Last week, from April 26th, US Bitcoin Spot ETFs experienced considerable net outflows amounting to $328 million, according to Farside Investors’ report.

Last week, from April 26, 2024, Bitcoin Spot ETFs based in the United States experienced substantial withdrawals amounting to $328 million, according to data from Farside Investors.

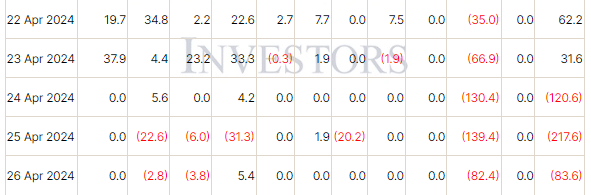

At the start, there were net investments of approximately $62.02 million. Amongst these, Grayscale’s GBTC experienced outflows totaling $34.83 million, while Fidelity’s FBTC attracted inflows worth $34.83 million. Additionally, BlackRock’s IBIT ETF received approximately $19.4 million in new investments.

On Tuesday, April 23rd, Farside UK’s data revealed that Bitcoin ETFs experienced inflows totaling $31.6 million. Notable contributors to this increase were BlackRock’s iShares BitCoin and Ark 21Shares’ ARKB funds. Conversely, on Wednesday, there were net outflows amounting to $120 million, with GBTC taking the lead in driving these withdrawals.

Starting from Thursday, the selling pressure increased significantly, with a total of $217 million being withdrawn from all 10 Spot Bitcoin ETFs. The largest portion of this amount, $140 million, was taken out of GBTC alone. On Friday, there were further withdrawals amounting to $83.6 million, except for ARKB which experienced a minor inflow of $5.4 million.

As an analyst, I’ve noticed investor anxiety escalating due to a crypto market downturn and the DTCC’s implementation of new collateral valuation regulations for Bitcoin ETFs. These events have added to the unrest in the Bitcoin ETF sector, potentially shaping broader market perceptions.

The future of the ETF market is unclear, as Bitcoin’s price instability and possible downtrends may lead to shifts in investment flows.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-04-29 07:48