As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I find myself observing Bitcoin’s price action with a mix of intrigue and cautious optimism. The steady performance of BTC amidst the tech stock slump is a testament to its resilience and growing acceptance as a safe haven asset.

On Friday, the price of Bitcoin managed to maintain its position above $64,000, despite a dip in tech companies such as Intel and Nvidia.

On Thursday, despite a tough day on the New York Stock Exchange, Bitcoin’s (BTC) value stood at approximately $64,700 – representing a 4% increase from its lowest point this week and an 8% decrease from its peak on Monday.

Semiconductor firms faced significant declines in performance. For instance, Intel’s shares tumbled by more than 22%, hitting their lowest point since 2015. This represents a drop of over 65% from its peak value reached in April 2022. The downward trend began after the company reported disappointing quarterly earnings and unveiled plans to eliminate approximately 18,000 jobs.

Over the past year, Nvidia, a major player in the artificial intelligence sector, has dipped into a severe downtrend, plummeting more than 25% from its peak this year. Interestingly, during the same period, MicroStrategy, the largest Bitcoin holder, surged ahead by an impressive 250%.

The recent decline in technology stocks is affecting stock markets worldwide. In the United States, both the Dow Jones and Nasdaq 100 index futures have dropped significantly, with the former losing more than 500 points, while in Asia, the Hang Seng and Nikkei 225 indices have experienced a decrease of over 2% and 5%, respectively.

Bitcoin price faces risks and opportunities

Moving ahead, Bitcoin encounters both potential threats and advantages. Initially, there’s a possibility that Bitcoin may follow suit with stocks in a downturn if risk-averse trends persist. Interestingly, at times, Bitcoin’s trajectory mirrors that of the stock market.

1. Following this, it appears that investors are preparing for a potential victory of Kamala Harris in November, as indicated by data from PredictIt and a tightening gap between her and Trump in the Polymarket poll.

Supporters of cryptocurrency think that if re-elected, Donald Trump might be more favorable towards their industry. Recently, he suggested that if elected, he would exchange any Bitcoin held by the government into a form of national reserve.

Even though the identity of the U.S. president can change, history has demonstrated that Bitcoin tends to thrive regardless. Its success has been evident under President Obama, during Trump’s initial term, and currently under President Biden. Furthermore, recent indications suggest that Bitcoin Exchange-Traded Funds (ETFs) are still experiencing investments, as $50.1 million was added on Thursday, despite the unstable state of the stock market.

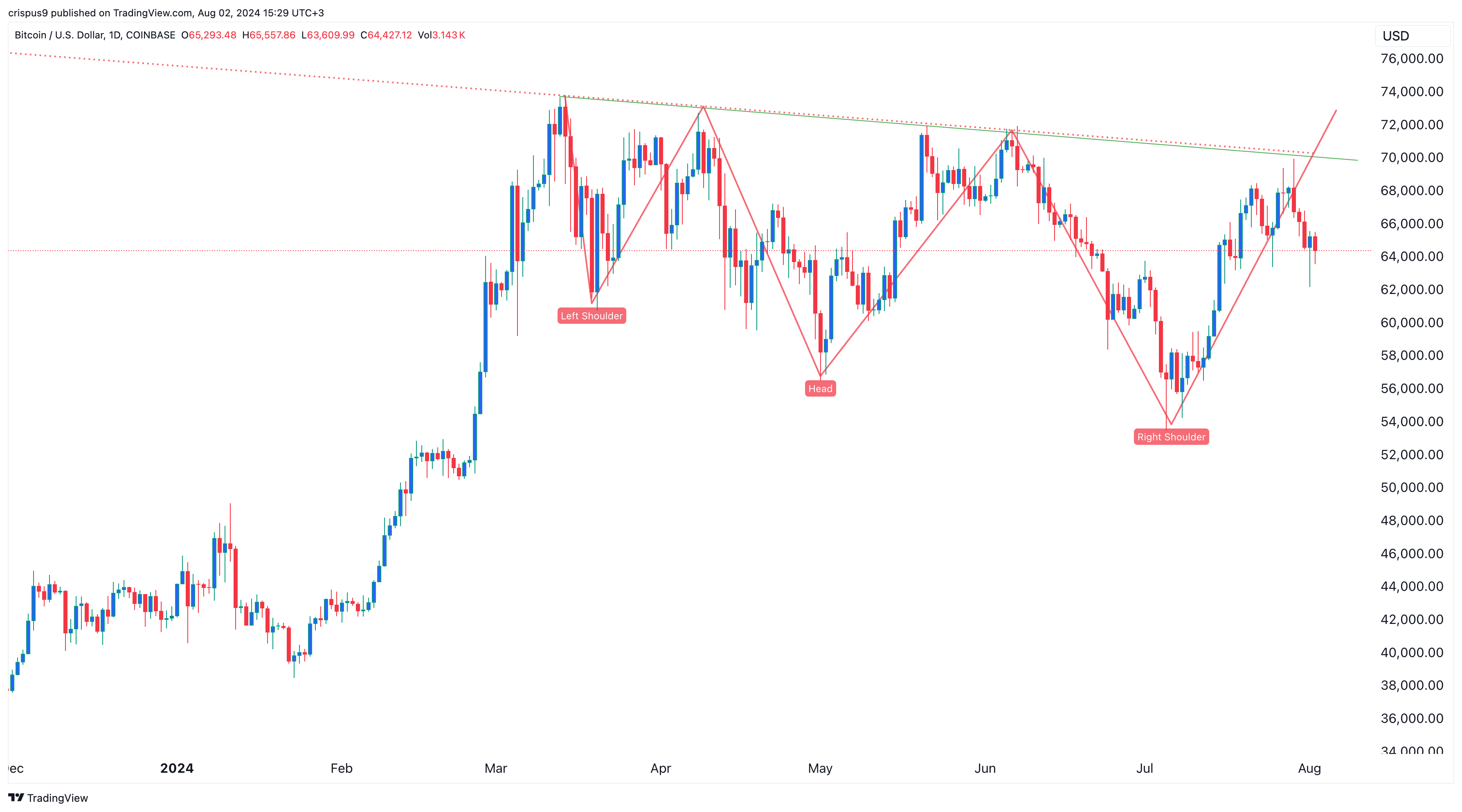

Furthermore, Bitcoin encounters a technical hurdle since it persistently finds it difficult to surpass the resistance levels of $70,000 and $72,000.

Looking on the optimistic side, it appears that the coin might be developing a reverse head and shoulders pattern. This pattern typically leads to a powerful surge in price, but this will only be verified if the price climbs beyond the resistance levels at $70,000, $72,000, and $73,800 – which happens to be the highest point this year so far.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-08-03 01:33