As a seasoned crypto investor with scars from more than a few market corrections, I find myself watching the Bitcoin price drop with a mix of disappointment and familiarity. The recent 3% decline to $58,900, triggered by unexpected inflation data, is a stark reminder that this volatile market can take a sudden turn at any moment.

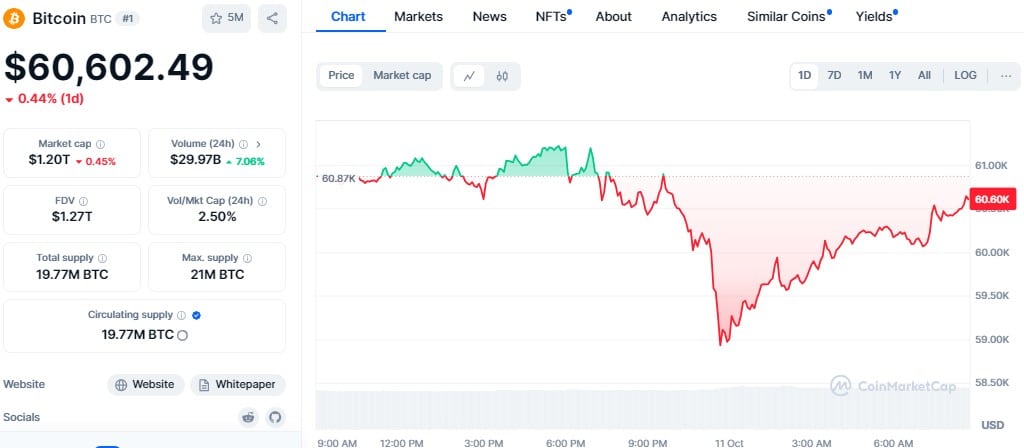

In the past day, the value of a single Bitcoin dipped by 3%, hitting a three-week low of $58,900 due to surprising U.S. inflation figures. This raised worries that the Federal Reserve could hold off on reducing interest rates. Yet, Bitcoin started regaining ground and increased by 2.84% to trade at $60,602.

Due to the price drop, trades valued at approximately $196 million were forced to be closed (liquidated), impacting around 57,000 investors, as reported by Coinglass. Of these liquidations, positions in Bitcoin accounted for approximately $67.18 million, while traders of Ethereum experienced losses totaling about $40.70 million.

The recent drop in Bitcoin prices appears to mirror investors’ apprehensions about an impending economic downturn. The Consumer Price Index (CPI) increased by 0.2% in September, causing worries about stagflation – a situation where the economy remains sluggish while prices continue to rise. Moreover, jobless claims surged to their highest level in 14 months on October 5, with approximately 258,000 individuals filing for unemployment benefits, as reported by CNBC.

In simple terms, the pessimistic mood of the market deepened due to two straight days of Bitcoin ETF withdrawals worth about $59 million, making traders less optimistic. Additionally, the U.S. Securities and Exchange Commission’s lawsuit against Cumberland DRW for suspected unregistered cryptocurrency dealings increased regulatory uncertainty.

As a crypto investor, I couldn’t help but find a glimmer of hope amidst the general bearish sentiment. Metaplanet Inc., a significant player in our space, made a positive move by acquiring close to 109 Bitcoin, worth approximately 1 billion yen. This purchase adds to their existing Bitcoin holdings, now totaling 748.502 BTC.

Traders are approaching Bitcoin market activities with a sense of caution, as decreased confidence is indicated by the decline in the demand for Bitcoin futures and options. This drop in demand has caused the futures premium to fall below the 3% neutral benchmark, which is concerning since it suggests a growing negative trend (bearish momentum) that might lead to increased bearish pressure, potentially causing further price decreases.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-11 07:48