In the curious world of Bitcoin, where numbers dance and charts attempt to tell stories, one key ingredient often gets lost in translation: open interest (OI). It’s like the story of the boy who cried “market sentiment!” but really was just trying to get a better Wi-Fi signal. By watching the weekly melodrama unfold on major platforms, we can tell if traders are surprised or just really bad at reading the room.

Open Interest and Market Reactions — Or How Traders Learn That Maybe Leverage Isn’t Their Friend

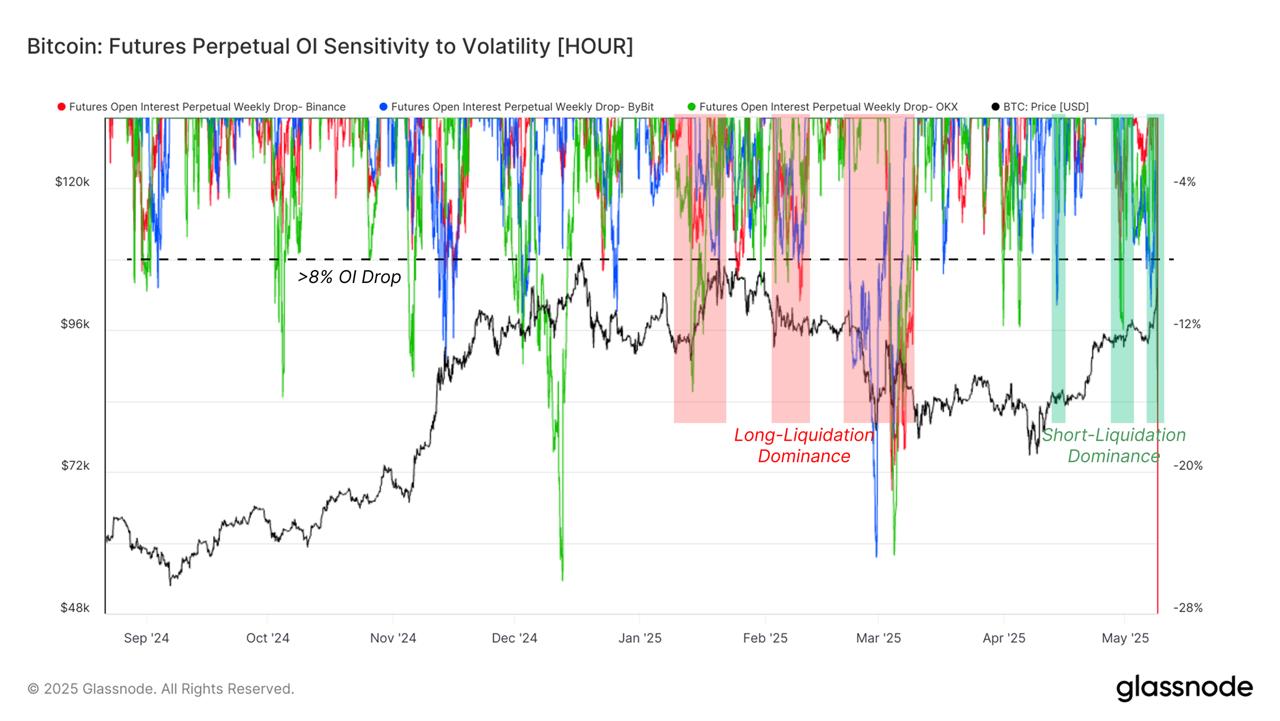

Since January 2025, OI has been the magic 8-ball for figuring out when traders are caught with their financial pants down. For example, when Bitcoin dipped below $80,000, the OI shrank faster than a snowman in summer—more than 10% a week—like a caffeine addict realizing they’ve gone cold turkey. Apparently, over-leveraged longs were being liquidated faster than you can say “margin call,” as prices teetered on the edge of destruction.

Fast forward to the recent rally past $90k, and guess what? The OI shrank again. But this time, it was a short squeeze—because nothing says ‘healthy markets’ like forcing short traders to cry uncle. These theatrical shakeouts—where excessive leverage gets the guillotine—are basically the market’s way of saying, “Let’s tidy up before we do the dance again.”

Futures Market: Short Squeezes and the Slightly Less Chaotic Ride

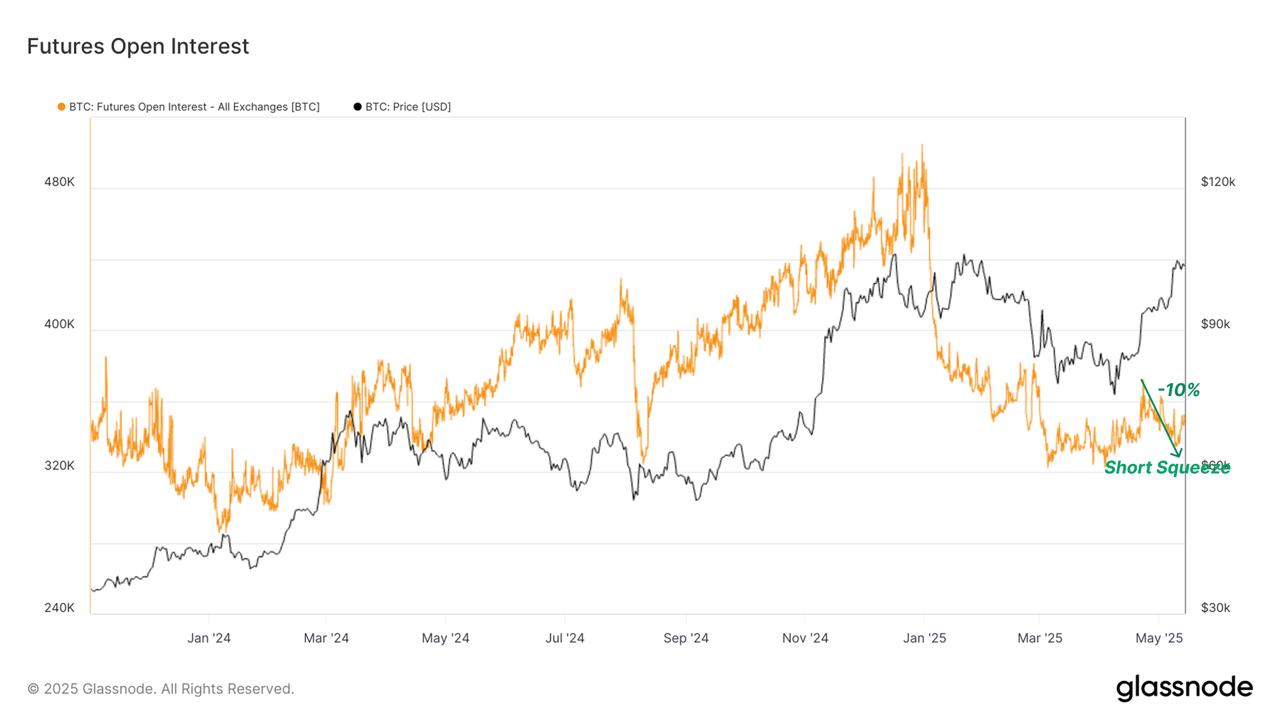

As the shorts got their comeuppance, futures open interest took a dive—down 10%, from 370,000 BTC to a more modest 336,000 BTC—proof that the market is as generous as a cat with a new toy, removing excess leverage. This trimming reduces the chances of a sudden, cataclysmic deleveraging event that would make roller-coaster enthusiasts jealous of the volatility.

Meanwhile, the funding rate—which sounds like something out of a sci-fi novel but is actually a measure of market sentiment—is being rather unexcited. Despite the bullish price action, it whispers “steady as she goes,” like a captain who’s seen a hundred storms but still has a sense of humor. Over the past weeks, it’s hobbling around 0.007%, or about 7.6% annually—enough to make long traders feel justified without making them feel like they’re on a sinking ship.

Since late April, the funding rate has been steadily creeping up, probably to remind traders that they should still be cautious but not quite ready for a panic. It’s sort of like your grandma telling you to wear clean underwear—important, but probably not worth obsessing over.

Options Market: The Crystal Ball of Bullishness? Possibly

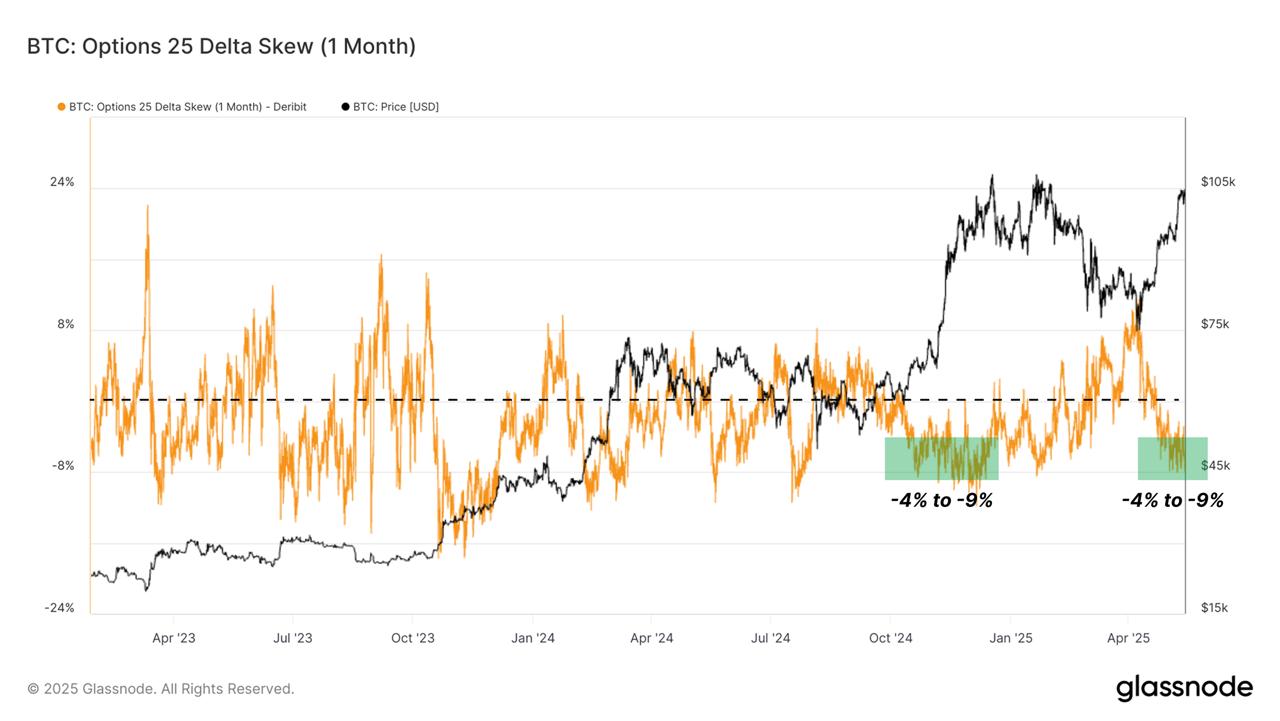

Peek into the options market and you find the 1-Month 25 Delta Skew—think of it as the gossip of the trading world. Basically, it measures how ‘expensive’ the calls (betting on price rises) are compared to puts (betting on declines). A negative skew—where calls are pricier—is like the market leaning forward with a grin and a wink, signaling bullishness on the horizon.

Currently, the skew sits at -6.1%, which means calls are more sought after than puts—like an exclusive club where everyone wants to get in on the action. It’s a sign that traders are feeling optimistic—probably because they’ve watched Bitcoin go up and decided, “Yep, that looks good enough to bet on.”

While not a guarantee—because markets are about as predictable as a cat on espresso—a persistent negative skew suggests rising confidence. We just hope it doesn’t turn into one of those “I told you so” moments when everyone rushes to buy calls and the market throws a tantrum.

In brief: The market looks like a slightly confused but hopeful tourist at the roller coaster—lots of excitement, a few nerve-wracking drops, but overall still on the ride for now.

Source

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-17 22:12