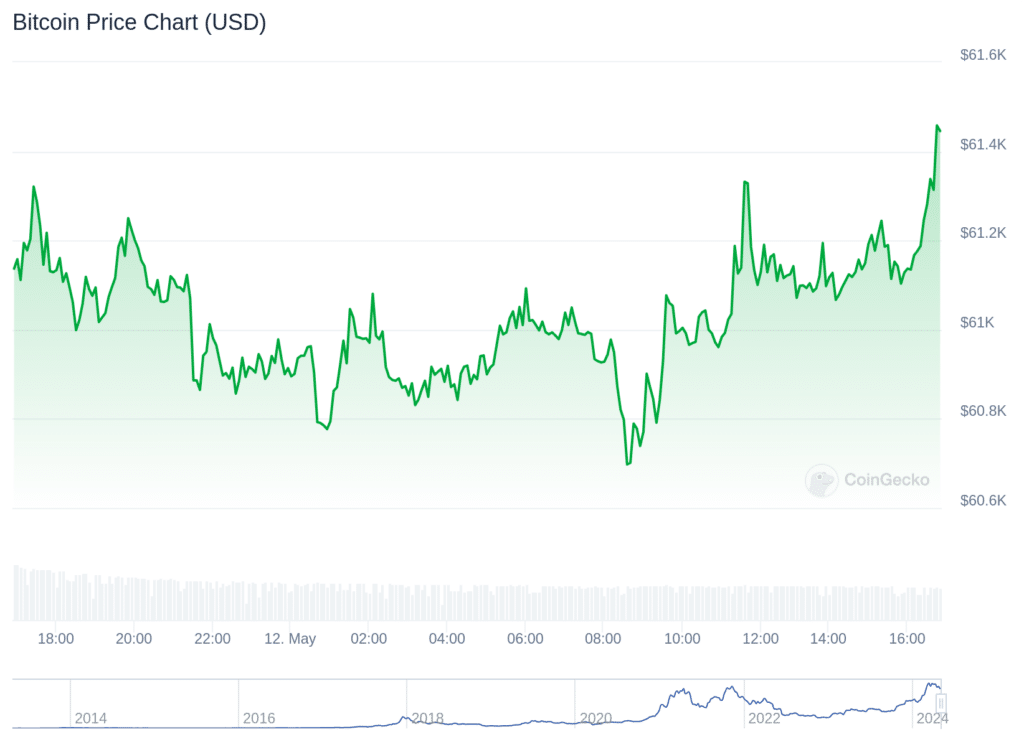

In spite of the obstacles, Bitcoin’s value remained fairly consistent, resting around $61,000 at the current moment, and experiencing a minimal gain of 0.1% over the previous day.

Yesterday’s trading volume for the coin amounted to $19.53 billion, which is over 37% greater than the $12.67 billion recorded in the past 24 hours.

I’ve analyzed the price trends over the past week, and I found that Bitcoin experienced a 4.6% decrease in value. In contrast, the broader global crypto market saw a decline of only 4.2% during the same period based on data from CoinGecko. This indicates that Bitcoin underperformed relative to the overall crypto market.

During times of market consolidation with decreased on-chain Bitcoin activity, the mood of investors and larger economic influences will significantly impact Bitcoin’s future direction in the upcoming weeks.

Bitcoin, Runes protocol

Based on data from Dune Analytics’ dashboard, the Runes protocol generated approximately $135 million in transaction fees on the Bitcoin network with the highest transaction volume.

During the week following the halving event, the on-chain data indicated that over 2,100 Bitcoin worth of tokens were issued under the given standard.

As an analyst, I’ve observed a noticeable decrease in the pace of events taking place within the Runes protocol since then. Based on data from Dune Analytics, as reported by The Block, last Friday, May 10, marked the lowest level of activity recorded on the platform.

Read More

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-05-12 19:30