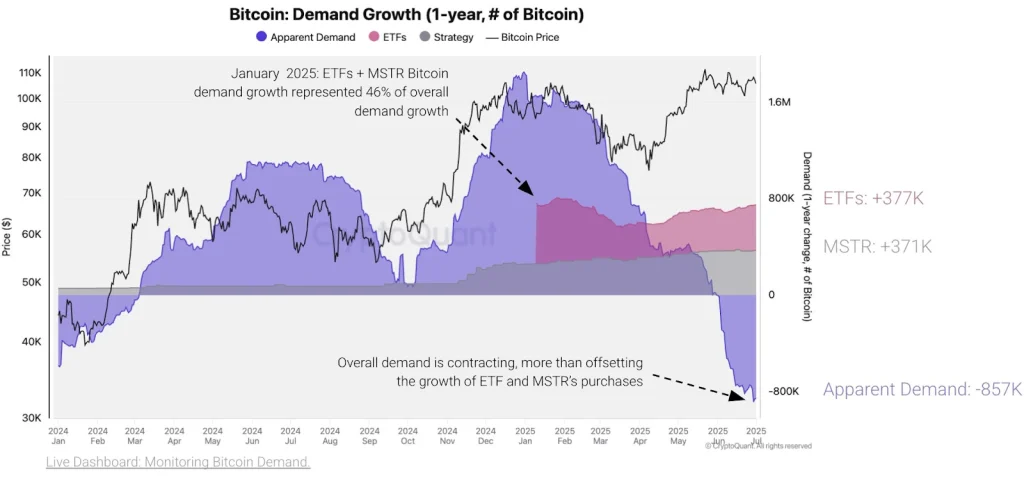

Oh, the enigmatic world of Bitcoin (BTC) continues to bewitch and bemuse, much like a poorly rehearsed play where the actors are unsure if they are in a tragedy or a comedy. Despite the apparent net cash inflows in the last few weeks, Bitcoin has experienced a curious reduction in demand, especially from those grandiose institutional investors who once strutted about like peacocks in a garden of tulips. According to the on-chain data analysis provided by CryptoQuant, the net demand for Bitcoin has been waning, like a candle flickering in the wind.

Indeed, the overall demand for Bitcoin has contracted so significantly that it seems as if the entire world has decided to take a collective nap, reducing their demand by 895k coins in the past 30 days. 🌙 The reduced Bitcoin demand, coupled with a significant cumulative short leverage trades, has played a major role in its midterm bearish sentiment, much like a rain cloud hovering over a picnic. 🌦️

Bitcoin Price Gains Bullish Momentum

But wait, dear reader, for the plot thickens! After closing above a crucial resistance level around $108,360 on Wednesday, Bitcoin (BTC) price rallied towards the next milestone of around $110,570 on Thursday, July 3. It’s as if the market decided to throw a grand ball, and Bitcoin, dressed in its finest, is now aiming to retest its all-time high of nearly $112k. 🎉

Furthermore, BTC price has invalidated the previously formed falling trend after closing above the upper border of the logarithmic trend. According to market data analysis from CryptoQuant, the selling pressure from U.S. whales and institutional investors has gradually declined, much like the audience at a particularly dull opera. 🎭

What the Charts Say

BTC price is approaching to retest the all-time high around $111,814, which signals a potential double top if a rejection occurs. With the daily Relative Strength Index (RSI) signaling a possible bearish divergence, it is prudent to wait for the BTC price to consistently close above $112k in the subsequent days to avoid being caught in a fakeout. It’s like waiting for the final curtain to drop before you applaud, lest you be the one caught in an awkward silence. 🙈

The daily MACD indicator also shows that the bullish sentiment has been gaining momentum, whereby the histograms have been increasing above the zero line. The bullish momentum is also bolstered by the fact that BTC price has registered more positive monthly returns in Julys in the past ten years. It’s as if July is Bitcoin’s lucky month, much like how some people believe in the power of a four-leaf clover. 🍀

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-07-03 23:12