As a seasoned researcher with over a decade of experience in financial markets, I’ve seen my fair share of market turbulence. The recent Bitcoin plunge and the broader cryptocurrency market downturn is yet another reminder of the rollercoaster ride that comes with investing in this space.

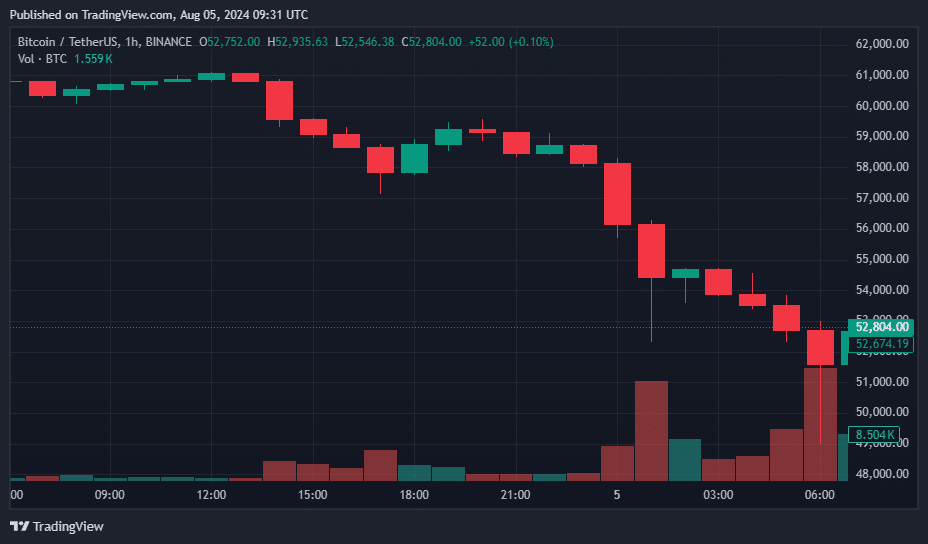

On August 5th, Bitcoin saw a significant drop, falling to $49,221 from its previous steady state of approximately $58,350, which it held for nearly two hours.

As I pen this analysis, Bitcoin (BTC) boasts a daily trading volume of approximately $79.5 billion. However, its market capitalization has dipped to a level of $1.04 trillion. Despite this, it’s important to note that Bitcoin remains 28.2% lower than its all-time high of $73,737, which was attained on March 14th.

In response to a broader market slump, Ethereum (ETH) experienced a significant decrease of almost 20%, dropping from approximately $2,695 to a low of $2,171. However, it slightly rebounded to around $2,321, as reported by data from crypto.news.

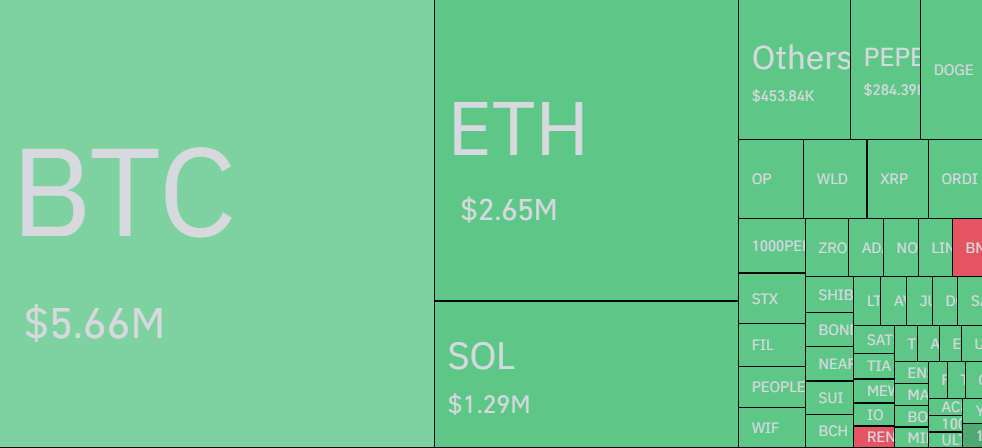

In the past day, intense market volatility led to the closure of over 1 billion dollars worth of highly leveraged trades. Mostly, these were long positions, with Bitcoin and Ethereum long positions taking the brunt of the losses, amounting to approximately $305 million for Bitcoin and $299 million for Ethereum, according to CoinGlass data.

As a crypto investor, I’ve noticed some unexpected market swings lately, and it seems that these fluctuations might be connected to various external economic events. For instance, the Japanese stock market experienced a substantial decline, with the Nikkei 225 index dropping by 7.1%. This downturn was primarily caused by hefty losses in the Japanese banking sector, which can be traced back to an increase in interest rates set by their central bank.

As a researcher, I’ve encountered mounting pressures due to unfavorable employment statistics in the U.S., decelerated expansion in leading tech equities, and news about massive sell-offs by digital currency trading companies, such as Jump Crypto.

In just the past few days, we’ve experienced one of the largest declines in the crypto market over the past year, erasing anywhere between $200 and $500 billion from its overall value.

In the midst of financial turmoil, the Bitcoin Fear and Greed Index dropped sharply to 31. This marks a contrast from last week’s reading of 74, which signaled a market driven by greed. At the same time, U.S. Bitcoin ETFs experienced substantial withdrawals of cash, totaling about $237 million on Friday.

In the midst of a broader market downturn, I’ve noticed an impressive surge in Bitcoin’s dominance index, reaching 56.23% – a level not seen since May 2021. This rise indicates that Bitcoin is holding its ground more effectively compared to other cryptocurrencies, suggesting increased consolidation of its market share.

In addition, some financial experts are contemplating whether the growing tension between Iran and Israel might impact worldwide market equilibrium, possibly causing a shift in the cryptocurrency markets as investors opt for less risky investments.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-05 14:24