As a seasoned analyst with over two decades of experience in the financial markets, I find the recent developments in Bitcoin particularly intriguing. The $23 billion worth of BTC accumulated by permanent holders in just a month is a significant spike that warrants attention. This trend, coupled with Ki Young Ju’s other bullish indicators, suggests a robust and ongoing bull market for Bitcoin.

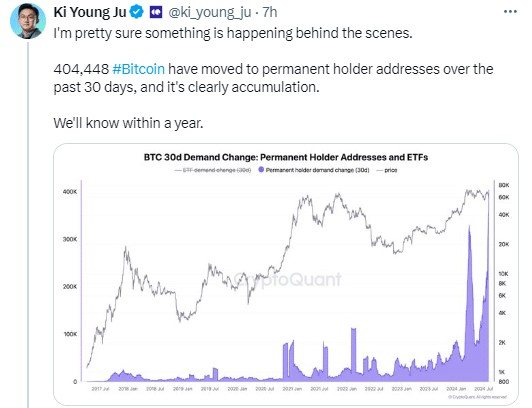

Over the last month, Bitcoin owners with long-term holdings have amassed approximately $23 billion in Bitcoin, as shown by on-chain statistics. This substantial increase in Bitcoin demand over the past 30 days was pointed out by Ki Young Ju in a post on X on August 7.

Approximately $22.8 billion, which is equivalent to around 404,448 Bitcoins, have recently moved to long-term storage wallets. Ki Young Ju cautions that individual investors may regret not purchasing Bitcoin now, as large institutions could make significant Bitcoin purchases by the third quarter of 2024, potentially leading to potential price increases.

Ki Young Ju additionally highlighted several optimistic signs. He noted that the phase of miner capitulation appears to be nearing its end, as Bitcoin’s hash rate is close to setting new record highs. Furthermore, the cost of mining in the U.S. currently stands at approximately $43,000 per Bitcoin, which indicates stability unless the prices drop below this threshold.

Ki Young Ju observed that retail investors, like in the middle of 2020, are scarcely participating, and the activity of ‘whales’ (large investors) has noticeably decreased. During March to June, long-term holders were seen selling their assets, but currently, there seems to be no substantial pressure for them to sell further.

According to Ki Young Ju’s assessment, the bull market appears to be holding strong for now. Yet, if the market fails to recuperate within the next fortnight, he may need to reevaluate his perspective. This could potentially suggest that large investors are either making incorrect predictions or have overlooked key aspects of the current macroeconomic climate.

Following a dip on August 5 that brought Bitcoin’s price down to $52,000, the cryptocurrency has risen by 14%, reaching $57,000 as of August 6. At the moment, Bitcoin is experiencing a 1.7% increase, trading at $56,836. Additionally, the Fear and Greed index has climbed to 29.

Ki Young Ju’s findings indicate a substantial buildup of Bitcoin ownership among long-term investors, hinting at possible upcoming declarations by prominent institutions. It may be regrettable for individual investors if they fail to seize this opportunity before substantial purchases by large entities are disclosed.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-07 09:26