As a seasoned researcher who has witnessed the rise and fall of various financial markets, I must admit that the current momentum in Bitcoin is truly captivating. The consistent ETF inflows and record-breaking gains are reminiscent of the dot-com boom at the turn of the millennium. It’s a testament to the growing institutional confidence in cryptocurrencies, and it’s hard not to get excited about the potential for such groundbreaking technology.

As a crypto investor, I’m seeing growing confidence from institutions with Bitcoin’s unprecedented price surge and continuous inflow into ETFs – it’s an encouraging sign for the future of digital assets!

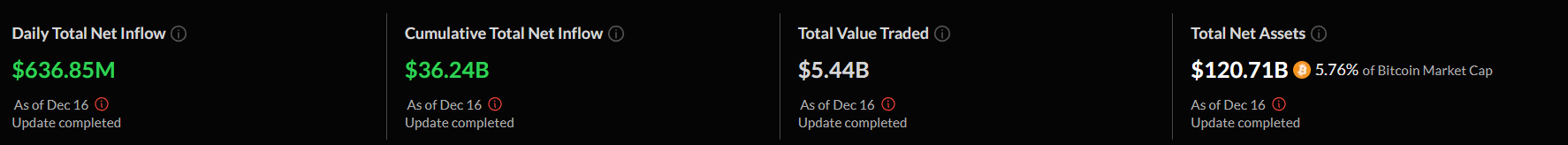

Based on data from SoSoValue, there was a net investment of $637 million into Bitcoin (BTC) spot ETFs on December 16, making it the 13th consecutive day with positive inflows. This ongoing surge in investments coincides with Bitcoin reaching new record highs, suggesting growing trust among investors in the cryptocurrency market.

As a crypto investor, I’m excited to share some recent inflows data. Leading the pack is BlackRock’s IBIT, with an impressive one-day inflow of $418 million, boosting its total net inflow to a staggering $36.3 billion. Following closely, Fidelity’s FBTC saw a $116 million inflow, taking its overall net inflow to $12.4 billion. Grayscale’s GBTC has been on an upward trajectory, reporting a net inflow of $17.65 million. Notably, Bitwise’s BITB and Ark’s ARKB also demonstrated significant institutional interest, contributing to the widespread involvement across various funds.

On December 16th, the value of a single Bitcoin reached an all-time peak of nearly $107,000. This remarkable achievement can be attributed to several factors, including President-elect Donald Trump’s positive stance towards cryptocurrencies and his plans to establish a strategic Bitcoin reserve within the U.S., which has boosted investor confidence.

The combined net worth of all Bitcoin spot ETFs amounts to approximately 5.76% of Bitcoin’s overall market value, which stands at around $120.7 billion.

Based on certain predictions, Bitcoin’s worth could potentially surge up to $250,000 due to continuous Exchange Traded Fund (ETF) investments and favorable legal adjustments.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-17 11:52