As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by Bitcoin’s current consolidation phase. Having witnessed numerous market cycles and trends, I can’t help but see parallels between the present situation and historical patterns.

On August 19th, the value of Bitcoin stayed within a narrow band, extending a period of consolidation that’s been ongoing for close to two weeks.

Currently priced at around $58,000, Bitcoin (BTC) was a key factor in a 2.2% drop in the total value of the global cryptocurrency market. This decline lowered the overall market capitalization to approximately $2.06 trillion.

BTC consolidation continues

Today, with trading volumes remaining relatively low in both the spot and future markets, there was a rather quiet movement in Bitcoin’s price. Although Bitcoin’s open interest grew somewhat on Monday, reaching approximately $30 billion, it still fell short of this month’s high of $36 billion.

On Monday, the trading activity for Bitcoin plummeted to approximately $17 billion, a notable decline from its peak of more than $120 billion on Aug. 6. Generally, Bitcoin and other digital currencies witness reduced trading volumes when they are not surging upwards. In the past week, the trading volume has dropped by over 20% for Solana (SOL), Ethereum (ETH), and Decentralized Exchanges like Base.

It appears that certain significant Bitcoin investors might be selling off their holdings. As per a post on X by Lookonchain, Ceffu – a firm providing institutional-level custody and liquidity services – has transferred approximately $211 million worth of Bitcoin to Binance since July 31.

On or after July 31st, an entity known as Ceffu has transferred approximately 3,568 Bitcoin (equivalent to around 211.6 million dollars) to Binance. Given that Ceffu offers custody and liquidity services for institutions, it’s plausible that these institutions could be offloading their Bitcoin holdings.

— Lookonchain (@lookonchain) August 19, 2024

Regardless of recent events surrounding Mt. Gox, there are encouraging indicators for Bitcoin. For instance, despite the turbulence caused by Mt. Gox’s activities, Bitcoin has managed to maintain its stability. Interestingly, data suggests that the Bitcoin stored in Mt. Gox wallets reduced from 141,686 coins in early January to 46,164, implying that the market has effectively absorbed these sales without experiencing a major price drop.

I’ve noticed a significant trend: more prominent financial institutions are now incorporating spot Bitcoin ETFs into their portfolios, which indicates that the digital asset is becoming increasingly accepted within mainstream finance. Notably, esteemed organizations such as Goldman Sachs, HSBC, and Barclays have shown interest in this area.

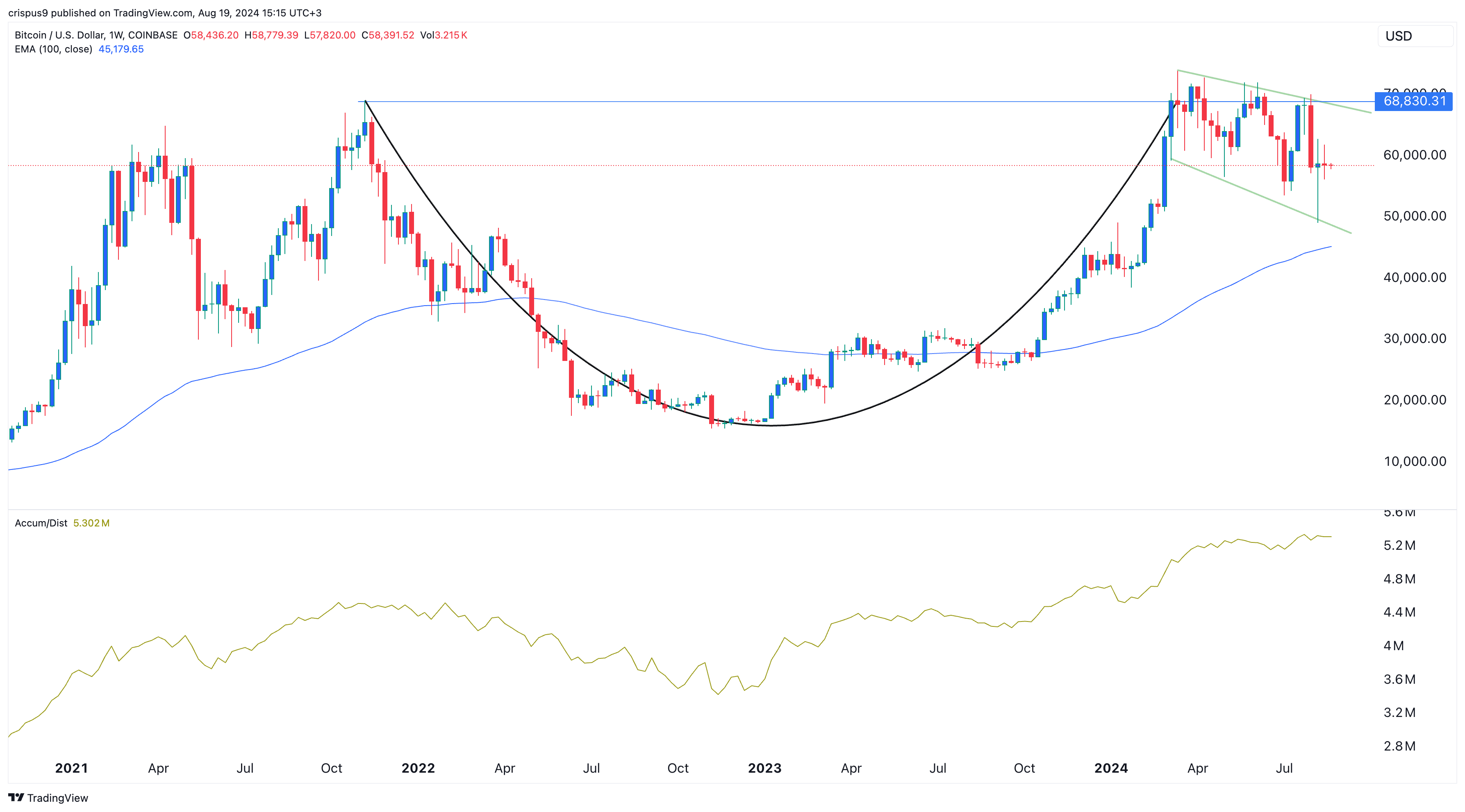

Bitcoin price weekly chart

Looking at a longer perspective, it appears that Bitcoin has been maintaining its strength. For quite some time now, Bitcoin has managed to stay above its 100-week Exponential Moving Average, as shown on the weekly chart, starting from around October last year.

The chart pattern for Bitcoin resembles a falling broadening wedge, which is usually followed by an upward surge in value. This pattern is identified by linking the lower troughs and troughs that aren’t as low, and it tends to result in a strong breakout when the price rises above the bottom of the wedge.

Furthermore, Bitcoin appears to have formed a “cup and handle” chart formation, with an upper limit around $68,830. This “handle” includes a “wedge” pattern, and the accumulation and distribution indicator is currently at its highest level in years.

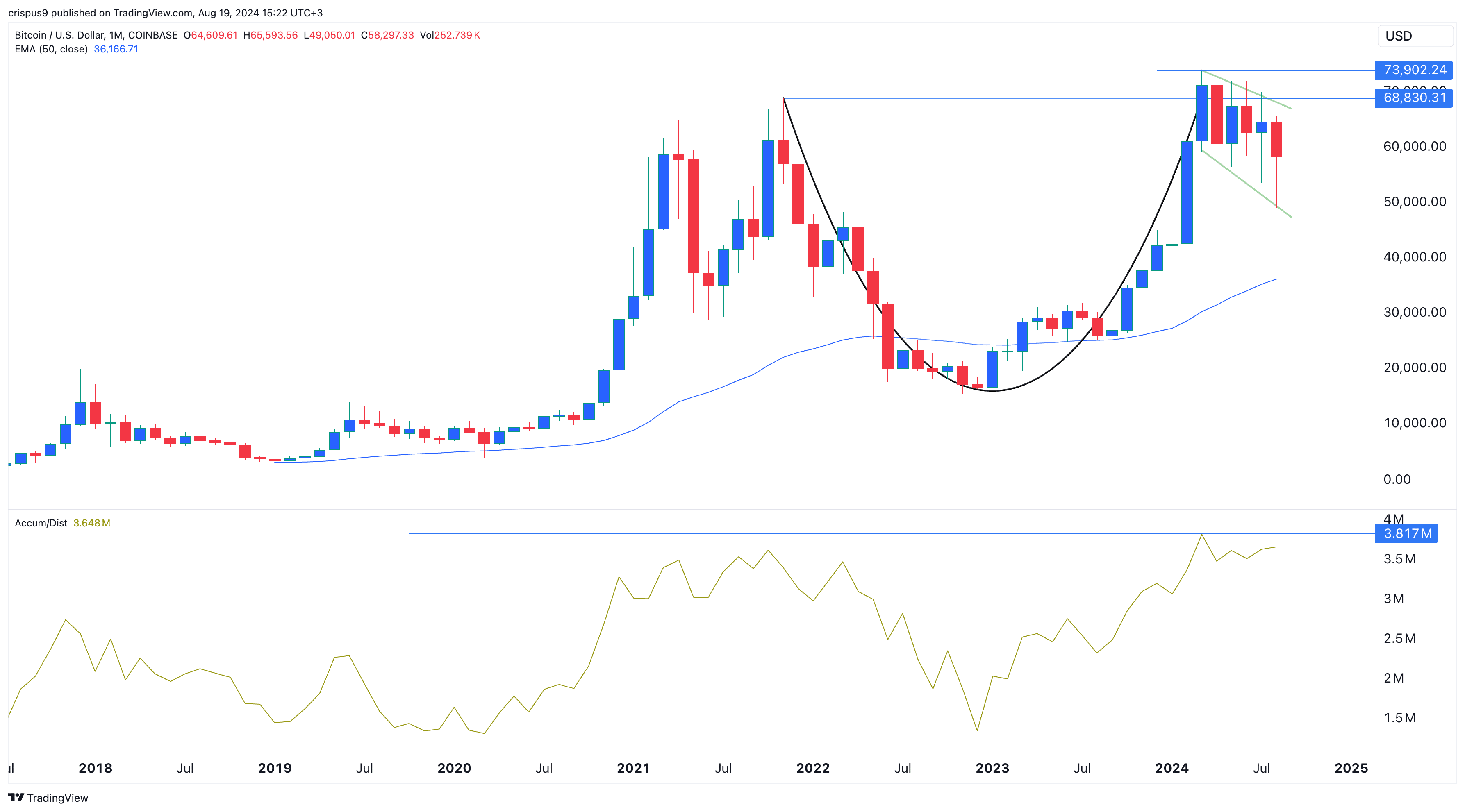

BTC price monthly chart

The monthly graph suggests a possible increase in Bitcoin’s value, much like the weekly graph, it displays a ‘cup and handle’ pattern which includes an accumulation and distribution indicator at its highest point ever recorded. Bitcoin continues to stay above its 50-month average line.

The cryptocurrency Bitcoin is shaping up to resemble a hammer-like candlestick formation, which is identified by a lengthy lower shadow, a compact body, and essentially no upper shadow. For this pattern to be complete, Bitcoin should close the month at or slightly below $64,000. If it does so, this could potentially indicate further price increases ahead.

If Bitcoin surpasses its highest point this year ($73,902) in future developments, we can consider it as a confirmation of an uptrend.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-19 15:48