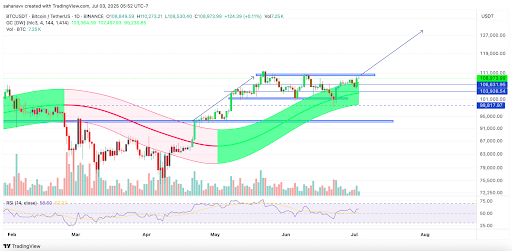

Bitcoin has reached a new high of around $110,000 in the past three weeks, bouncing back from its low in June at approximately $58,000. This impressive recovery is driven by continuous inflows into ETFs and an overall positive trend in global markets. On the technical side, Bitcoin has surpassed a significant resistance level at $108,000, with its upward movement reinforced by increasing Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) crossover. Analysts are now looking towards $115,000 as the next significant objective, given that favorable macroeconomic conditions continue.

ETF Inflows, Macroeconomic Tailwinds, etc., Add Momentum

One significant factor fueling the rise in Bitcoin’s price is the ongoing investment into Bitcoin Exchange-Traded Funds (ETFs), particularly BlackRock’s iShares Bitcoin Trust (IBIT). This fund continues to draw substantial investments from large institutions, suggesting that it remains a popular choice. The consistent influx of funds implies growing trust from traditional financial sectors, which in turn strengthens Bitcoin’s standing as a store of value and investment tool.

Additionally, Macroeconomic elements are significantly contributing to Bitcoin’s growth. A softer-than-anticipated ADP employment report in the U.S. has sparked speculation about potential Federal Reserve interest rate decreases. This speculation has led to a general move towards riskier assets, with Bitcoin gaining traction as an attractive high-risk investment option.

After $110K, Where Will Bitcoin Price Head Next?

The cost of a single Bitcoin (BTC) climbed above $110,000, marking its highest point in three weeks. This upward trend is linked to institutional investments and positive economic indicators that are reviving optimism in various financial sectors. As the price inches near its all-time high, investors seem to be hanging onto their Bitcoin rather than cashing out, signaling their faith in further price growth.

Or: The price of one Bitcoin (BTC) jumped past $110K, reaching its highest point in three weeks. This bullish move is connected to robust institutional investments and favorable economic news that are boosting confidence across financial markets. With the price almost touching its all-time high, investors appear to be keeping their Bitcoins instead of selling them, implying they believe in future price increases.

As a crypto investor, I’m observing an exciting trend in the daily chart of Bitcoin: The price has broken through the bearish influence, soaring above the resistance of the Gaussian Channel, much like it did back in mid-April which led to a 20% surge. Currently, the price is trying to crack the crucial resistance zone, and if successful, this could mark a new All-Time High (ATH) for the Bitcoin (BTC) price rally. Additionally, the RSI (Relative Strength Index), traditionally found within the average range, is on an upward trajectory, suggesting that the strength of this rally is growing.

Based on the present trends in Bitcoin’s chart patterns and market circumstances, it’s plausible that the peak of its current price surge might reach approximately $125,000. This potential maximum could occur around Q4 of 2025.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-07-03 16:48