On this fateful Tuesday, Bitcoin, that once-mighty titan of the digital realm, now languishes at a mere $86,930. The price has plummeted below the sacred $90,000 support level for the first time in over three months, casting a pall of despair over the hearts of traders. The Crypto Fear & Greed Index, once a beacon of “greed,” now echoes with the whispers of “fear.” How the mighty have fallen! 😱

As the Bitcoin (BTC) price correction unfolds, a curious trend emerges among institutional investors. A five-day streak of net outflows from U.S.-based Spot Bitcoin ETFs raises eyebrows and questions alike. Are these institutional giants abandoning ship? Is the BTC bull run truly over? We delve into the murky waters of on-chain and technical indicators to unearth the next big Bitcoin trade. 🧐

Table of Contents

Bitcoin supply on exchanges grows while whales dump BTC

Once heralded for reaching the $100,000 milestone and soaring to an all-time high above $109,000, Bitcoin now finds itself in a downward spiral. The decline is orchestrated by key market movers: waning institutional interest, U.S. macroeconomic tremors, and an influx of supply on exchanges. Oh, the irony! 🎭

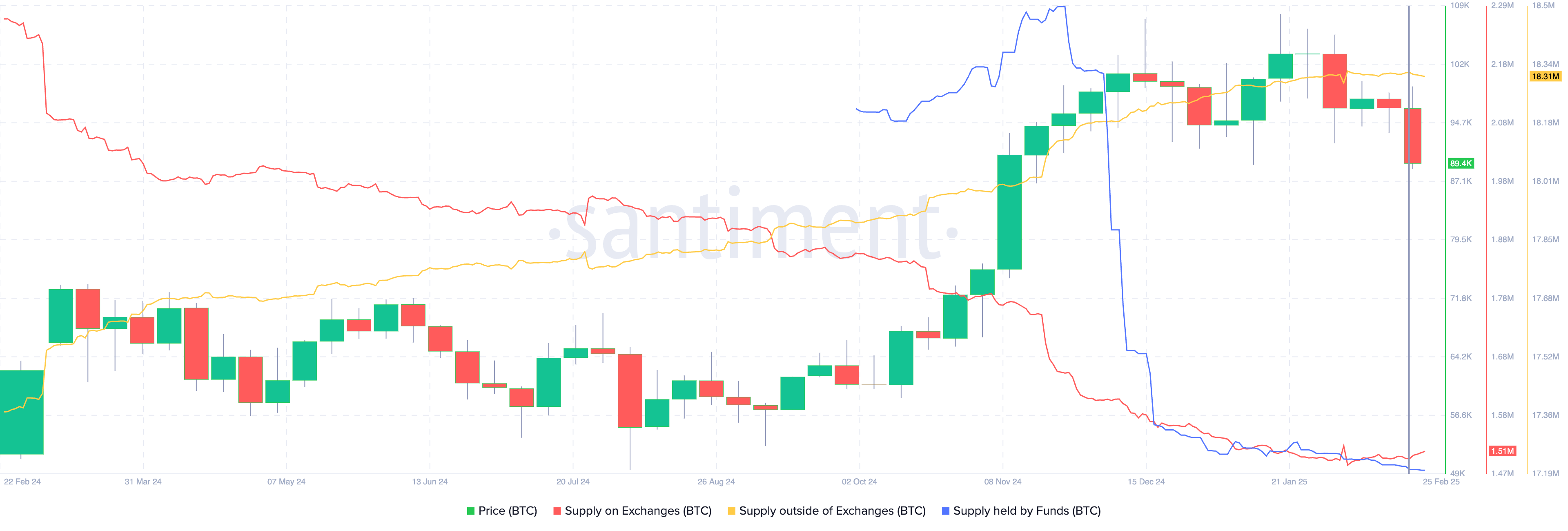

On-chain data from Santiment reveals a troubling trend: supply on exchanges is rising while the supply held by whale wallets is dwindling. This typically signals that those who once hoarded BTC are now transferring their precious holdings to exchanges, perhaps in a desperate bid to salvage their investments. 🐋

What was once a bullish sign of accumulation by non-exchange wallets now morphs into a harbinger of doom, as a decline in these holdings suggests an expectation of further price drops. A key metric, the BTC supply held by funds, is also in decline, hinting at a retreat by institutional players. The specter of negative flows looms large, as observed by Farside Investors. 📉

Institutional investors lose interest in Bitcoin, should you be worried?

According to CoinShares, institutions have yanked a staggering $595 million from Bitcoin funds this month alone. In just one week, a total of $571 million has fled, while Ethereum, Solana, XRP, and multi-asset funds bask in the glow of inflows. The irony is palpable! 😅

Net flows in crypto are dragged down by the outflows from Bitcoin-based funds. CoinShares compiled this data until February 21, after which the BTC supply on exchanges surged. Between February 21 and 25, Bitcoin faced additional selling pressure, pushing its price further into the abyss below the $90,000 support. 📉

Meanwhile, MicroStrategy’s stock tumbles, as analysts at 10x Research elucidate the correlation between MSTR and Bitcoin’s price trajectory. Markus Thielen, the CEO of 10x Research, explains that investors mistook MSTR for a leveraged Bitcoin call option, failing to recognize they were overpaying by a staggering 60% above its fair value. Oh, the folly of man! 🤦♂️

When MSTR shares peaked, they traded at a whopping $40 billion in volume on November 21, 2024. Thielen suspects that investors offloaded part of their positions to unsuspecting retail buyers, leaving them to wallow in significant losses, even as Bitcoin’s price remained stagnant. The performance of MSTR thus influences the sentiment of traders, who treat it as a leveraged Bitcoin call option. The drop in BTC below $90,000 has critical implications for these traders and retail holders alike, as a market dynamic shift looms ominously. ⚖️

Are whales dumping Bitcoin?

Santiment’s on-chain analysis reveals a decline in whale transactions, particularly in two segments valued

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-02-25 23:05