As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find this recent trend intriguing. The shift from large holder outflows to net inflows, as shown by IntoTheBlock and confirmed by CryptoQuant CEO Ki Young Ju, suggests a growing accumulation among whales – a phenomenon that has surged an astounding 813% since the beginning of the year!

The data from the blockchain indicates a substantial decrease in Bitcoin transfers by major investors, with Bitcoin maintaining its position above the $68,000 level.

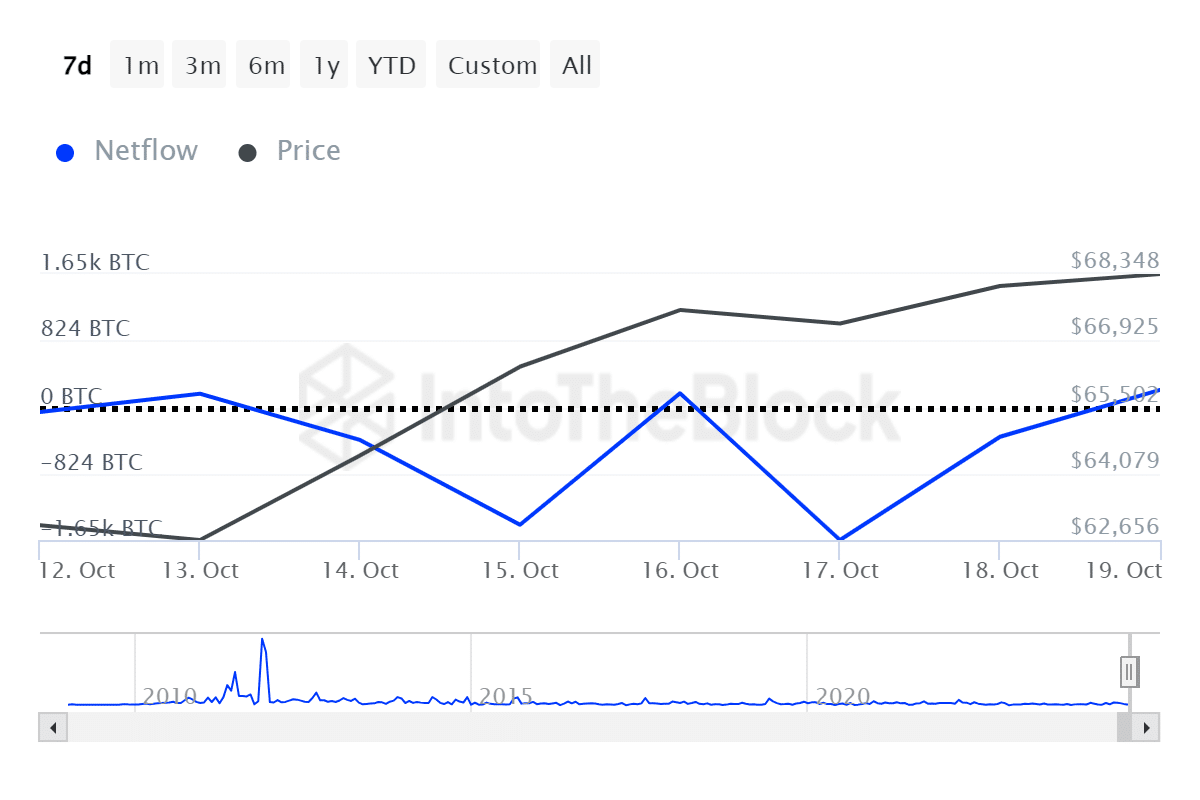

Based on data from IntoTheBlock, the movement of Bitcoin (BTC) held by large investors (whales) changed from sending out 1,650 BTC on October 17 to bringing in 211 BTC on October 19. This trend suggests that these significant holders are increasingly accumulating Bitcoin.

CryptoQuant CEO Ki Young Ju confirmed the intensified accumulation.

According to an article on crypto.news, data from Young Ju indicates that there were approximately 1.97 million Bitcoin coins held in newly created whale wallets (containing at least 1,000 BTC) yesterday, marking a dramatic increase of over 800% since the beginning of this year.

A major factor fueling Bitcoin’s rising trend is growing investor enthusiasm towards US-based Bitcoin exchange-traded funds (ETFs), which have sparked considerable attention.

Based on the data from the report, last week witnessed a $2.1 billion investment into these particular products, bringing the total net inflows above $21 billion.

Furthermore, as per ITB’s data, the Bitcoin exchange outflows persisted for a third day in a row, with an outflow of approximately 2,300 Bitcoins, equivalent to around $157 million, observed on October 19th.

As a researcher observing the Bitcoin market, I notice that an uptick in exchange outflows often indicates reduced selling pressure. Nevertheless, given that the Bitcoin price is approaching its record high of $73,750, it’s likely we’ll see some short-term profit-taking activity.

Over the last day, Bitcoin has been holding steady within a range of $68,000 to $68,600. Currently, its total market capitalization stands at approximately $1.35 trillion, with daily trading volumes amounting to around $13.8 billion – a decrease of 55%.

A declining trading volume could potentially bring lower price volatility for the leading asset.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-20 17:38