As a seasoned crypto investor with a decade-long journey through the digital asset wilderness, I can confidently say that the recent surge of Bitcoin towards $65,000 has stirred an old familiar feeling – the anticipation of a potential bull run. The historical patterns and trends associated with October and U.S. presidential elections have always piqued my interest, and this year seems no different.

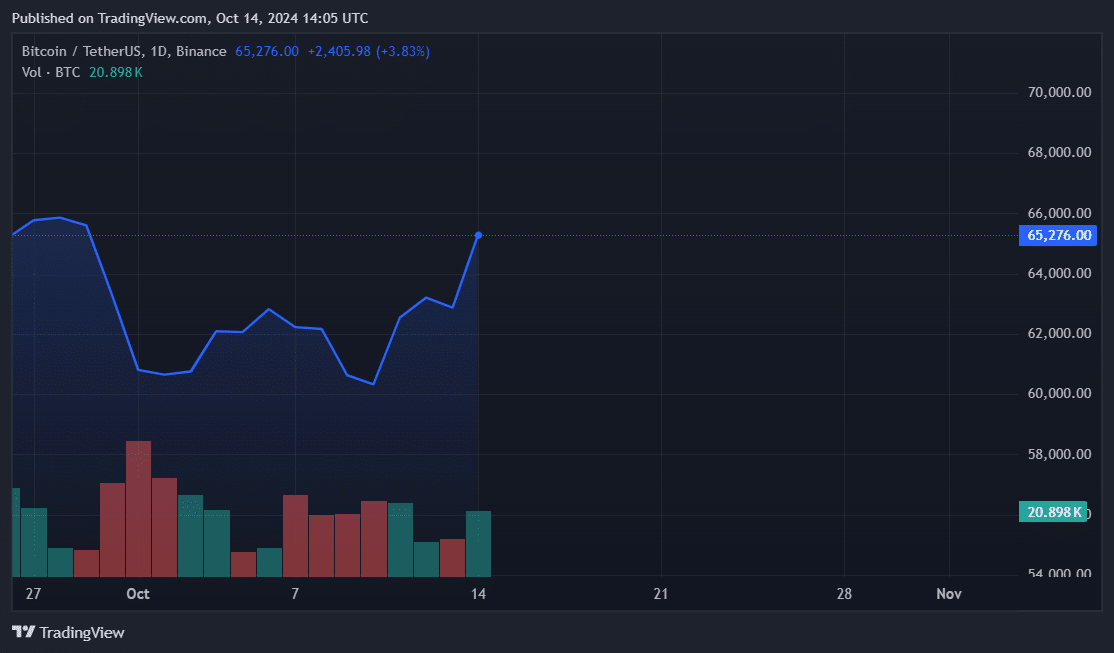

According to QCP Capital, Bitcoin‘s surge towards $65,000 following a slow beginning in October might spark the usual price increases that tend to occur during this month.

The analysts at a cryptocurrency trading firm stated through their Telegram channel that Bitcoin’s (BTC) 4% price increase on October 14 could indicate a potential rally for Bitcoin during the latter half of the month. This surge in price led to approximately $80 million being wiped out from leveraged short positions in both Bitcoin and Ethereum (ETH), reducing the bearish influence over these two prominent cryptocurrencies and the overall digital asset market.

Experts from QCP observed that an increase in Bitcoin’s price occurred about three weeks prior to the U.S. presidential elections in November. The trading data revealed that Bitcoin exhibited comparable price trends on two past instances. In January 2017, Bitcoin nearly doubled its value following a price surge that began in October, which coincided with the 2016 elections. Similar to this year, Bitcoin had experienced a period of stability for several months before the anticipated change in U.S. leadership.

2020 saw an impressive increase in Bitcoin’s value. Starting at approximately $11,000, just weeks before the presidential election, it skyrocketed to more than $42,000 by the first quarter of 2021. This remarkable surge nearly tripled its worth.

If past patterns persist and Bitcoin’s bull market revives after the U.S. elections, it’s possible that the value of BTC could climb to or surpass $120,000 by early 2025. In a scenario where BTC doubles in price, this would significantly boost its market capitalization, pushing it well over the $2 trillion mark, which would be an impressive milestone for Bitcoin as the leading cryptocurrency.

QCP Capital analysts believe that Mt. Gox’s revised repayment strategy could strengthen the positive perspective for Bitcoin. Previously, the bankrupt Bitcoin exchange pushed back its creditor compensation deadline to October 2025. As reported by crypto.news, Bitcoin buying activity has slowed down, and there is reduced selling pressure on multiple digital asset trading platforms.

So far, October, or “Uptober” as some call it, hasn’t been particularly impressive with Bitcoin only rising by 1.2%, which is significantly less than its average increase of 21%. After several months of price fluctuations, there’s a question if history will repeat itself. Today’s market surge has certainly provided a spark of optimism that was beginning to wane as Uptober enthusiasm dwindled.

QCP Capital

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-10-14 17:26