As a seasoned researcher with years of experience in the cryptocurrency market, I have learned to navigate its volatility like a seasoned sailor navigates stormy seas. The recent correction in Bitcoin price, finding support at the 50-day moving average, is a familiar dance that I’ve seen many times before.

The lack of volume during the Christmas season and the impact of the Federal Reserve’s monetary policy have certainly played their part in this latest movement. However, the real question on everyone’s mind is whether Bitcoin will experience a January effect, as it has done in years past.

History suggests that while Bitcoin does not always have strong gains in January, it is indeed a month to watch. But let’s be honest, when it comes to predicting Bitcoin’s moves, even the most experienced analyst can’t always call it right. After all, if I could accurately predict every move Bitcoin makes, I’d be sailing on a yacht in the Caribbean instead of poring over charts and data!

In any case, the daily chart shows that Bitcoin is currently at a crucial support level, which could point to more gains in the coming weeks. But as always, the market can be unpredictable, and we must remain vigilant for potential bearish signs such as the rising broadening wedge pattern.

In the end, whether Bitcoin experiences a January effect or not, one thing is certain – it will continue to keep us all on our toes! And if the market doesn’t give us enough excitement, I’m sure the next crypto meme will do the trick. After all, who can resist a good laugh in this rollercoaster ride we call the cryptocurrency market?

Bitcoin price has moved into a technical correction and found support at the 50-day moving average.

Bitcoin (BTC) dropped to around $94,830, marking a decrease of more than 12% from its peak this month, as the traditional holiday season price increase, known as the Santa Claus rally, did not occur.

The event transpired in a quiet setting, with many investors and traders still adopting the holiday spirit typical during the Christmas season.

On December 29th, Bitcoin’s trading volume was reportedly $22 billion by CoinGecko, which is lower compared to the $41 billion it had the day before. Interestingly, its trading volume on Friday was $45 billion, even higher than the $33 billion recorded on Thursday. Typically, in stable market conditions, Bitcoin’s daily trading volume surpasses $100 billion.

After the Federal Reserve’s aggressive monetary policy announcement earlier this month, Bitcoin’s momentum seemed to falter. They reduced interest rates by a quarter of a percent, but their dot plot suggested only two additional cuts. Previously, the Fed had indicated that as many as four reductions might occur in 2025, which was less than initially expected.

As an analyst, I’ve noticed that Bitcoin has faced challenges as speculation about a Strategic Bitcoin Reserve diminished and ETF inflows receded. The likelihood, according to Polymarket odds, that Donald Trump would establish these reserves within his first 100 days in office has decreased from a high of 60% in November to just 29%.

Over the past few days, I’ve noticed a slowdown in ETF inflows, particularly in Bitcoin ETFs. According to data from SoSoValue, these Bitcoin ETFs have experienced asset outflows for six out of the last seven market days. Despite this recent trend, they have amassed a total net asset value of $35.6 billion since their inception.

Will BTC have a January effect?

Despite the anticipated Santa Claus rally, where assets typically rise before December 25th, failing to materialize, Bitcoin investors remain optimistic about a potential “January effect.” This concept posits that many financial assets, such as stocks and cryptocurrencies, often experience growth in January as investors construct their portfolios for the new year.

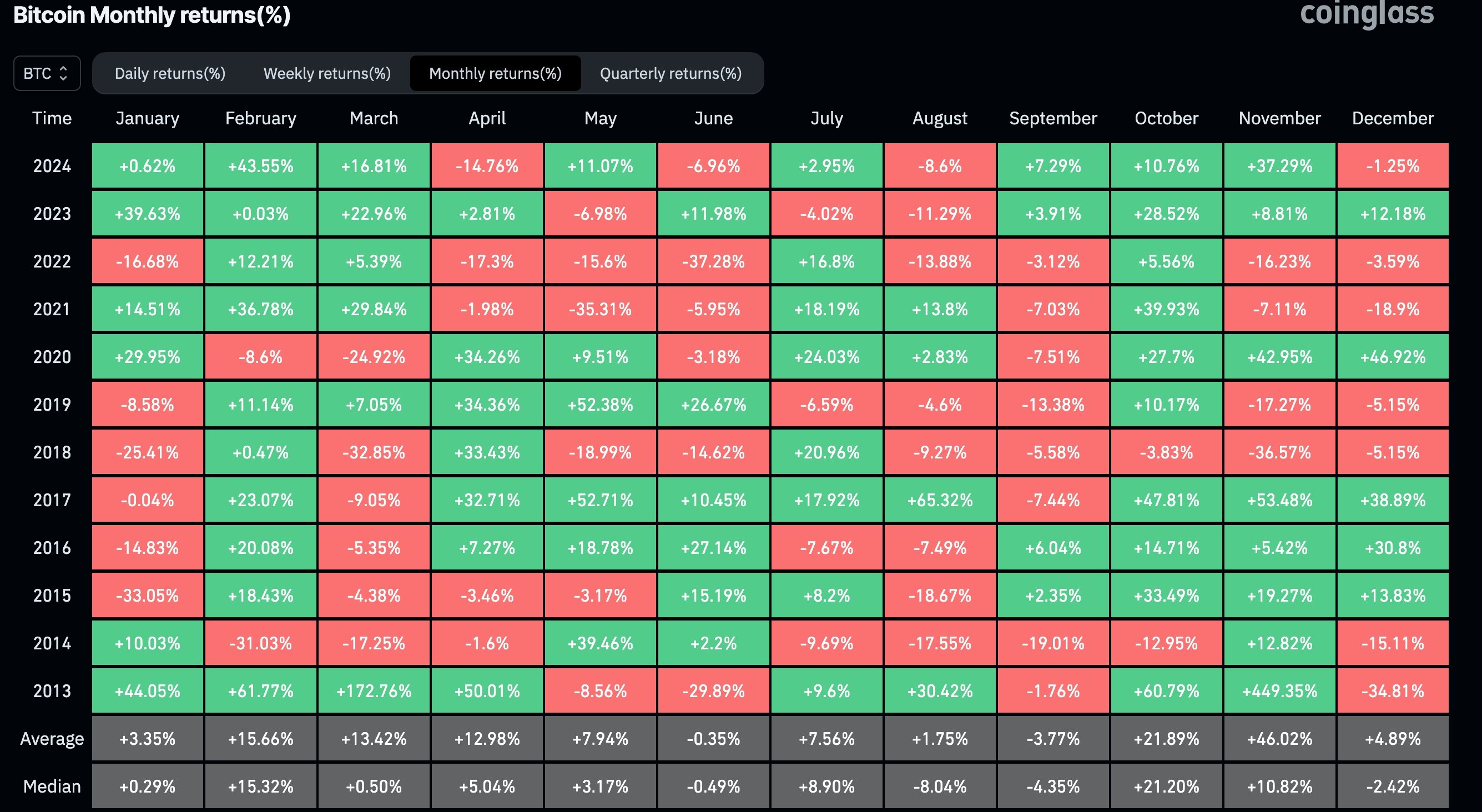

Historical data indicates that Bitcoin may not typically experience significant growth in the month of January. However, as displayed in the following chart, BTC has shown positive returns on six occasions since 2023. This year, it only increased by 0.62%, while it surged by approximately 39% a year prior.

February is usually a strong month for Bitcoin; it moved in the red just two times.

Bitcoin price is at a crucial support

The daily graph indicates that Bitcoin is currently hovering near a significant support point, suggesting potential increases over the next few weeks. It’s holding steady at its 50-day moving average. Additionally, the Bitcoin price has struggled to dip below the upward trendline that links the lowest points since November 17th.

As an analyst, I’ve noticed that the coin appears to be forming a rising broadening wedge pattern, which is often seen as a bearish signal. This means that a potential drop below the lower boundary of this pattern could suggest further price decrease, possibly reaching the level of $73,777 – its March high.

In another possible situation, the price of Bitcoin could recover and once again challenge the top boundary of the wedge, potentially reaching around $110,000.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-29 17:10