In a dazzling show of strength, Bitcoin surged through the Easter weekend, topping $88K on Monday, while the dollar sunk to a dismal three-year low.

BTC Soars Like a Rocket, While the Dollar Continues Its Freefall

President Trump’s economic tantrums—threatening to fire Federal Reserve Chairman Jerome Powell and slapping tariffs on everything under the sun—have shaken up traditional markets, causing foreign investors to flee. The result? A weakened dollar. But fear not, for Bitcoin (BTC) and gold seem to be stepping in as the new “safe havens”—who saw that coming? 💸

Market Overview: The Rise of Bitcoin

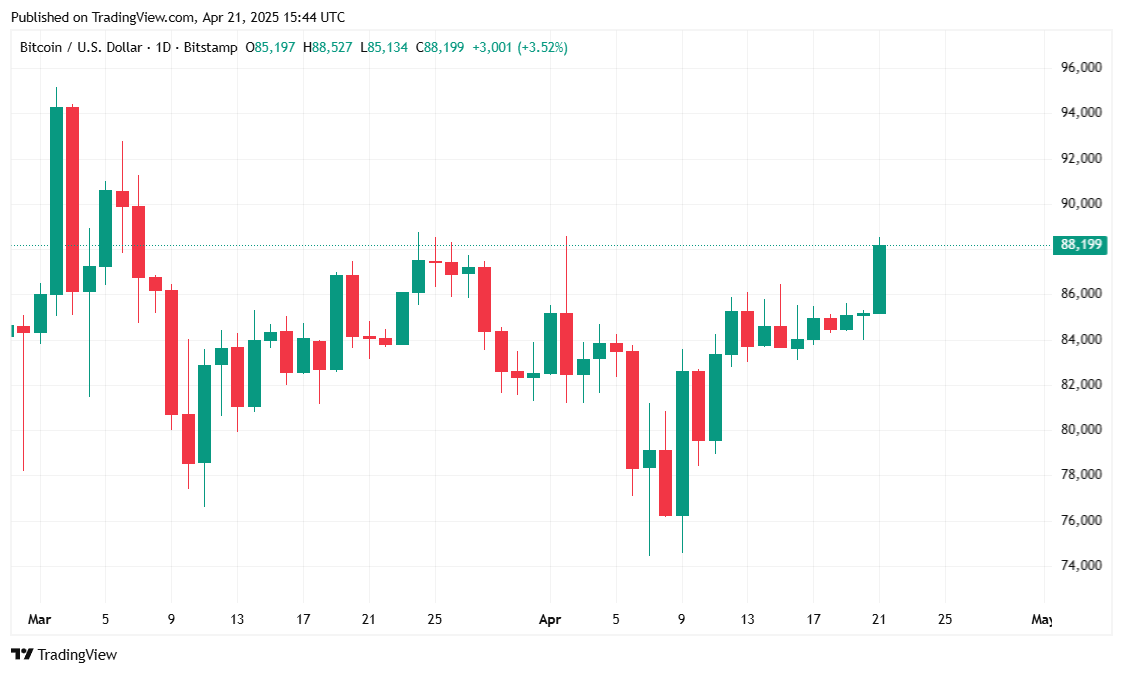

Bitcoin, fresh from its Easter break, kicked off the week with a bang, climbing 4.48% in just 24 hours to hit a whopping $88,260.09. As the market rallied, BTC danced between $84,281.02 and $88,460.10. For the last 7 days, BTC has gained a solid 5.08%, driven by buying enthusiasm and a general sense of optimism that’s sweeping through the crypto world like a spring breeze.

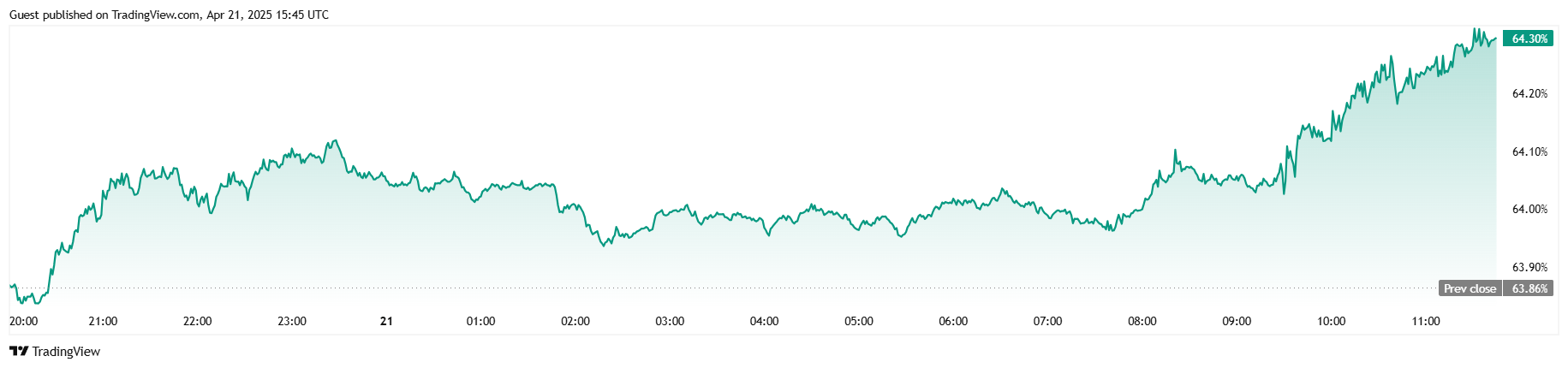

In what could only be described as a “wait, what?” moment, trading volume surged to $34.41 billion, a staggering 133.17% increase from the previous day. This post-weekend surge pushed Bitcoin’s market capitalization to a healthy $1.74 trillion, up by 4.15%. And let’s not forget BTC’s dominance, which rose to 64.30%—clearly, it’s the head honcho in the crypto playground now.

Meanwhile, Coinglass shows that Bitcoin futures are seeing some serious action, with open interest climbing by 11.45% to $61.89 billion. People are clearly getting more serious about their crypto game. But, don’t panic, liquidations are staying under control—just $460,490. Looks like this bull run is keeping its cool. 🐂💼

Trump’s ‘Great’ Economic Advice and the Fall of the Dollar

Not to be outdone by global economic trends, President Trump has been busy stirring the pot. He praised the less-than-scary inflation numbers from April 10, and then went on to call Jerome Powell “a major loser” for not slashing interest rates to juice up the U.S. economy. Because, of course, calling people names on social media is an excellent economic strategy. 😒

Trump, in his usual flair for drama, took to Truth Social to share his thoughts: “There can almost be no inflation, but there can be a slowing of the economy, unless Mr. Too Late, a major loser, lowers interest rates now,” Trump posted. “Europe has already ‘lowered’ seven times. Powell has always been ‘Too Late.’” Ah, nothing says “solid financial policy” like insults. 😂

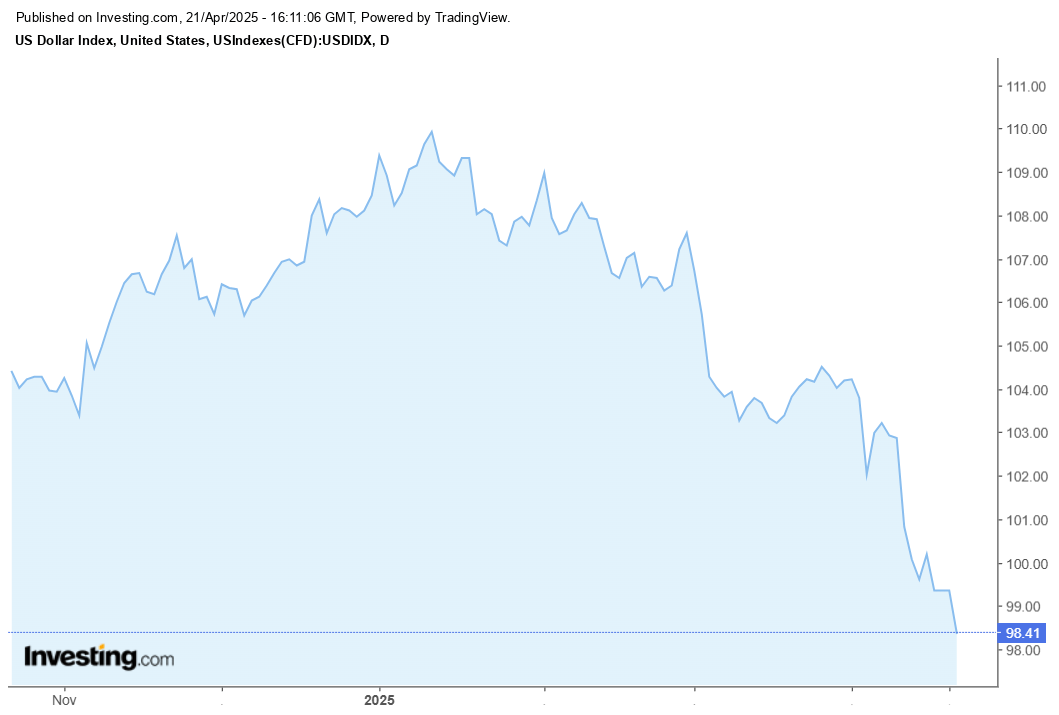

Of course, his recent threats to fire Powell and his aggressive trade policies have had one major consequence: foreign investors are fleeing the U.S. dollar like it’s on fire. This has sent the U.S. Dollar Index (DXY) tumbling to a three-year low, while gold and Bitcoin are happily reaching for the skies.

If this trend continues, we might just witness the ultimate plot twist—the dollar losing its throne as the world’s go-to currency. Bitcoin, a digital rebel born out of the chaos of fiat money, may soon take the crown. 🤯

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-21 20:01