As a researcher with a background in cryptocurrency market analysis, I find Martinez’s historical data on Bitcoin’s price performance during the month of July intriguing. Based on his analysis, it appears that when Bitcoin experiences a negative June, it tends to rebound strongly in July. This trend is supported by data showing an average return of 7.98% and a median return of 9.60% during this month.

As a crypto market researcher, I anticipate that the Bitcoin (BTC) price will bounce back in July following a bearish trend throughout the previous month.

Based on Martinez’s recent post from last Sunday, Bitcoin’s average price experienced a bounce-back of approximately 7.98% in July following a downward trend in June. However, it is important to note that the value of Bitcoin decreased by around 9.25% over the past month.

Historically speaking, Bitcoin has a tendency to recover well after experiencing declines in the month of June. On average, Bitcoin has yielded a gain of 7.98% and a median gain of 9.60% in the month of July.

— Ali (@ali_charts) June 30, 2024

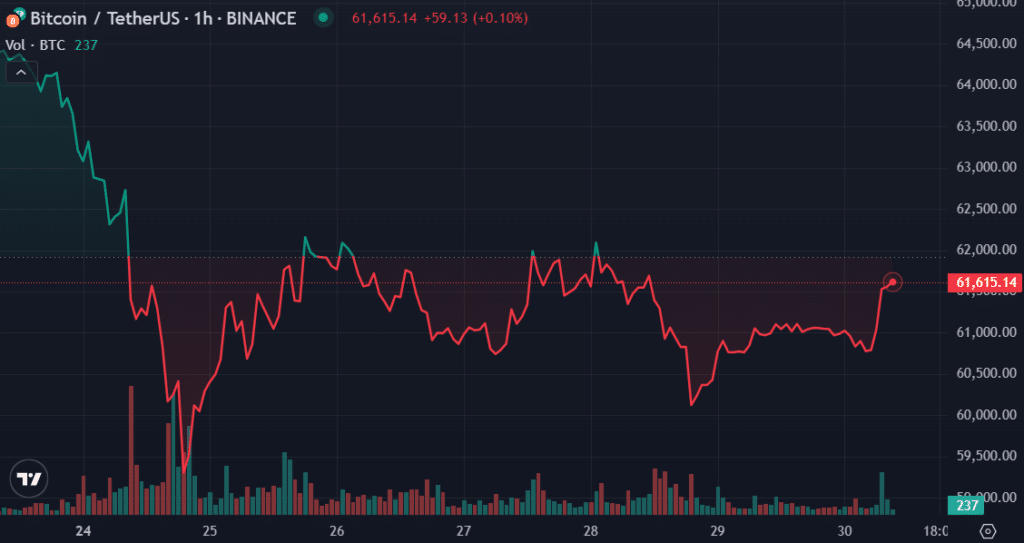

Bitcoin recorded a 30-day-high of $71,907 and a low of $58,554 in the mentioned timeframe.

Additionally, according to the data from Martinez, Bitcoin’s most substantial average price increase of 46.81% occurred during the month of November.

Over the last 24 hours, Bitcoin exhibited a mild surge, inching up by 0.94%. The value of the leading cryptocurrency now stands at $61,450. Notably, Bitcoin’s market capitalization has once more exceeded $1.2 trillion, with a daily trading volume of $13.1 billion.

With decreasing Bitcoin trade activity comes reduced price fluctuations and fewer forced sales.

Contrarily, billionaire entrepreneur and Bitcoin advocate Peter Thiel is of the opinion that the bitcoin price may not experience a significant surge. Despite this belief, Thiel continues to own a stake in Bitcoin.

As a researcher looking back on the past year, I can share that I was part of a team investing significant resources with Founders Fund. Specifically, we allocated approximately $200 million towards Bitcoin when its value was approximately $30,000 per unit.

The decline in Bitcoin’s value began on June 10, signified by the first instance of negative inflows into Bitcoin ETFs trading on US markets in over a month.

Last week, a total of $137.2 million flowed into Bitcoin ETFs during their last four trading sessions. As a result, the overall net inflows for these ETFs surpassed the $14.5 billion milestone.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-30 13:40