Strive Asset Management, that audacious troupe, seized a hefty $750 million in a private investment in public equity (PIPE) marvel at the end of May, all to acquire the glittering digital gold—bitcoin. Because what better way to flirt with the future than with a digital unicorn? 🦄💰

Bitcoin as the AI’s Worst Nightmare? Strive CEO Declares a Digital Fallback 🤖

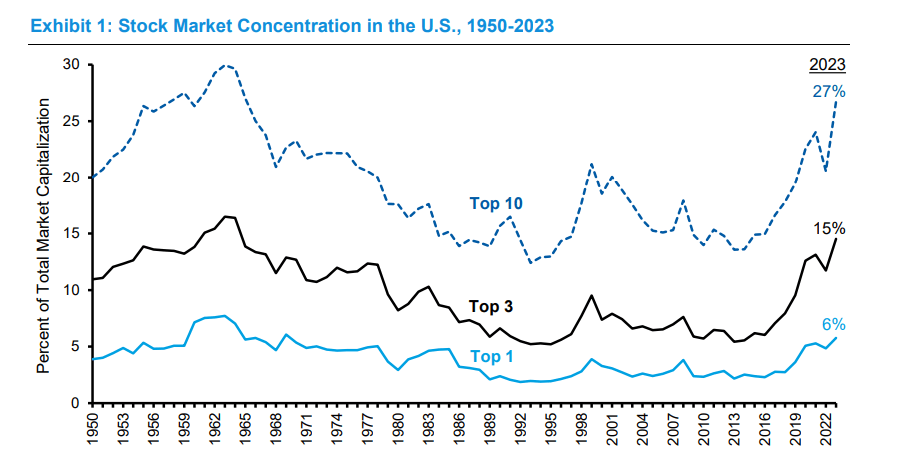

Artificial intelligence (AI)—that shiny disruptor—might just ghost half of all entry-level white-collar jobs within five short years, warns Dario Amodei, the oracle at Anthropic. Meanwhile, Matt Cole, the dashing CEO of Strive, proclaims that perhaps half of the S&P 500’s darling companies may evaporate into the digital ether unless they hedge their bets with bitcoin. Yes, dear reader, finance’s newest sacrament. 📉➡️💸

We’ve seen this tragicomedy before. Nearly 50% of the 1990 S&P 500 members had quietly exited stage left by 2020, replaced by the fast-rising internet titans, according to Cole—because nothing screams “reliable investment” like historical bloodbaths. 🕰️📉

“We saw all those tech stars parade in,” Cole pontificates in a charming interview with Bitcoin.com. “But what’s often overlooked is that over half the companies in the S&P 500 — from 1990 to 2020 — simply faded away. They were replaced, like bad actors in a low-budget sequel.”

And now, dear strap-hangers on the rollercoaster, Cole urges executives to hedge against the imminent seismic upheaval—by adorning their balance sheets with that rebellious, disruptive asset: bitcoin. Because, as he dryly notes, “What better way to prepare for doom than with a little digital insurance?” 💼🔮

Bitcoin: The Alpha Generation’s Plaything

Strive was born from the brains of Vivek Ramaswamy—a former presidential hopeful and biotech baron—and his high school confederate, Anson Frericks, an ex-beverage magnate. This boutique firm takes a stand—loudly—against the usual socio-political chit-chat, eschewing the fashionable DEI and ESG buzzwords in favor of bold, unapologetic investment. Currently boasting a modest $2 billion under its starkly pragmatic management, it has launched thirteen ETFs, because apparently, *that* is the new cool. 🥤💼

Enter Matt Cole—a man who shepherded a $70 billion fortress of fixed income at Calpers—who took the helm at Strive in 2023, after his former partner, Ramaswamy, bolted to chase the political dollar. His first act? Load up on bitcoin, naturally, and concoct an alpha strategy so cunning it could make Wall Street blush. 💣📈

“Most firms focus on beta—here, passive, sleepy, boring,” Cole explains with a sardonic grin. “But we’re going full-throttle on alpha—active, risky, and hopefully lucrative.”

Risk, schmisk! Cole, with his biotech pedigree and fondness for hedge fund brainpower, assures us those risks are as manageable as a cat on a Roomba. His secret sauce? A Venn diagram of Bitcoin connoisseurs and biotech hedge geniuses—because what could possibly go wrong? 🚀🔬

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2025-06-11 08:57