As an analyst with extensive experience in the cryptocurrency market, I believe that Bitcoin Runes are a game-changer for Bitcoin’s network, despite the initial surge in transaction fees during their minting phase. The data from Dune Analytics shows that the protocol has already generated significant revenue through transaction fees, and it has attracted a large number of users to the BTC network.

As a crypto investor, I’ve noticed an exciting development one week post-halving in the Bitcoin market. BitcoinRunes have reached a significant milestone, sparking intense discussions among onlookers and participants regarding its potential implications.

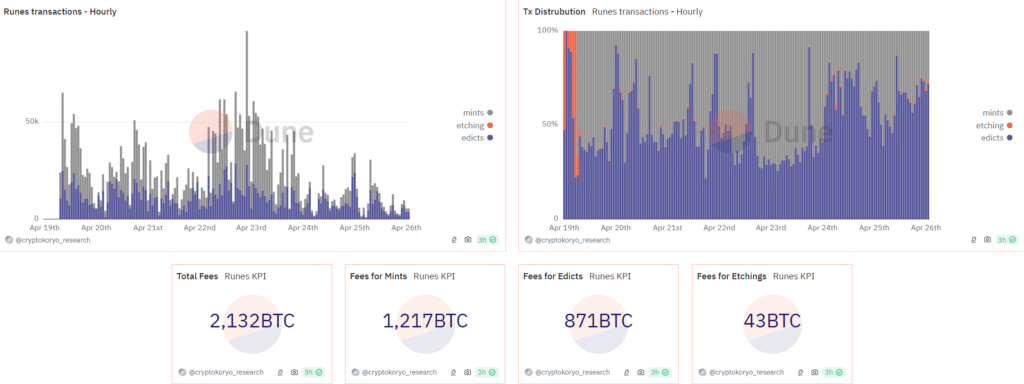

Based on Dune Analytics’ data representation, the Runes protocol on Bitcoin (BTC) has amassed approximately $135 million in transaction fees on the leading blockchain. Over the past week, this standard has facilitated over 2,100 BTC-worth of token issuances.

Casey Rodarmor, the creative force behind the Ordinals protocol, has introduced Bitcoin Runes as a means to enhance the BRC-20 standard on the Bitcoin network. This innovative development is anticipated to foster decentralized finance (DeFi) applications directly on the Bitcoin blockchain.

Using Runes, users can carry out faster transactions and create improved token versions on the Bitcoin network by taking advantage of its unique Unspent Transaction Output (UTXO) structure. This innovative concept emerged during the halving event and has been a significant contributor to Bitcoin’s on-chain activity since then.

Approximately 11,000 Runes have been created through Unisat Bitcoin Wallets, marking a significant increase in blockchain activity that led to elevated BTC gas fees immediately following the halving. Subsequently, gas fees have decreased since Bitcoin underwent its quadrennial software update, reducing block mining rewards by 50%.

Analysts: Bitcoin Runes may benefit network long-term

At a block height of 840,000, Bitcoin Runes were introduced, leading to a temporary increase in Bitcoin transaction fees. However, according to Bitcoin analyst Jade Ardinals, speaking with crypto.news, this heightened demand is mainly due to the process of creating new tokens – minting – and is not anticipated to persist indefinitely.

A researcher shared that the hype surrounding Runes led to a large-scale production, putting extra strain on Bitcoin’s blockchain storage. However, analysts anticipate that this strain will eventually lessen, but they also expect the Runes standard to draw in more Bitcoin developers due to its appeal.

In summary, the use of Runes in the network brings about largely favorable effects in the long run. The excitement surrounding their distribution via airdrops is expected to diminish once all the highly demanded tokens created during the halving have been distributed.

Jade ARdinals on Runes

On April 25, approximately half of all Bitcoin transactions were represented by Runes tokens based on data from Crypto Koryo’s Dune analytics dashboard.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-04-26 21:32