As an experienced market analyst, I’ve seen my fair share of market fluctuations in the cryptocurrency space. The recent surge in Bitcoin and subsequent double-digit gains for several altcoins is a welcome sight, especially after a prolonged period of sideways movement.

Bitcoin experienced a noteworthy surge in trading activity over the past day, significantly boosting investor confidence and inciting substantial financial inflows into the cryptocurrency market.

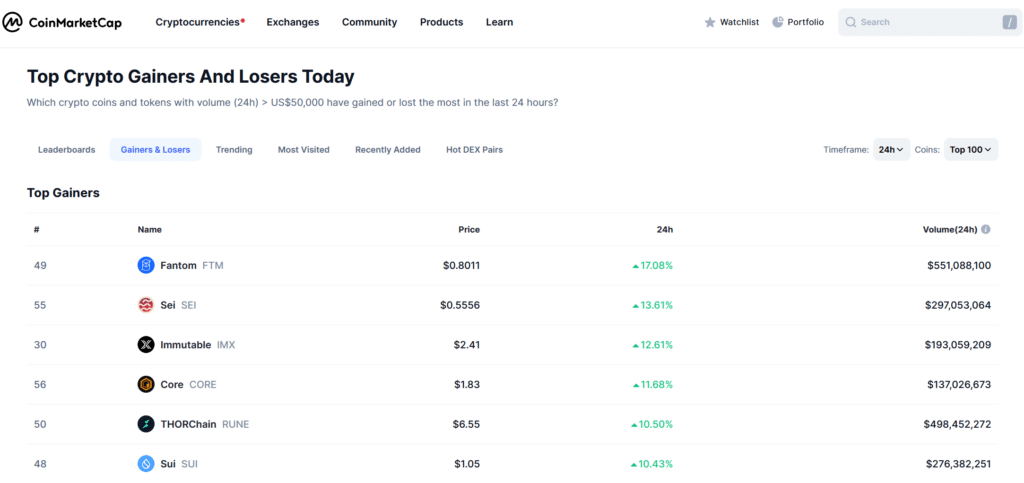

Six cryptocurrencies experienced notable price increases, with double-digit percentage growths, as Bitcoin surpassed $66,000 and added over 6% to its value during the past 24 hours on May 15, based on data from CoinMarketCap.

As a researcher, I’ve analyzed the latest cryptocurrency market trends at the time of this writing, and I discovered that Fantom (FTM), Sei (SEI), Immutable X (IMX), Core (CORE), THORChain (RUNE), and Sui (SUI) each experienced price growth exceeding 10%.

QCP Capital: Bullish Bitcoin signs afoot

After Bitcoin surpassed its present thresholds, QCP Capital identified potential indicators suggesting a resurgence of bullish energy in risk assets and the cryptocurrency sector.

Based on data shared by the U.S. Federal Reserve, the economy is showing positive signs, implying that the Fed has effectively addressed inflation worries. Following this announcement, QCP Capital reported significant purchases of call options worth between $100,000 and $120,000 with expiration dates in December.

As a crypto investor, I’ve noticed that several government entities and private organizations have recently revealed their investments in Bitcoin spot ETFs. This news could significantly impact the crypto market since the Bitcoin supply has been reduced by half due to the latest halving event.

“According to QCP Capital researchers, reported in a Telegram message, institutional interest in Bitcoin is escalating as prominent investors Millennium and Schonfeld have allocated around 3% and 2% of their assets under management (AUM) respectively to the Bitcoin spot ETF.”

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-05-16 17:59