Oh, the sweet irony of wealth! As Bitcoin ascends to the magnificent heights of $100,000 in the dazzling twilight of Q4 2024, one might expect a veritable gold rush into the crypto realm. Yet there it lies, flat and lifeless, like a fish out of water, with venture capital activity resembling the faint whisper of a summer breeze.

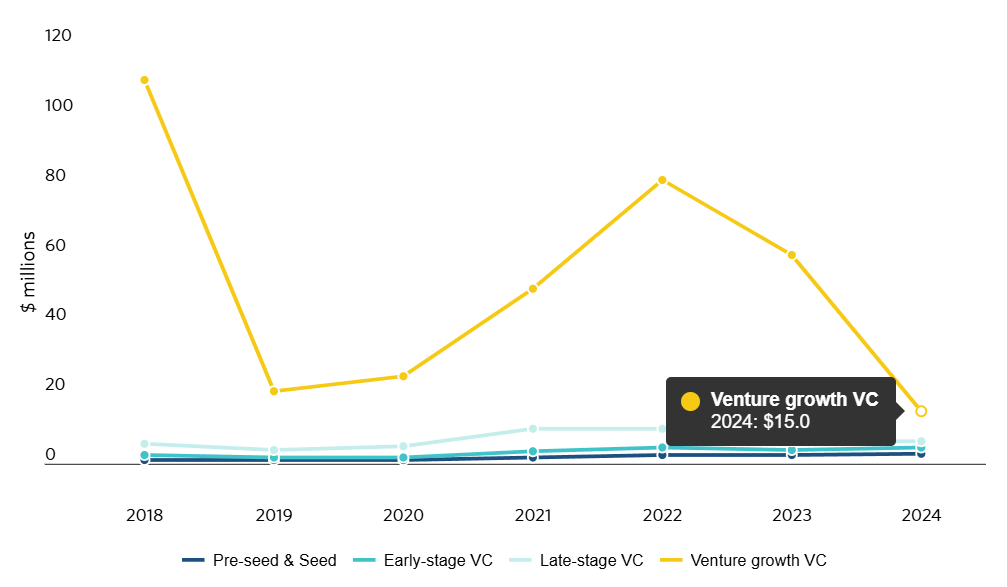

Behold, the sobering revelation from PitchBook! Their latest findings unveil a staggering decline in the median size of venture capital deals—a jaw-dropping 90% drop since 2018! It seems our investors have taken a page from the book of caution, becoming as selective as a cat with its food. 🐱🍽️

In a brilliantly sardonic analysis, PitchBook’s own Michael Bodley quipped that even as Bitcoin bubbles up like hot cake batter, the venture capitalists clutch their wallets tighter, as if they were guarding the last piece of pie at a family reunion. “Fewer deals,” he says, “pushing up median valuations.” Ah, the economics of scarcity! The median valuation for crypto startups ascended to a princely $32.1 million in 2024, a staggering leap from a mere $18 million the previous year—yet one wonders, what does it all mean? 🤷♂️

And let us not forget the musings of the sage Robert Le, who pointed out the past folly of 2022 when crypto entrepreneurs could charm investors with naught but a white paper and a smirk. Ah, the good old days! Now, however, a founder must display more evidence of merit than a mere manifesto of dreams. One must truly demonstrate a significant amount of traction or provide some shimmery bauble to entice the cautious VCs. It’s a cruel twist of fate, indeed.

As the pitch continues, the analysts prognosticate that this trend shall persist, like a stubborn stain on a pristine shirt. Concentrated deals shall emerge as the new norm, and the rhythm of crypto funding shall march to its own peculiar drumbeat.

But fear not, for in the wintry embrace of late December 2024, Le, with the optimism of a playful child, predicted that perhaps the crypto venture funding bloom shall “be much much stronger” in 2025, like the blossom of a dandelion through concrete. They’re forecasting an influx of $18 billion or more in venture capital dollars—though still a far cry from the halcyon days of $30 billion in 2021 and 2022. So, keep your eyes peeled and your wallets open, dear reader! 💰

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-02-11 13:47