As a seasoned researcher with over two decades of experience in the financial markets, I must admit that the recent surge of Bitcoin to an all-time high of $96,600 is indeed intriguing. Having witnessed the dot-com bubble and burst, the 2008 financial crisis, and now this digital gold rush, it’s fascinating to see how technology can disrupt traditional finance so profoundly.

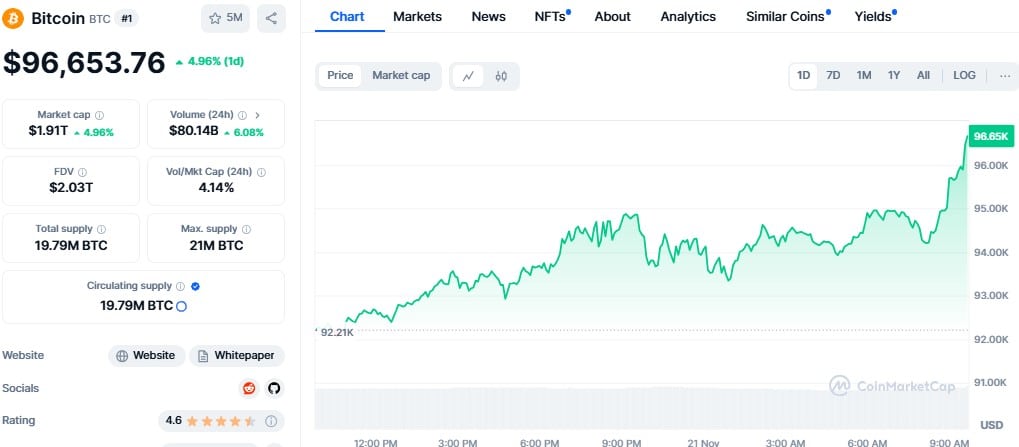

Once more, Bitcoin is grabbing attention as it sets a new record at $96,600. This upward momentum is driven by positive anticipation about its potential in the U.S. market. On Thursday, Bitcoin saw a 4.96% increase, reaching an early Asian high of $96,653, with investors hopeful it might touch the $100,000 milestone.

Enhancing the anticipation, it’s rumored that Donald Trump’s team is deliberating over a fresh White House post centering around cryptocurrency policy. This potential role might offer direct communication with the president-elect, who was initially critical of crypto but has now become one of its most ardent advocates.

The talks arise as the digital asset market gains substantial traction. MicroStrategy, the biggest corporate owner of Bitcoin, intends to boost its acquisitions through a $2.6 billion offering of convertible senior notes. Now recognized as a Bitcoin-focused treasury firm, it holds approximately $31 billion in assets.

Since Donald Trump’s victory on November 5, 2016, the total crypto market has experienced a surge of approximately $800 billion, as reported by CoinGecko. Proponents argue that Bitcoin could establish itself as a contemporary form of wealth storage, even facing criticism for its association with illegal activities. This interpretation aims to simplify and make the information more accessible while retaining the original meaning.

As an analyst, I’m observing a robust appetite for Bitcoin. In other words, the buyers seem to have the upper hand over the sellers, creating a tight market dynamic. Nevertheless, it’s important to note that the path to potential prices of $100,000 might not be a seamless ride.

Trump’s stand on cryptocurrencies involves proposals for a favorable regulatory environment and potentially setting aside Bitcoins as part of a national strategy. Although specifics are still undetermined, this stance mirrors intense advocacy by digital currency companies during his campaign.

As more governments and large companies show increasing curiosity, Bitcoin’s influence within the global economic landscape expands, attracting both advocates and doubters.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-21 08:04