As a researcher with a background in cryptocurrencies and finance, I find the recent trends in Bitcoin mining stocks particularly intriguing. The fourth Bitcoin halving event in early 2024 brought about significant shifts in the crypto mining landscape, impacting smaller firms more severely due to suboptimal infrastructure and lack of economies of scale.

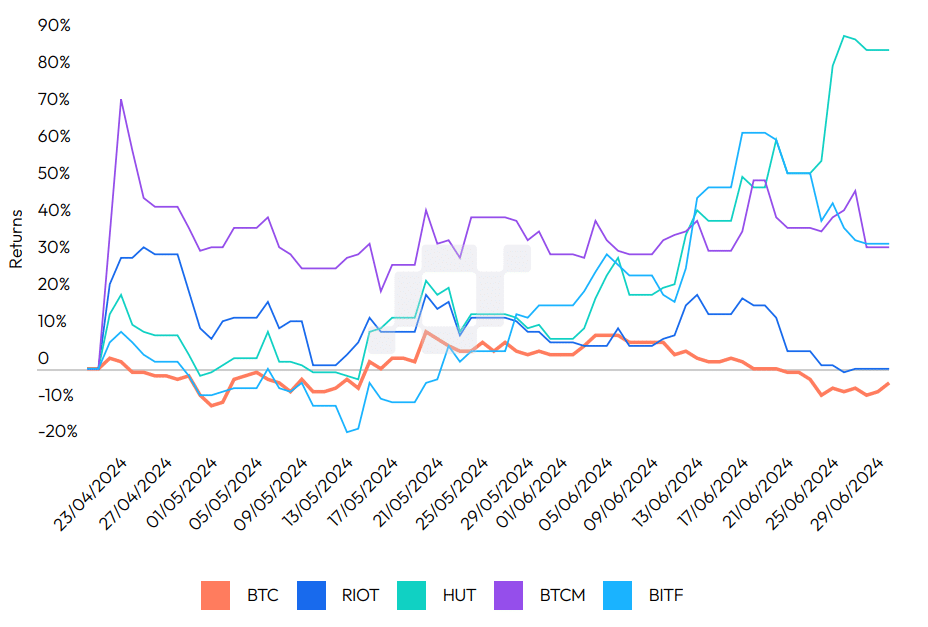

As a financial analyst, I have observed an intriguing trend in the crypto market during early 2024. Bitcoin had a robust beginning, but surprisingly, the stocks of crypto mining companies like Hut 8 and Bitfarms outperformed Bitcoin itself following the halving event. This finding might seem counterintuitive at first glance, but a deeper analysis reveals some compelling reasons behind it.

In their recent research report, analysts at CCData noted that the aftermath of the fourth Bitcoin halving has resulted in substantial changes within the crypto mining industry. Smaller mining companies have been disproportionately affected due to inferior infrastructure and a failure to achieve economies of scale.

Private equity firms have been active in merging smaller mining companies and streamlining their operations, even amidst challenges for Bitcoin’s price. This move has significantly boosted the stocks of Hut 8 (HUT) and Bitfarms (BITF), with returns of 86% and 34%, respectively. In contrast, Bitcoin itself has dipped by 3.62% following its halving event.

In the three months after Bitcoin’s halving event, its price stayed within a band of $59,000 and $72,000. Meanwhile, significant American stock indices reached new peak levels during the same period. Additionally, there was less trading action on centralized cryptocurrency exchanges, sparking debate among market observers about potential price peaks in this cycle.

Based on historical patterns, the halving event has typically been followed by a phase of price growth. This period has ranged from 366 days (in 2014) to 548 days (in 2021), leading up to a market peak, according to CCData’s analysis. The experts believe that any price stagnation is merely temporary and that the market will surpass its previous record highs once more before the year ends.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-07-02 16:18