As a seasoned crypto investor with over a decade of experience in the market, I have witnessed the rollercoaster ride of digital assets and their potential to revolutionize finance. Larry Fink’s recent comments on Bitcoin resonate deeply with my own observations and analysis.

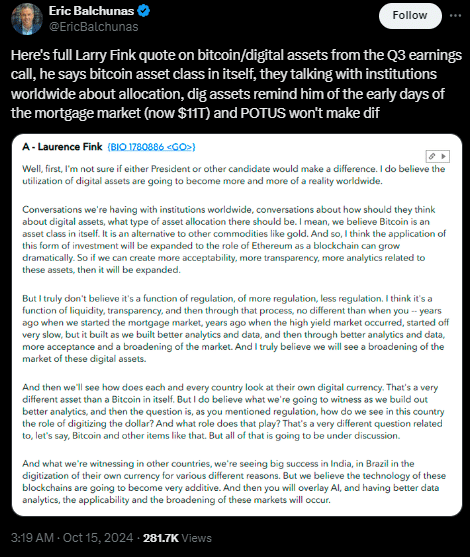

According to BlackRock’s CEO, Larry Fink, Bitcoin‘s growth path is expected to continue regardless of who wins the upcoming U.S. presidential election.

It’s increasingly clear that digital currencies hold significant promise, and there are growing discussions about how companies should handle this emerging type of asset when it comes to financial management and investment strategies. This is the essence of Fink’s argument.

Larry linked Bitcoin to gold in his explanation, of how investment in this type of digital asset also falls into a category of its own. He therefore explained that it is projected that the use of digital currencies will grow bigger as the relevant technology improves.

In simpler terms, Fink compared the evolution of this situation to the transformation of the mortgage sector. At first, it moved at a leisurely pace within the economy, but then, as technology advanced and more data became available, the way things worked shifted dramatically.

He said, “I firmly think it’s not about regulations, but rather about liquidity and clarity.

It’s intriguing that Fink, who typically holds a neutral or critical stance on cryptocurrencies, has recently expressed views reminiscent of crypto market skeptics in 2021. However, his more recent comments suggest a shift in perspective.

Since the activation of BlackRock and the launch of the Bitcoin exchange-traded fund (ETF) in March, these sought-after assets by investors have gathered over $23 billion in value.

As a crypto investor, I find myself aligning with the CEO’s perspective and that of analysts at Standard Chartered, who predict Bitcoin could soar to $200,000 by 2025, irrespective of who assumes the U.S. presidency. The fact that both Presidential candidates, Donald Trump and Kamala Harris, have recently shown favorable views towards cryptocurrencies, underscores the swift transformation taking place within the digital asset ecosystem.

Additionally, Fink pointed out that countries such as India and Brazil are successfully advancing digital currency adoption.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-10-15 11:00