Bitcoin: The Unexpected Lifeboat in America’s Economy Crash? 🚤💸

Good morning, dear reader. Welcome to the US Crypto News briefing, where we serve up the latest in crypto—preferably with a dash of sarcasm and a hint of despair for good measure.

Pour yourself a robust coffee, settle in, and ponder the marvels of American demographics: an aging population, rising debts, and the inevitable question—how does Bitcoin fit into this grand circus?

Crypto News of The Day: US Debt Will Sink Fiat

Max Keiser, ever the prophets of doom, recently pointed a trembling finger at the swelling US debt, as if anyone hadn’t noticed.  Meanwhile, Raoul Pal, founder of Real Vision (a man who insists he knows things), has echoed the sentiment but with a flourish. He describes Bitcoin as a “life raft” amid the rising chaos—because nothing else quite does the trick.

Meanwhile, Raoul Pal, founder of Real Vision (a man who insists he knows things), has echoed the sentiment but with a flourish. He describes Bitcoin as a “life raft” amid the rising chaos—because nothing else quite does the trick.

“Over time, due to aging demographics, governments need to borrow more money to support GDP growth to pay interest on the debt… That debases the currency and lowers the denominator, making scarce assets appear even more desirable,” Pal writes, sounding like a man who has read too much history—or perhaps just too much coffee.

He insists this misunderstood phenomenon is the key to understanding the markets—because who needs common sense when you have demographics? The US, naturally, exemplifies this demographic debt trap: fewer workers, more retirees, inflation, and a government increasingly dependent on the benevolence of the Federal Reserve.

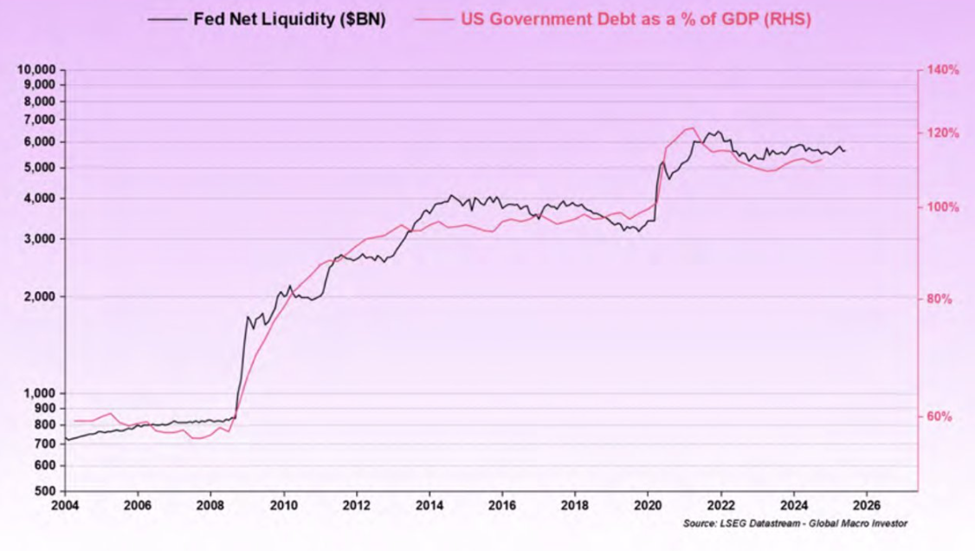

In February 2024, the Congressional Budget Office (CBO) projected US debt at a staggering 116% of GDP in a mere decade, up from just over 100% today. Who needs fiscal discipline when you have endless borrowing?

To keep this charade going, the government relies on the Federal Reserve like a child clutching a blankie—printing money, easing QE, and reassuring us all that debt is merely a number. But that’s just a convenient fiction. The dollar shrivels a bit more each year—an approximate 8% erosion, because who cares about pesky currency stability?

“At over 100% of GDP in debt, there’s no real cash flow left to fund this reckless growth, so they just keep printing—Fed net liquidity is the magic fairy dust,” Pal chimes. It’s the financial equivalent of putting all your chips on the roulette wheel and praying to Madam Fortuna.

Another voice joins the chorus of despair: Jack Mallers, who calls Bitcoin a “life raft” for those fleeing the sinking ship of fiat currency, saying, “The Fed’s rate cuts are a gift: we built an open-source escape pod. Get out of dollars. #Bitcoin.” Brilliant, if only it were that simple.

Pal’s Prediction: Bitcoin Counters 8% Fiat Debasement Annually

Raoul Pal, ever the optimist—or perhaps the cynic with enough coffee—claims that Bitcoin and its ilk serve as a safety buffer, offsetting an 8% annual decline in dollar value, all while soaking up new adopters like a sponge on a water slide.

Back in 2020, amidst the COVID chaos, he proclaimed Bitcoin the “life raft”—not just a way out but a superior system, an energy black hole devouring traditional finance (sounds charming, doesn’t it?). Now, his conviction only deepens.

Macro analysts Garret and Pal have long argued that demographics steer markets—Japan is the cautionary tale: graying populations, stagnant productivity, soaring debt. It’s as if the old man’s wallet is bleeding out, and no one knows how to stop it.

“When both population and productivity decline, the long-term GDP trend plunges. The only solution? Increase debt—a strategy as old as time and just as effective,” Pal asserted years ago on some obscure platform.

Enter Bitcoin, with its limited supply of 21 million coins—a stark contrast to fiat’s endless ‘printing press.’ Its allure lies in scarcity and rising global adoption; El Salvador’s bold move to make Bitcoin legal tender in 2021 was perhaps less mad than it looked, in a world teetering on the brink.

Charts of the Day

Byte-Sized Alpha

Crypto Stocks: The Pre-Market Spectacle

| Company | At the Close of June 3 | Pre-Market Overview |

| Strategy (MSTR) | $387.43 | $387.59 (+0.041%) |

| Coinbase Global (COIN) | $258.91 | $263.15 (+1.64%) |

| Galaxy Digital Holdings (GLXY.TO) | $19.13 | $19.21 (+0.42%) |

| MARA Holdings (MARA) | $15.33 | $15.29 (-0.26%) |

| Riot Platforms (RIOT) | $9.03 | $9.09 (+0.66%) |

| Core Scientific (CORZ) | $11.80 | $11.98 (+1.53%) |

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-06-04 16:39