As an experienced crypto analyst, I’ve closely followed the developments surrounding Bitcoin’s Rune protocol since its launch. Initially, the excitement around this new innovation was palpable, with record-breaking transaction fees and a significant impact on Bitcoin’s average fee. However, recent data indicates that activity on the Rune protocol has dropped significantly, reaching its lowest level on May 11.

The level of activity on Bitcoin‘s Rune protocol has noticeably decreased, according to data, hitting a record low on May 11th.

As an analyst, I’ve noticed an intriguing development in the crypto sphere. The Runes protocol made its grand entrance on April 19, aligning perfectly with the most recent Bitcoin halving event. This debut was far from understated; it ignited a wave of excitement and resulted in a significant increase in Bitcoin transaction fees. On that very day, an impressive $107 million was transacted, marking a new record. Within the first week, the figure reached an astounding $135 million.

As a researcher studying the cryptocurrency market, I’ve noticed a shift in the excitement surrounding Runes since its launch a few weeks ago. Based on data from a Dune analytics dashboard, there has been a significant decrease in activity related to this cryptocurrency. Important growth metrics have also taken a hit, indicating a noticeable decline in engagement and interest within the community.

In its inaugural week following the Bitcoin halving, the Runes protocol accrued a substantial fee revenue of $135 million. However, there has been a significant decline in activity since then. The day with the least amount of activity was May 10, and only twice within the past twelve days have fees exceeded the $1 million mark.

— Wu Blockchain (@WuBlockchain) May 12, 2024

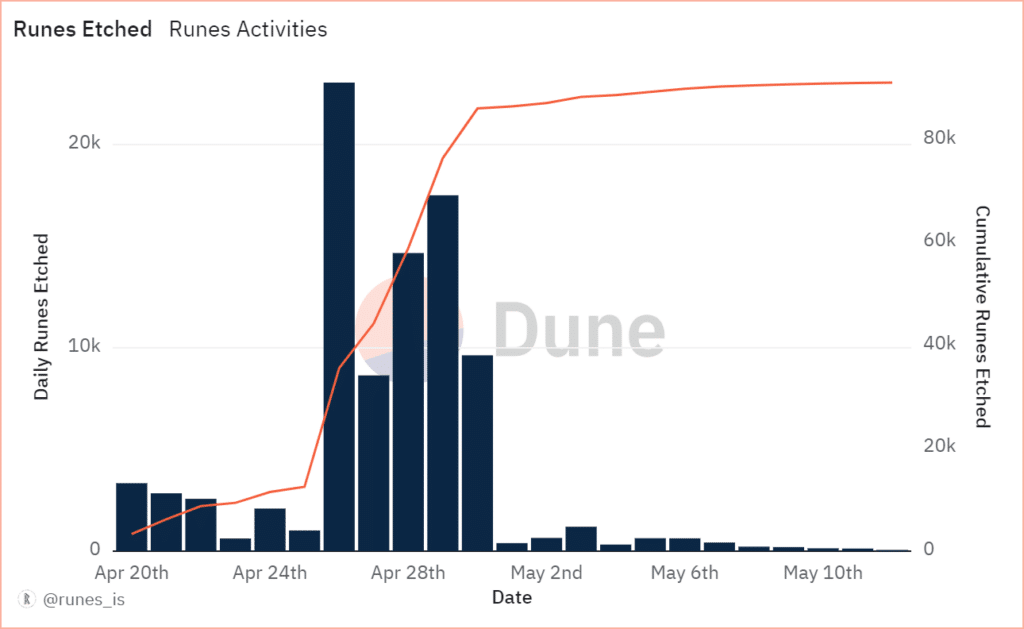

Based on the data I’ve analyzed, there were only 5,023 Runes inscribed between May 1 and May 10, while a significant number of 9,639 Runes were etched on April 30 alone. Among the recorded days during this period, May 11 saw the least amount of etching activities with only 129 Runes inscribed.

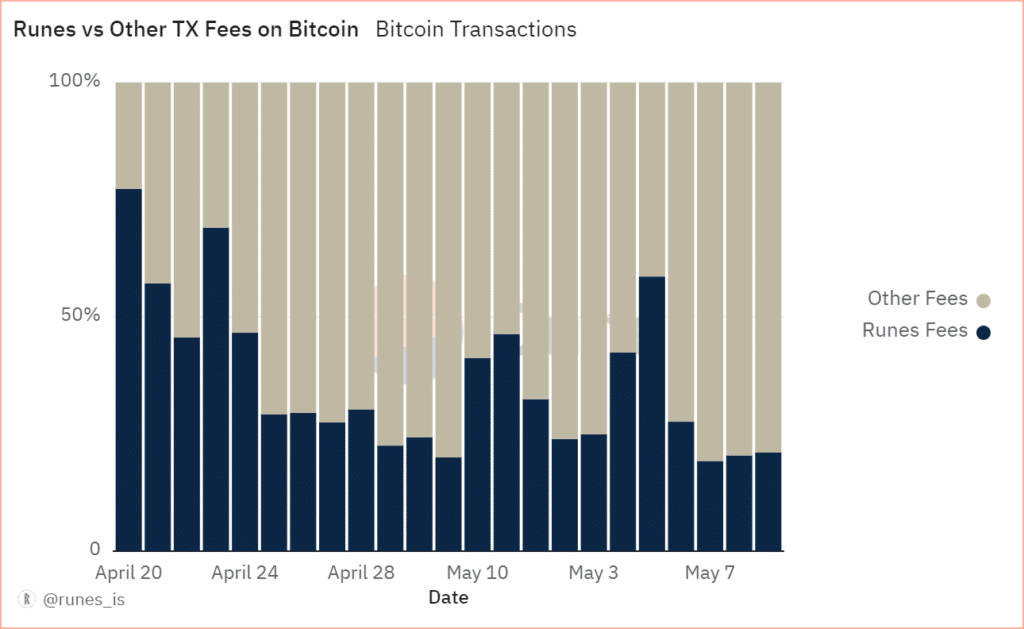

On the Bitcoin network, Runes saw significant transaction activity on April 20 and April 23, accounting for an impressive 77% and 69% of all transactions during those days, respectively.

The mining community eagerly embraced this change as their income had been decreased by the Bitcoin halving, which resulted in a new reward of 3.125 BTC per block.

As a researcher studying the impact of various protocols on Bitcoin transactions, I’ve observed that the introduction of Rune in early April led to a significant increase in average transaction fees. Prior to its launch, fees were around $5. But on April 20, fees spiked dramatically, reaching an all-time high of over $128, as reported by YCharts.

I analyzed the Bitcoin network transactions and noticed that after an initial surge, Runes transactions saw a significant decrease, accounting for under 30% of all transactions between late February and May 5. Then, suddenly, there was a turnaround.

On May 11, Runes protocol reached a record-low point in terms of user engagement. Fewer new accounts were created, and interaction between existing ones declined significantly. Consequently, the number of newly minted tokens dropped, leading to reduced fees generated for the network.

As a researcher studying the recent trend in Runes activity, I’ve noticed that this decline occurs amidst decreased on-chain activity on the Bitcoin network. Various metrics, such as transaction volumes, daily active addresses, and whale transactions, are approaching their lowest points in nearly a decade. Although the precise reason for this phenomenon remains elusive, it’s essential to closely monitor these trends to gain insights into the current state of both networks.

It’s plausible, albeit unverified, that the wider Bitcoin market’s deceleration could have influenced the level of activity on the Rune protocol as well.

The fungible token protocol signifies a major technological advancement on the Bitcoin blockchain as it allows for multiple token types using the UTXO model and the OP_RETURN command.

“This new development provides a more streamlined approach to tokenization than previous methods such as BRC20, focusing mainly on facilitating meme coin transactions on the Bitcoin platform.”

As a crypto investor, I’ve noticed that despite the current market downturn, particular collections of Rune still hold significant value. This observation suggests a thriving niche market within the Rune ecosystem that remains robust.

As an analyst, I’ve noticed that Casey Rodarmor, the mastermind behind Bitcoin Ordinals and the Runes protocol, has shared intriguing insights about an upcoming audio-reactive generative art project during a recent Ordinals event in Hong Kong. This revelation underscores the forward-thinking and inventive culture shaping the Runes ecosystem.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-05-13 10:40