As a long-term crypto investor with experience in the market since its early days, I’ve seen my fair share of volatility and price fluctuations. However, the recent sell-off of Bitcoin, which has plunged under $55,000, leaving me staring at prices last seen in February, is concerning.

The cost of Bitcoin has persisted in going downward, dipping below the $55,000 mark once more, bringing us back to prices not seen since late February.

As a researcher studying the cryptocurrency market, I’ve noticed that Bitcoin’s (BTC) downward trend has gained momentum following news of Mt. Gox transferring approximately 47,000 BTC, equivalent to around $2.6 billion, to a new digital wallet. This move occurred prior to the exchange’s planned $9 billion payout. Currently, Bitcoin is trading at a price of $54,561 – a figure last seen in February during Bitcoin’s surge towards a record-breaking all-time high.

BREAKINGMt Gox moves 47,228 BTC ($2.71 billion dollars) from cold storage to a new wallet. — Arkham (@ArkhamIntel) July 5, 2024

After the completion of the transaction, the Mt. Gox trustee announced on July 5 during Asian trading hours that the defunct exchange had transferred Bitcoin and Bitcoin Cash to certain rehabilitation creditors. The trustee failed to disclose the exact quantity of Bitcoins sent to each creditor.

The cryptocurrency market has experienced considerable stress in recent times, leading to dampened investor confidence and challenging miner activities since the April halving. This event saw mining rewards decrease from 6.25 Bitcoin to 3.125 Bitcoin. With Bitcoin’s current price, only five ASIC rigs from Avalon and Antminer are reportedly still profitable based on data from f2pool’s X post.

With Bitcoin’s current trading price under $58,000, what is the present-day profitability of mining?

— f2pool 🐟 (@f2pool_official) July 4, 2024

As a researcher studying the cryptocurrency market, I’ve observed a significant decline in Bitcoin’s price falling below the $55,000 mark. This sudden drop has put immense pressure on speculators, leading to a total liquidation of approximately $682 million in both long and short positions across various exchanges, as reported by Coinglass.

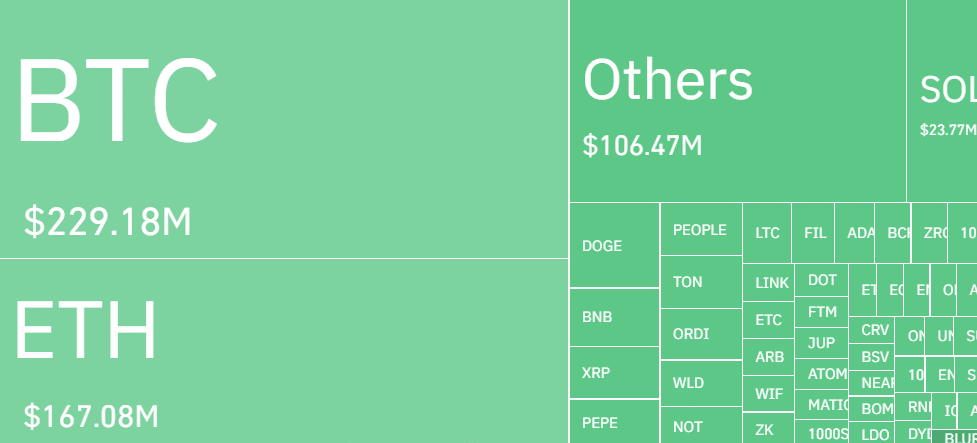

In the last 24 hours, approximately 235,000 traders have had their positions closed on Binance, with the largest single liquidation order being worth around $18.4 million in the ETH/USDT market. As reported by CoinGecko, the combined value of all cryptocurrencies in circulation has decreased by over 8%, dropping to a total of $2 trillion. This decline has prompted further selling from speculators.

According to crypto.news’ previous article, Justin Sun, the founder of TRON, expressed his readiness to purchase confiscated Bitcoins from the German government in private deals. The exact start date for these negotiations is uncertain, yet the transfer of Bitcoin from German-marked wallets to centralized exchanges has sparked interest among traders due to potential connections with Mt. Gox’s reparations.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-05 09:52