As a seasoned crypto investor with a decade of experience under my belt, I find myself increasingly optimistic about the future of Bitcoin (BTC) following the recent developments and price action. The court victory for Tornado Cash is a significant step towards regulatory clarity in the US, which could pave the way for more institutional adoption.

The cost of Bitcoin rebounded on Wednesday, halting a two-day decline that had brought it close to the $90,000 mark.

Bitcoin (BTC) experienced a resurgence following a significant court verdict in favor of Tornado Cash, a cryptocurrency tumbler. A panel of three judges determined that it was an error to penalize its smart contract. Notably, Coinbase, the largest U.S.-based crypto exchange, was among the companies backing this company.

Privacy wins. Today the Fifth Circuit held that @USTreasury’s sanctions against Tornado Cash smart contracts are unlawful. This is a historic win for crypto and all who cares about defending liberty. @coinbase is proud to have helped lead this important challenge. 1/6

— paulgrewal.eth (@iampaulgrewal) November 26, 2024

This win signifies that the cryptocurrency market is making strides with legal successes in the U.S., potentially leading to increased regulatory transparency. Furthermore, optimism is growing that the Trump administration may exhibit a favorable stance towards the cryptocurrency industry.

Currently, crypto experts are suggesting that the recent dip was only temporary, as they remain optimistic about the market’s future. In a recent post, Charles Hoskinson, a wealthy figure in the crypto world who founded Cardano, forecasted that the value of Cardano could potentially reach between $250,000 and $500,000 within the next 12 to 24 months.

His view is that more companies will start moving some of their assets to Bitcoin, as MicroStrategy and El Salvador have done. Today, MicroStrategy owns BTC coins worth $32 billion, while its market cap stands at over $70 billion.

Should Bitcoin’s value reach $500,000 with its present supply of 19.6 million, its total market capitalization would exceed $9.75 trillion. This figure would surpass the combined worth of tech giants like NVIDIA and Microsoft.

An optimistic argument for Bitcoin is that its journey from $0 to $100,000 spanned around 15 years. This suggests a faster pace in reaching the next milestone of $200,000. To illustrate, the Dow Jones Index hit $10,000 in 2010 and doubled that value to $20,000 by 2020. It then took just two years to reach $30,000 and less than another two years to move up to $40,000.

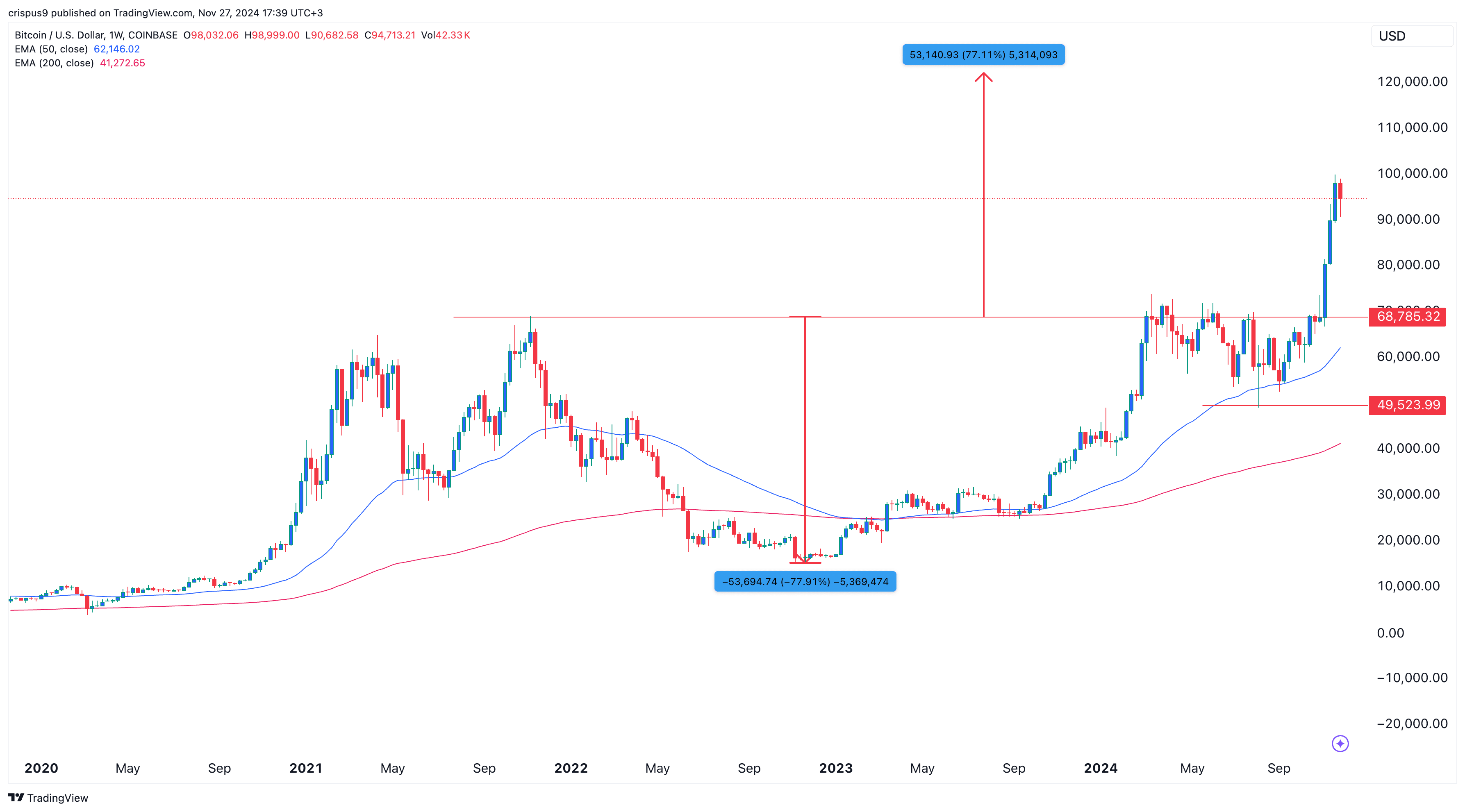

Bitcoin price cup and handle points to a jump to $122,000

The weekly chart shows that the BTC price formed a cup and handle pattern whose upper side was about $68,800. The depth of this cup was about 78%. Therefore, measuring that distance from the upper side means that the coin will jump to $122,000 in the near term.

Adding strength to the optimistic outlook, Bitcoin’s price has exhibited a bullish chart pattern known as a “golden cross.” This occurs when the 200-day and 50-day moving averages intersect, with the 50-day moving average crossing above the 200-day. Historically, such crossovers have often led to significant price movements in Bitcoin’s favor.

If the coin drops below the lower boundary of the ‘handle’ (which is currently at $49,523), the optimistic perspective no longer holds true.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2024-11-27 18:12