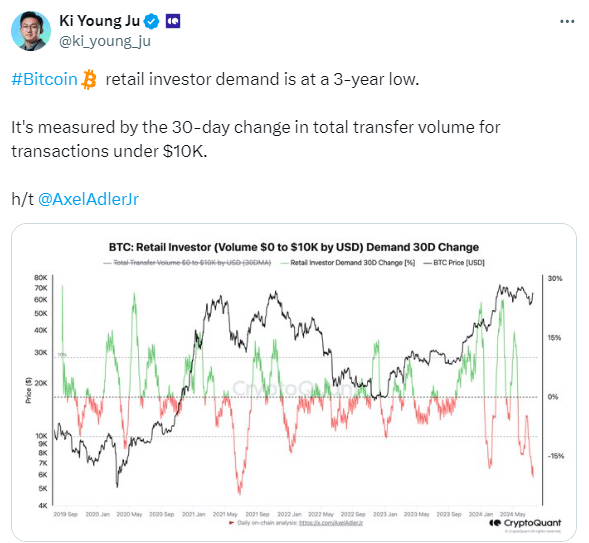

As a seasoned researcher with extensive experience in the cryptocurrency market, I find the recent decline in retail investor interest in Bitcoin to be a cause for concern. The data from CryptoQuant showing a drop below -15% in monthly demand from retail investors, as indicated by transactions under $10K, is particularly alarming.

As a researcher studying the Bitcoin market, I’ve noticed a troubling trend: retail investor interest in Bitcoin has dipped to its lowest point in the past three years. This development has raised concerns among analysts and investors alike about the potential for a significant price increase. The root cause of this decline appears to be a substantial decrease in transactions below $10,000 – a clear sign that smaller-scale investors are retreating from the market.

Based on information from CryptoQuant’s founder Ki Young Ju, the average monthly decrease in demand from retail investors has fallen beneath -15% during the previous 30-day period. The indicator, which monitors transactions under $10K, indicates a significant reduction in retail investor involvement.

Minkyu Woo, a contributor at CryptoQuant, pointed out that authentic bull markets are initiated by substantial buying volumes from individual investors, or retail investors. Historically, such surges in retail activity have fueled market optimism. However, currently, there’s a noticeable absence of this volume, which leaves analysts and traders feeling cautious.

As a crypto investor, I’ve noticed that there’s been a decrease in retail interest in Bitcoin ETFs lately. However, it’s important to keep in mind that institutional investors may still be active in the market, despite the drop in retail inflows. For instance, Jan van Eck, the CEO of VanEck, mentioned previously that most inflows into U.S. spot Bitcoin ETFs have come from individual investors. However, on July 17, these inflows plummeted by 87%, reaching only $53.3 million across 11 tracked products. According to Farside’s report, this significant drop suggests that retail investors might be taking a step back, but institutional investors could potentially be stepping up their game.

I’ve analyzed the Bitcoin market and noticed that its price is having a hard time holding onto a significant support level. On July 17, Bitcoin momentarily reached a peak of $65,686 before experiencing a downturn, bringing the price down to $63,521. Currently, Bitcoin is trading at $63,975 based on CoinMarketCap’s data.

Based on Google’s statistics, the number of searches related to “Bitcoin” has decreased by approximately 44% in the last three months following the Bitcoin halving. Additionally, this represents a nearly 57% drop from its record high price of $73,679 on March 13. This significant decrease in search interest suggests that retail investor excitement, which is crucial for fueling a substantial bull market, has waned.

The market is looking forward to a revival of retail investment in Bitcoin, but it’s unclear if this will lead to another bull market for the cryptocurrency.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-19 09:57