As a seasoned crypto investor with a knack for spotting trends and riding the waves of market volatility, I must admit that the recent surge of Bitcoin to almost $90,000 has left me both exhilarated and cautiously optimistic. The fact that it’s now the eighth-largest asset in the world is a testament to its growing influence and acceptance as a legitimate investment option.

Bitcoin almost hit the $90,000 mark earlier today and became the eighth-largest asset in the world.

Today, Bitcoin (BTC) peaked at a record-breaking price of $89,604, while the overall cryptocurrency market flourished with significant growth, and interestingly, the total value of all cryptocurrencies worldwide reached an unprecedented high of $3.11 trillion.

After the rally, Bitcoin’s total market value soared to approximately $1.77 trillion, outpacing silver’s worth of around $1.7 trillion, and coming very near to the $1.8 trillion market cap of Saudi Aramco, a major petroleum and gas corporation owned by the Saudi Arabian government.

A significant factor was the approximately $1.1 billion that flowed into Bitcoin exchange-traded funds based in the United States on November 11th.

The value of large-scale Bitcoin transactions exceeded $100 billion, according to data from IntoTheBlock, on the day before yesterday.

Large numbers of whale transactions (transactions by large-scale investors) frequently cause a sense of apprehension about missing out among individual investors, leading to massive investments flooding in.

The road to $100k

The surge in Bitcoin’s price appears to be slowing since it approached $90,000. This is a typical pattern because some investors choose to cash out their earnings after significant increases.

A poll with a $238,000 volume on Polymarket shows a 40% chance of Bitcoin surpassing $100,000.

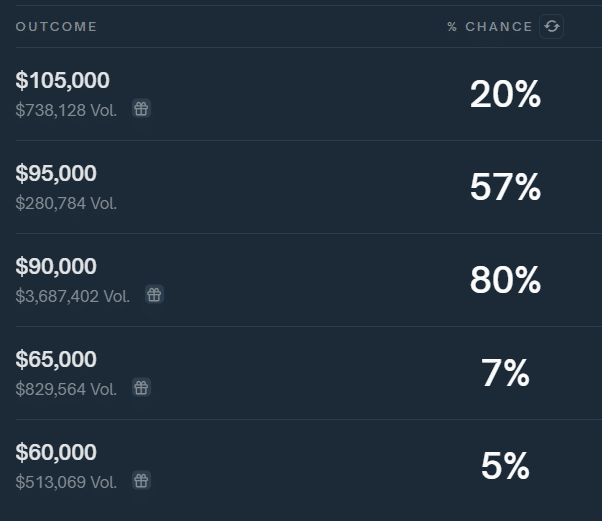

A different prediction ballot, holding a wager of $3.6 million, indicates an estimated 80% probability that Bitcoin (BTC) will reach $90,000. The odds for BTC to touch $95,000 and $105,000 stand at 57% and 20%, respectively, according to the poll findings.

As an analyst on Kalshi’s market prediction platform, I can share that the likelihood of Bitcoin (BTC) reaching the $100,000 milestone currently stands at approximately 45%.

At present, Bitcoin is being traded for less than $87,000, reflecting a general market trend that appears to be easing or slowing down.

The global crypto market cap also declined to $3.08 trillion, according to CoinGecko data.

On November 13th, the release of the U.S. Consumer Price Index (CPI) report for October is expected. This report provides insight into the current inflation rate within the United States. Depending on its findings, the CPI report could either reinforce the ongoing bull market or potentially shift its trajectory.

According to data from Trading Economics, the Consumer Price Index (CPI) for September was 2.4%, and it’s projected to rise slightly to 2.6% in August. It’s worth noting that the inflation report plays a crucial role in determining interest rates during the December decision-making process.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-12 14:26