As an experienced analyst, I believe that the recent price action of Bitcoin is concerning, but we should not jump to conclusions just yet. The outflows from Bitcoin ETFs and the selling pressure from miners have caused a significant drop in price, which has now broken below the key support level of $65,000.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin faced significant selling pressure this past week. The fears surrounding demand and potential ETF inflows have taken a toll on BTC‘s price, causing it to slide for the second consecutive week. Unfortunately, Bitcoin has dropped below the crucial support level of $65,000.

Bitcoins current decline is over 12% from its record high, giving the impression that bearish market forces are prevailing. Following Bitcoin’s inability to surpass the $72,000 resistance level last week, most Bitcoin exchange-traded funds (ETFs) have experienced withdrawals. The collective outflow for these ETFs amounted to $145.9 million, with the Fidelity Wise Origin Bitcoin Fund (FBTC) seeing the largest withdrawal.

After the Federal Reserve announced its rate decision, which kept interest rates steady between 5.25% and 5.50%, but indicated a possible reduction later in the year, there was an increase in these outflows.

The value of Bitcoin has decreased following the revelation that many Bitcoin mining corporations have been offloading their coins. For 33 consecutive days, mining companies such as Marathon Digital and Riot Platforms have sold their Bitcoins.

As a researcher studying the Bitcoin mining landscape, I have observed that we are currently in the midst of a miner capitulation, which began around 33 days ago. Based on historical data from the past five years, these events typically last for an average of 41 days.

— James Van Straten (@jvs_btc) June 17, 2024

Bitcoin price prediction

BTC weekly chart

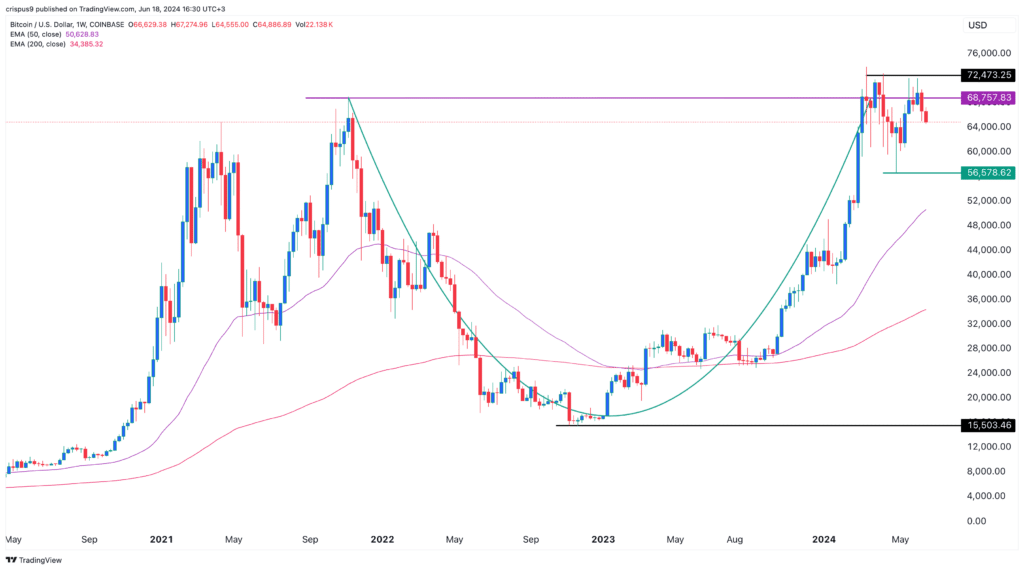

In March 2023, Bitcoin displayed a golden cross formation as its 200-week and 50-week Exponential Moving Averages (EMAs) intersected in an upward manner, signaling a bullish trend. Since then, Bitcoin has continued to trade above these averages. Notably, Bitcoin is shaping up to form a cup and handle pattern, which is typically seen as a bullish indication of continuation. The current consolidation may represent the development of the shoulders section in this chart pattern.

Based on current market trends, it’s plausible that Bitcoin could experience a significant price increase in the short term, potentially surpassing its 2021 peak of $73,500. This bullish trend would be signaled by a clear upward price movement.

As a crypto investor, I’m keeping a close eye on Bitcoin’s price action. Currently, Bitcoin has formed a small double-top pattern at $72,473, which is a bearish sign in the market. This means that there’s a possibility of a drop and a retest of its neckline at $56,578, which represents a 12.65% decline from the current level. If this were to happen, it could negatively impact my bullish thesis for Bitcoin.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-18 16:46