As a researcher with a background in cryptocurrency analysis, I find the historical data suggesting a positive trend for Bitcoin in July particularly intriguing. Based on previous years’ trends, an average increase of nearly 8% in July follows a red candle close in June. Considering that Bitcoin lost almost 10% of its value last month, this bodes well for BTC holders and sets the stage for potential growth.

The historical trends of Bitcoin indicate that July has typically been a profitable month for investors in the past. Following a almost 10% decrease in Bitcoin’s value during the previous month, this is encouraging news.

Bitcoin regained control over the $62,200 mark and edged closer to $63,000 on Monday following a 2% price surge. According to CoinGlass data, this upward trend allowed Bitcoin to surpass a significant liquidity barrier of approximately $43 million. If historical trends hold true, this achievement could pave the way for a profitable month for Bitcoin.

As a crypto investor, I’ve noticed an intriguing pattern over the past few years. Specifically, Bitcoin has typically experienced significant growth in the month of July following a red candle closure in June. Between 2013 and 2024, there were six instances where Bitcoin saw a decline in value during the month of June. However, despite these setbacks, Bitcoin managed to rebound strongly in July, with an average increase of nearly 9.6% during those same years.

Based on my research as a crypto analyst, according to crypto.news, miners’ sell-offs, which had been driven by fatigue and the need to cover operational costs post-Bitcoin halving, have shown signs of abating. Previously, these entities had offloaded large amounts of BTC. However, this trend seems to be decelerating as we enter a new month.

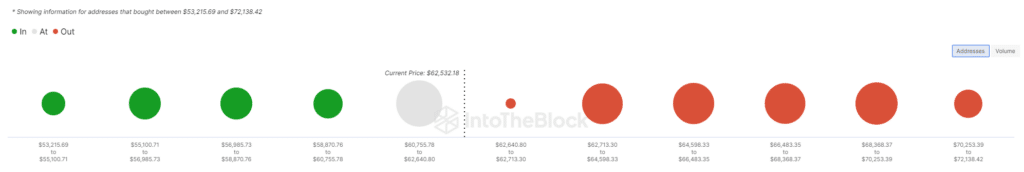

Bitcoin support and resistance points

As a crypto investor, based on the latest data from Glassnode and IntoTheBlock, I can confirm that Bitcoin has found strong support in the range of $60,500 to $61,600. This significant level is backed by approximately two million addresses holding over 891,800 BTC, which translates to a staggering $55.7 billion in value. While it’s uncommon for the crypto market to fall below this point, it’s essential to remember that nothing is impossible in the volatile world of cryptocurrencies.

As a researcher studying the Bitcoin market, I’ve identified two significant resistance levels that could potentially hinder its advance toward the $70,000 range in the short term. These resistance walls are located at $64,700 and $64,550.

Macro events to look out for

According to Lucy Gazmarian’s perspective, the relationship between Bitcoin (BTC) and significant economic occurrences may grow stronger due to inflationary periods and geopolitical instability. With persistent inflation, notably in the United States, and escalating conflicts in Europe and the Middle East, macroeconomic events could wield a more profound influence over BTC markets.

As a researcher, I’m examining upcoming economic events that could potentially impact Bitcoin’s price trend in July. Federal Reserve Chairman Jerome Powell is set to deliver a speech on July 2. Following that, the Federal Open Market Committee (FOMC) will release minutes from their latest meeting on July 3. Lastly, the U.S. Jobs report will be published on July 5.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-01 18:22