As a seasoned analyst with a decade of experience in the cryptocurrency market, I’ve witnessed the highs and lows, the ebbs and flows, and the transformations that this dynamic industry undergoes. The recent developments in Bitcoin mining are no exception to this pattern.

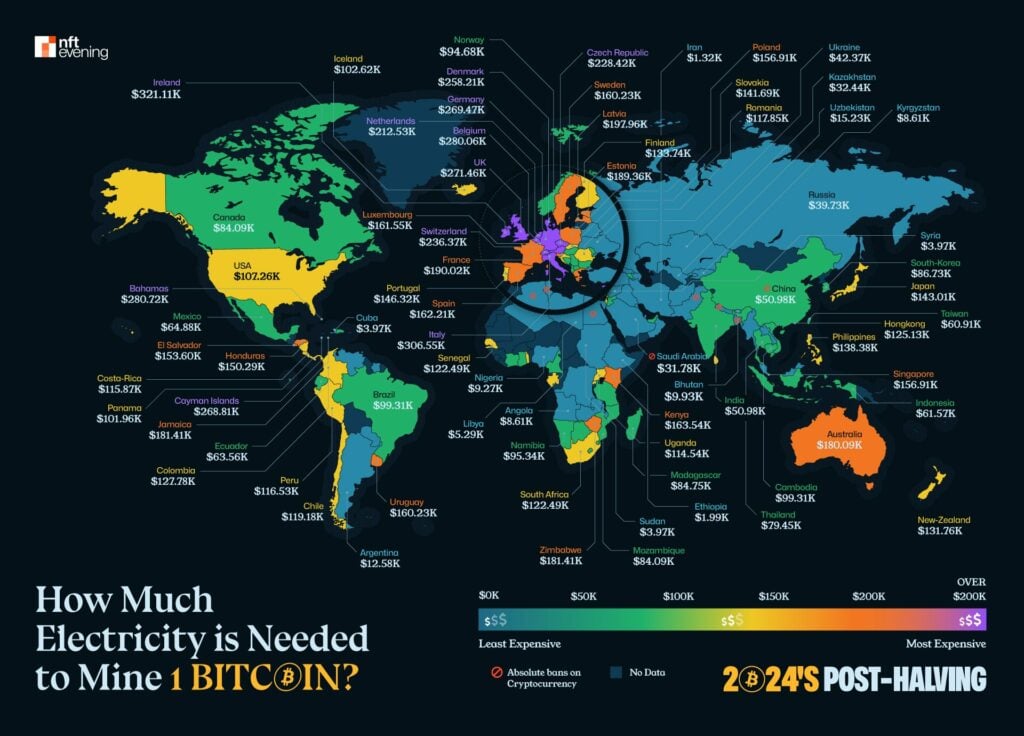

After the halving in April, the cost associated with mining a single Bitcoin underwent significant fluctuations. Meanwhile, eight nations that offer relatively low-cost electricity have already prohibited Bitcoin mining.

According to a study conducted in September by NFT Evening, mining Bitcoin (BTC) used to be a lucrative venture for early adopters, but its profitability has decreased significantly following the halving that took place earlier this year.

In Ireland and Iran, the cost of mining a single Bitcoin varies greatly – it’s approximately $321,112 in Ireland but only around $1,324 in Iran. The high energy costs in the U.S. meant that American miners were at a 50% loss when the price of Bitcoin fell to $57,909 last month, even though the U.S. is one of the world’s largest Bitcoin mining hubs globally.

Bitcoin, originally designed by the mysterious figure known as Satoshi Nakamoto, operates on a consensus model called proof-of-work. In simpler terms, this means that individuals contributing to the network are required to use their computational resources to solve intricate mathematical puzzles. Solving these problems successfully earns them rewards in the form of newly minted Bitcoins.

The block rewards are denominated in Bitcoin, allowing new tokens to enter circulation until BTC’s fixed supply of 21 million is achieved.

Bitcoin mining profitability in strict regimes

Interestingly enough, it turns out that Bitcoin mining can be extremely lucrative in countries that have banned cryptocurrency. In fact, over 20 Asian countries, such as China (which is known for its anti-Bitcoin stance), have energy pricing structures that make Bitcoin mining particularly profitable. Furthermore, several African nations like Ethiopia, Sudan, and Libya offer affordable power packages, making them attractive destinations for both individual and institutional miners.

Currently, hefty energy taxes are causing instability in certain European nations and making it more challenging for new players to venture into Bitcoin mining. According to a report by NFT Evening, the cost of mining one Bitcoin in Germany or the U.K. is approximately five times higher than the asset’s current market value.

Every four years, a significant event occurs in the $2 billion Bitcoin mining industry – the amount of Bitcoin awarded for mining a new block is reduced by half. This design element was included in the system by Bitcoin’s creator, Nakamoto, to limit the number of Bitcoins entering circulation and make it harder for new coins to be minted. As a result, every four years, miners receive fewer tokens as compensation for operating their energy-consuming computer systems that process transactions.

According to the findings, the current mining period motivates individuals to look for countries with lower energy consumption, or they may face legal consequences similar to those enforced in countries such as China.

However, the shift affected even large-scale miners like Stronghold. A few weeks following the halving in May, this miner began considering selling its business, as many were adapting their operations to maintain profitability. Bitfarms, a rival company, reportedly intended to acquire Stronghold, thereby increasing its mining capabilities.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-04 21:46