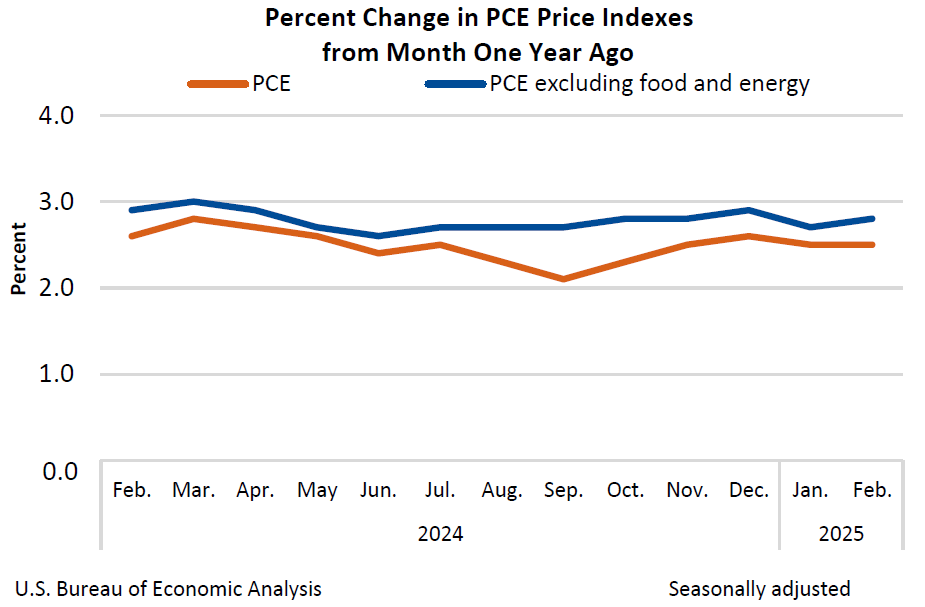

Ah, the “core” personal consumption expenditures (PCE) price index! It’s a statistic so refined that it delicately tiptoes around the volatile, tempestuous realms of food and energy prices. One might almost mistake it for a dapper gentleman avoiding a puddle on his promenade.

PCE Shock: Bitcoin Falls Under $85K as Inflation Worries Return

In what can only be described as an economical plot twist worthy of Wagnerian drama, both the traditional and crypto markets performed synchronized dives this morning. The culprit? The U.S. Bureau of Economic Analysis (BEA) had the audacity to reveal a core PCE price index increase of 0.4%—a figure more bloated than a dinner party guest who’s been left alone with the trifle. 🍨

But do not panic entirely; when the rowdy hooligans of food and energy prices were invited back to the party, the “all-items” PCE price index rose a polite 0.3%, keeping everyone’s monocles securely in place.

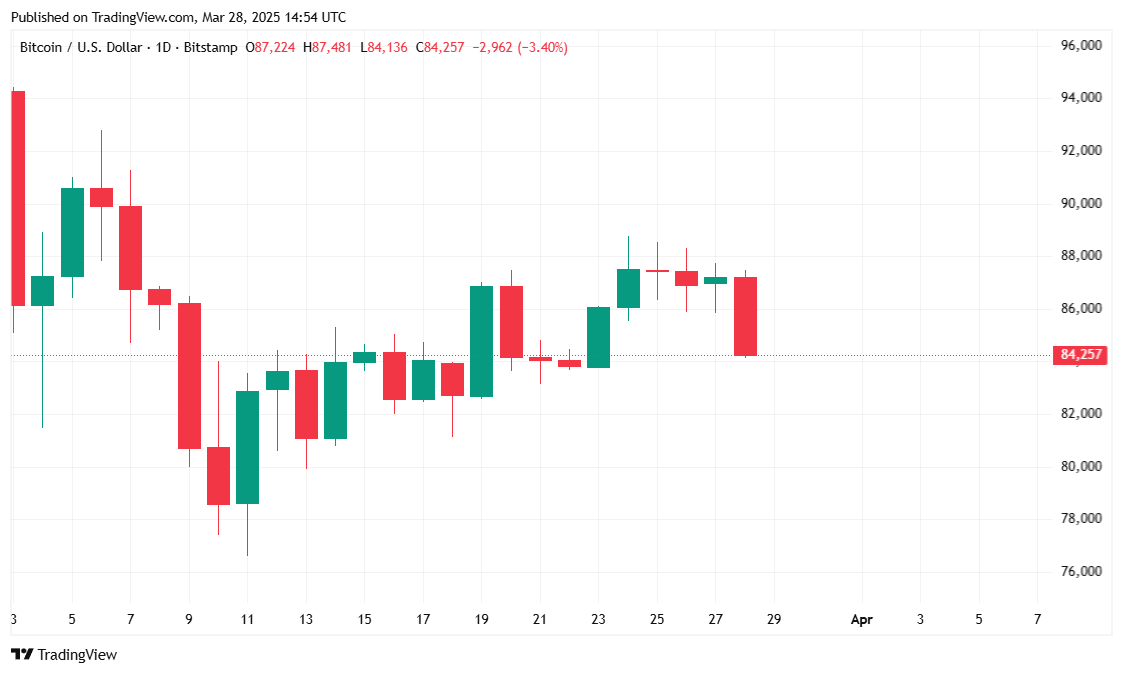

And poor Bitcoin (BTC), the eternal drama queen of currencies, threw itself on the chaise longue, dropping below a tragic $85,000. Yet, don’t write the obituary just yet—it’s still gossiping about a slight 0.29% lift over the past week. 😉

Bitcoin Market Overview

At the time of this dispatch, Bitcoin is languishing at $84,274.18—a 3.37% drop that would make any Victorian governess clutch her pearls. Yet, its weekly adventure remains a timidly positive one. Volatility, that ever-fickle muse, had BTC dancing between $84,145.77 and $87,702.17—an emotional rollercoaster that would make Byron weep.

Trading Volume & Market Capitalization

Bitcoin’s 24-hour trading volume took a theatrical 17.10% leap to $31.03 billion. Clearly, the market sharks smelled blood—or was it champagne? Alas, its market capitalization has shrunk by 3.47%, now sitting at an unamused $1.67 trillion. If Bitcoin were a London socialite, it would be furiously fanning itself and seeking the nearest fainting couch. 🛋️

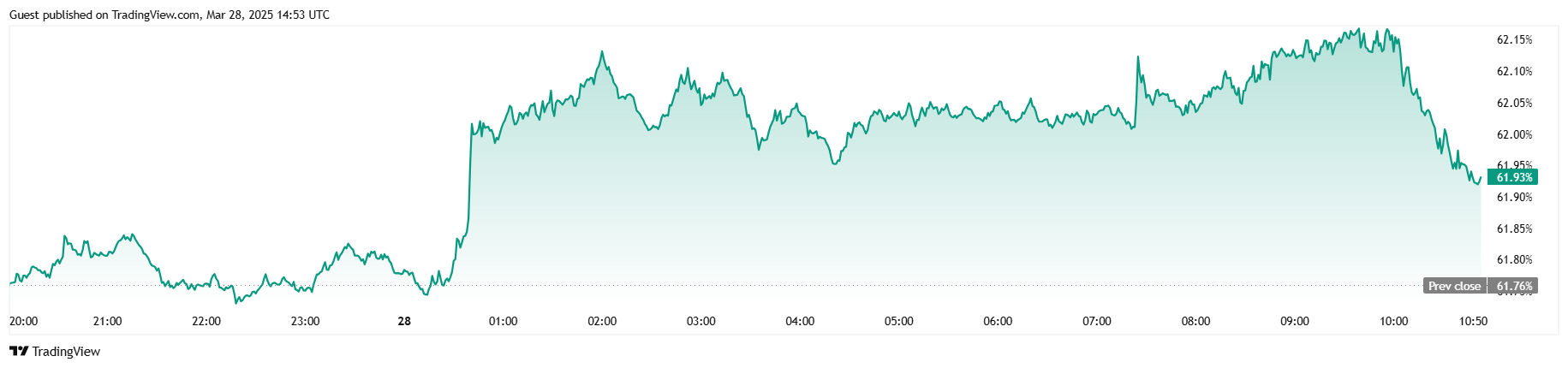

Bitcoin Dominance & Futures Market Insights

Oh, the indignities continue. While BTC dominance made a faint 0.23% recovery to reach 61.93%, altcoins suffered greater ignominy. One imagines Ethereum sobbing quietly in the corner, clutching a wilted flower. 🌹

And what of the futures market, you inquire? A sorry tale indeed! Bitcoin futures open interest shrank 1.88%, timidly retreating to $56.18 billion. Leveraged positions are being abandoned faster than chairs at a poorly catered wedding. Total liquidations in the past day hit $22.34 million, with bulls suffering the brunt of it—a financial tragedy Shakespeare himself would find too bleak to pen. 🎭

Bitcoin Outlook: Uncertainty Reigns

The horizon for Bitcoin is murkier than a glass of absinthe in a poorly lit Parisian café. Inflation fears are the somber tune to which this market waltzes, and if persistent, we may be subjected to the Federal Reserve playing disciplinarian yet again. Should inflation tighten its grip, Bitcoin’s ambitions may find themselves stumbling like an overly enthusiastic poet on stage. 🌌

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- USD MXN PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2025-03-28 19:31